First earnings season after the start of a recession, bear market

Financial media is ablaze with the idea that this week is going to be an important one for investors. We'll be getting our first real glimpse at corporate earnings and how the pandemic has altered the corporate landscape.

Even a cursory glance through news archives will show that a narrow, short-term focus on earnings reports has been misguided time and time again. Investors are forward-looking; earnings are backward-looking. Even forward earnings guidance and Wall Street estimates are heavily weighted by the recent past.

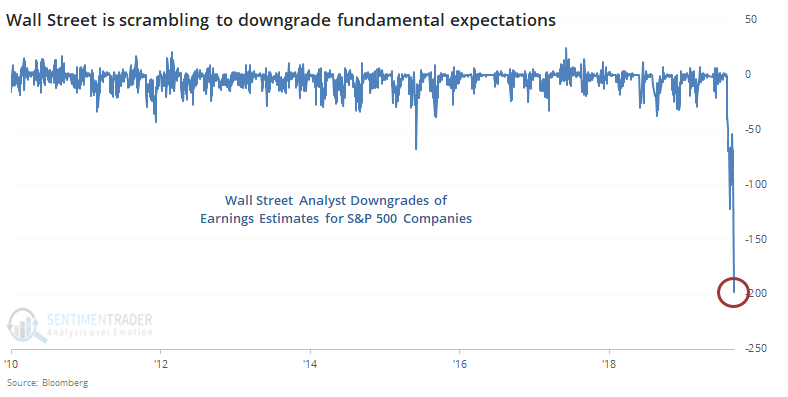

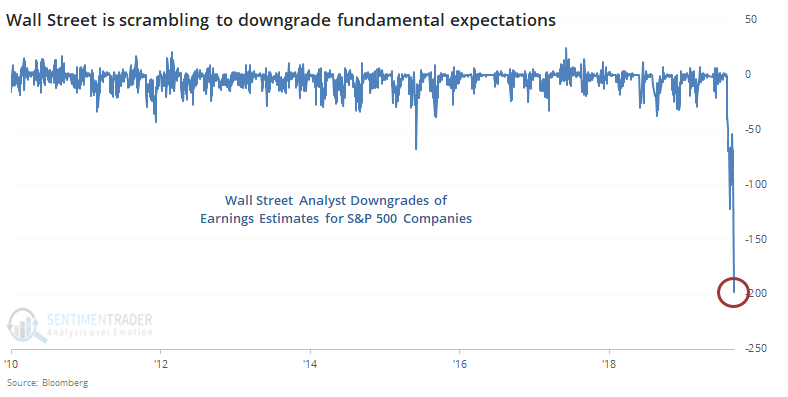

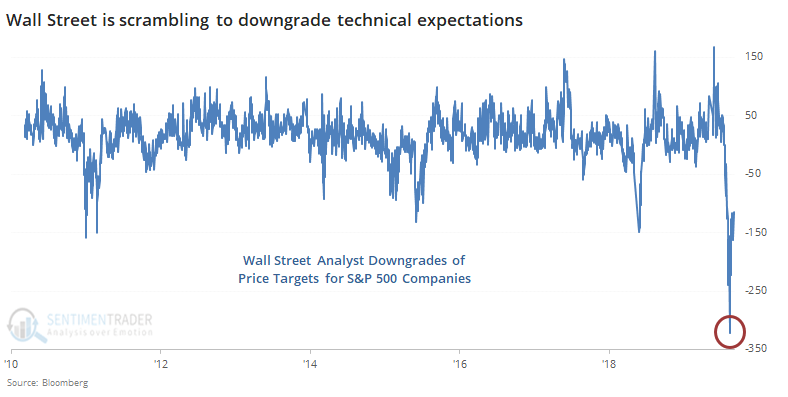

Based on the latest figures tallied by Bloomberg, Wall Street is scrambling to downgrade just about everything in sight to get ahead of these earnings releases. In recent days, they've had more net downgrades of almost 4 times as many stocks in the S&P 500 at one time as any other period in the last decade.

They've been downgrading the technicals of stocks at a record pace, too. There is a very strong contrary nature to this data - the more net upgrades, the worse stocks perform going forward; the more downgrades, the better they do. We saw that in January when they were busy upgrading price targets.

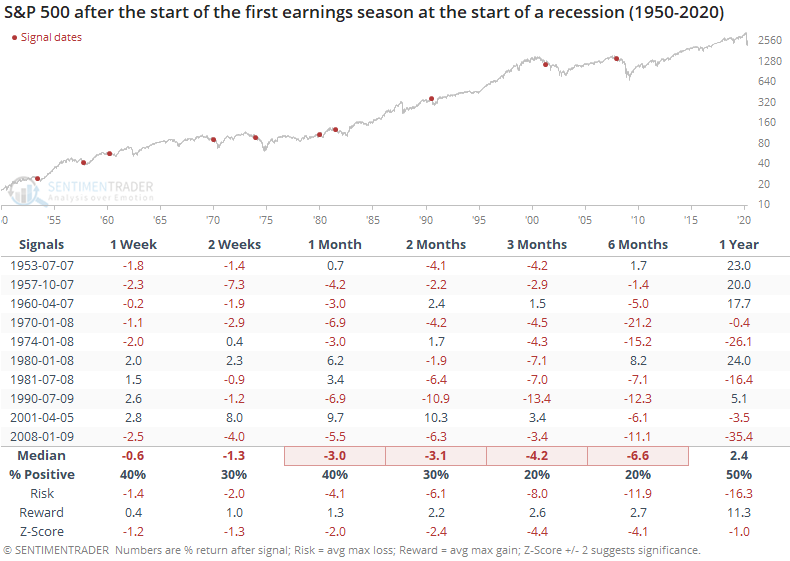

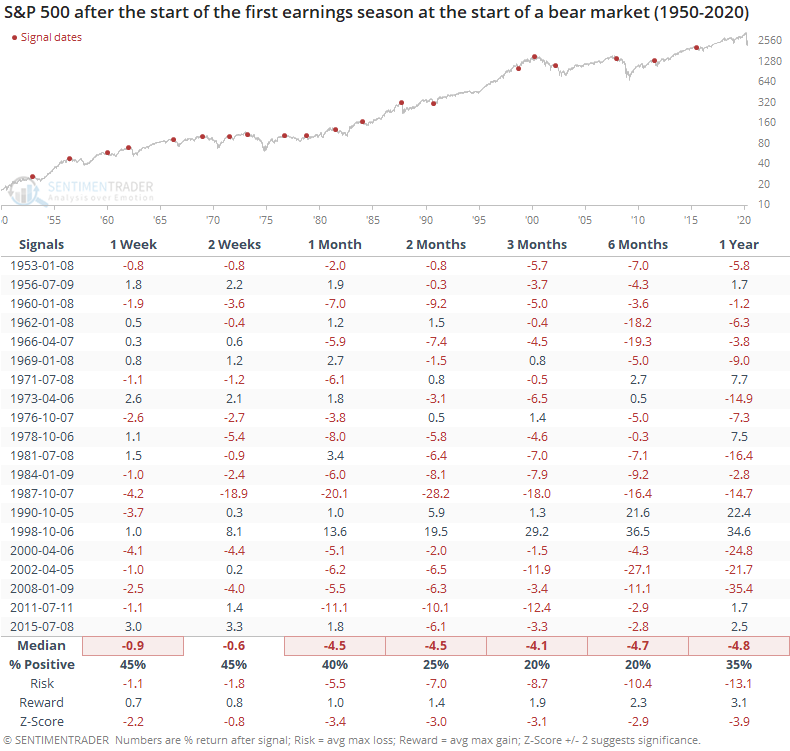

Still, let's look at how stocks reacted when earnings season (approximately) began during the first earnings season following the onset of recession.

This was not good. Stocks sold off consistently and significantly over the medium-term, with heavy risk relative to reward.

Even if the economy will somehow avoid recession, by most definitions we've already suffered a bear market. Below, we can see how the S&P fared after the first earnings season following the beginning of a bear market.

This was even worse in some respects - the numbers were about as bad but with double the sample size.

But...

The issue with looking at it this way is that it's backward-looking. Recessions and bear markets aren't dated until after the fact. Many of the dates in the above tables triggered when stocks were near all-time highs, which isn't anything like our current environment.

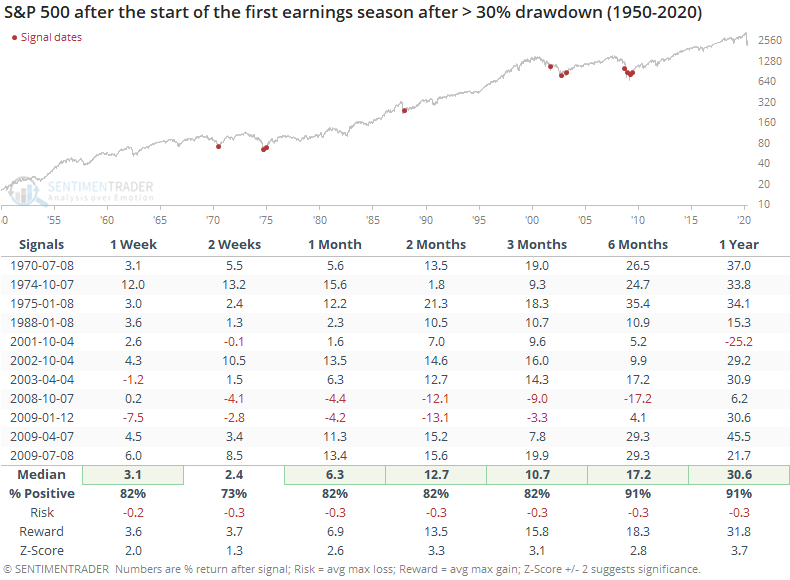

So, let's re-run the test and look for the starts of earnings season following a time when the S&P had already suffered at least a 30% drawdown from its 52-week high at some point during the preceding earnings off-season.

Because stocks had just suffered massive losses, investors had already baked much of the worst of the coincident recessions and bear markets. Surely, the earnings reports were about to be terrible, but investors already knew that and were trying to look around the corner about what the prospects were once the economy recovered.

There is no question that we're in unprecedented times. There are few investors alive that have seen anything even remotely what we're dealing with now. But we must steel ourselves against the easy idea that poor earnings in the coming days and weeks = poor future stock returns. Maybe it will, because uncertainty is so high. Historically, however, the fact that losses have been so large heading into a poor earnings season suggests that investors have already priced in most of the worst-case scenarios.