Follow-On Selling

More concerns about the efficacy of trade talks are the consensus excuse for why futures are showing a large loss this morning. Whatever the actual reason(s), we're seeing a rare one-two punch.

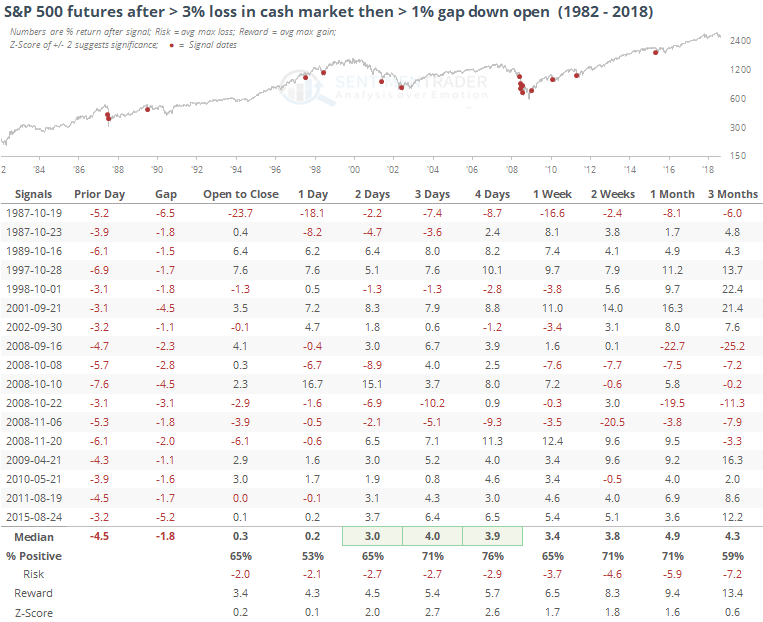

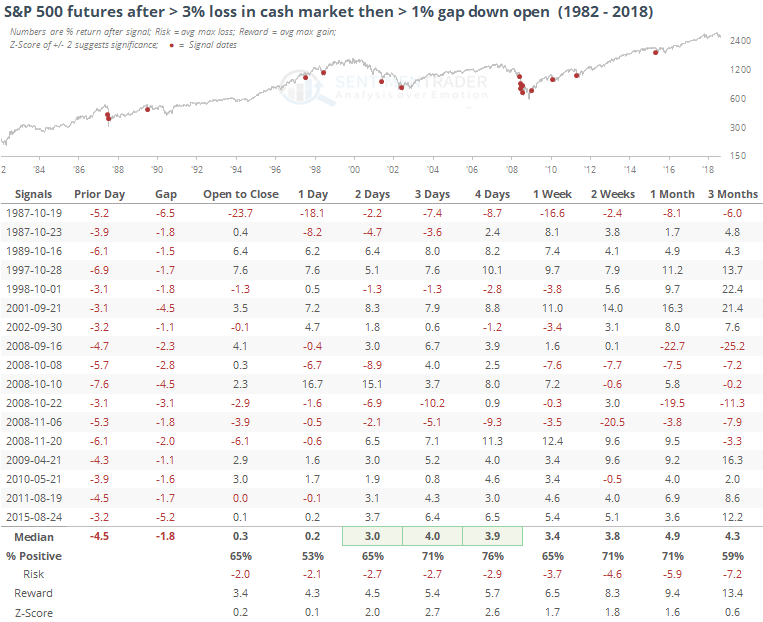

The last times the S&P 500 cash index lost at least 3% then the futures market gapped down more than 1% the next morning was:

- During the bottoming process in August 2015

- During the bottoming process in August 2011

- During the bottoming process in May 2010

It happened a handful of times during the financial crisis, which led to further losses, and a handful of times prior to that, which almost universally led to large rallies...except for the big one, Black Monday.

Even including the worst-case dates, futures did tend to show gains from the morning of the large gap down through the close 3 and 4 days later.

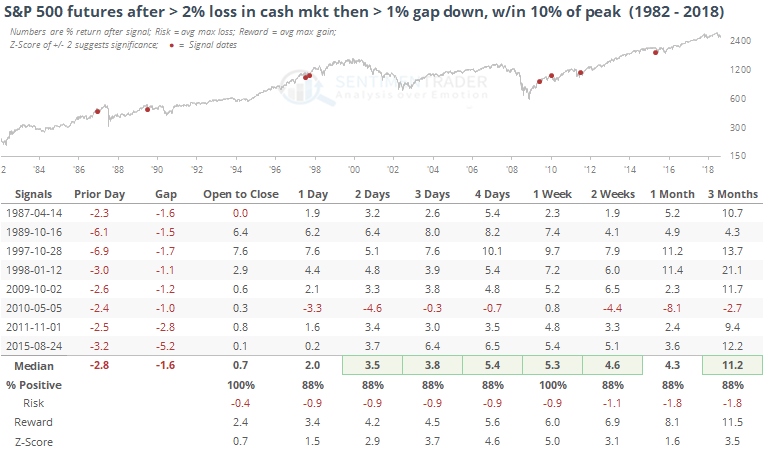

What's notable about the current volatility is that it's occurring while stocks are still within correction territory. If we look for other large gaps following a big (2%) down day when the S&P was still within 10% of its peak, then we get the following.

Every one of them rallied over the next week. The sample size is small and the early May 2010 one *barely* squeaked out a gain, but otherwise it was very positive.

There are compelling reasons suggesting that the selling pressure this morning is overdone based on news that was already known by the players involved in the arrest of the Huawei executive, but trying to guess what was known by politicians and what their response could be during a high-stakes game of trade negotiations is beyond the scope here.

Based purely on typical behavior following knee-jerk selling pressure after large losses, the early morning sales appear overdone and likely to reverse in the days ahead, except for the rare case of a crash, which is never a good bet.