Financials' New Lows; Bank Loan Pessimism

Among all the carnage over the past week, Financials have been among the hardest hit. Despite the attempted reversal on Monday, many of the stocks in this sector either didn't participate, didn't fully reverse, or sunk so far during the morning that they still hit their lowest level in at least a year.

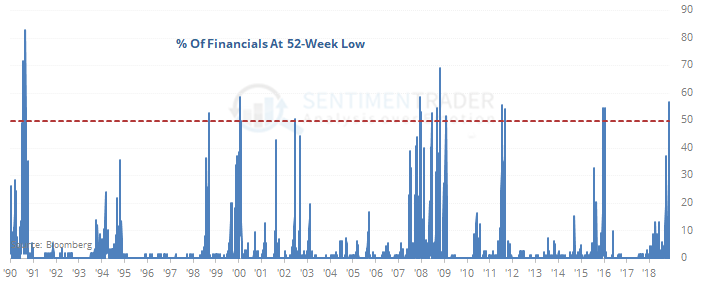

As a result, the percentage of stocks in the S&P 500 Financial sector that reached a 52-week low skyrocketed to more than half of all the stocks in the sector. It's the first time since February 2016 that half the sector was at a new low.

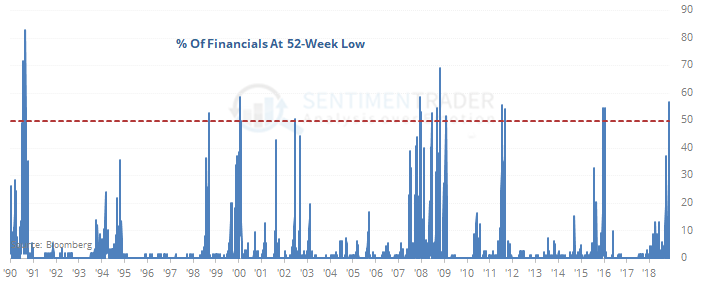

We can see from the chart that it doesn't happen often. And when it does, it has had a strong tendency to rebound over the next week before suffering more volatility.

Returns gyrated over the medium-term, even if they were mostly positive. By 6-12 months later, most of that weakness had been shaken out. Interestingly, all of the risk over the next 6-12 months was absorbed in the first three months after the spike in new lows. The average risk in the next year of -9.5% was the same as it was during the first three months. But the average reward jumped to +49% (!) versus "only" +19% during the first three months.

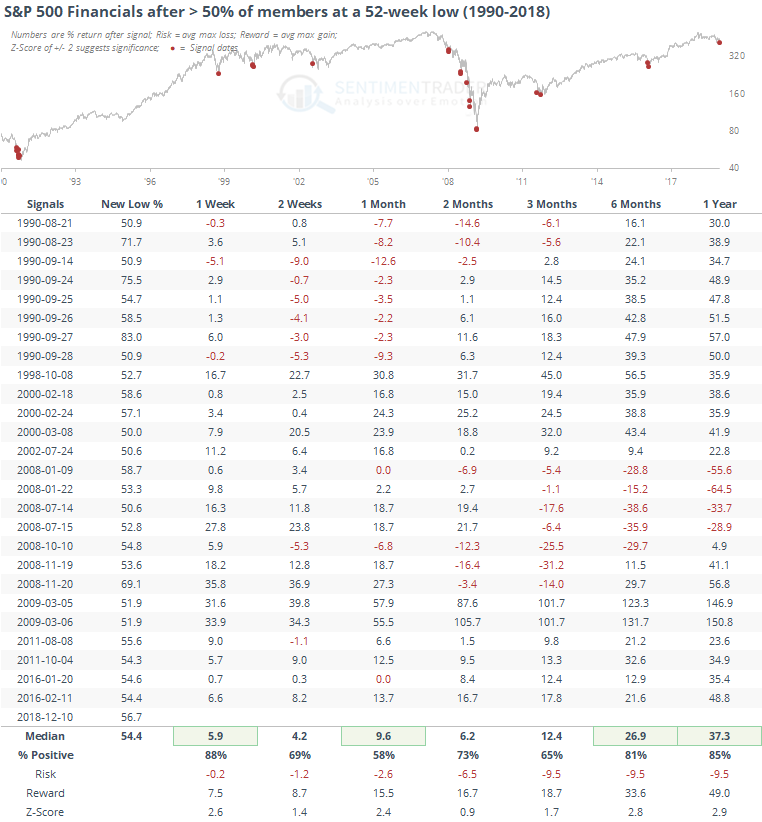

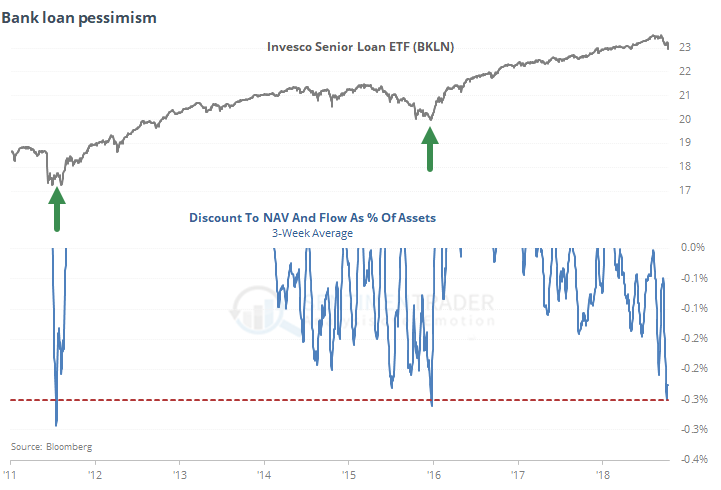

The worry over rates that triggered a decline in some of the financials has spread to other parts of the market, and we're seeing some unusual trading in various ETFs that focus in the space. The 800-pound gorilla in bank loan funds is BKLN, and over the past few weeks, investors have dumped the fund. Despite losses that are quite a bit milder than mid-2011 and early 2016, the fund has averaged a 0.25% discount to its net asset value, and about a 0.2% decline in assets each day.

Both of those are historically large. When combined, it's the 3rd most negativity seen since the fund's inception, and both of the others occurred at/near major lows for the fund. A different outcome this time strongly suggests "this time is different" with regard to some of these bond ETFs.

Pessimism is high in sectors considered ill-exposed to rapid changes in rates, and has reached a level in a couple of them that has strongly tended to lead to bounces, at least.