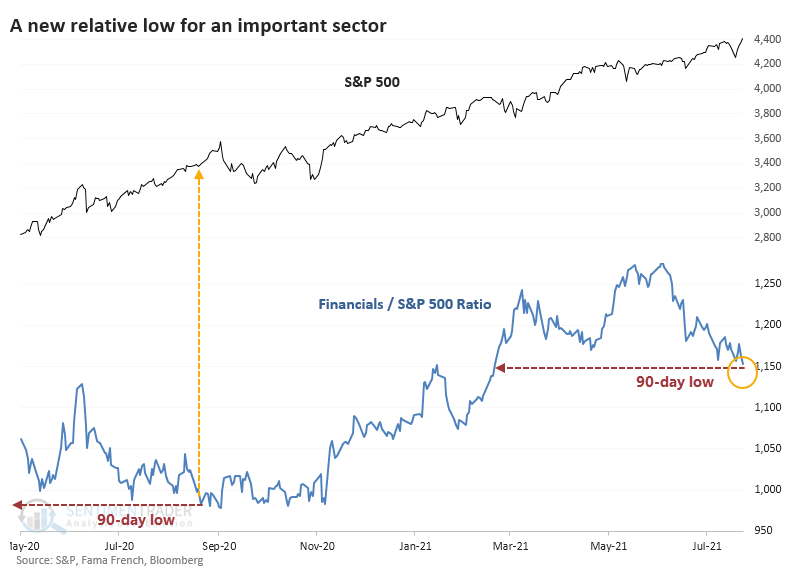

Financials Just Slumped to a 90-Day Relative Low

Small-Cap stocks aren't the only ones struggling to keep up with the S&P 500's torrid pace.

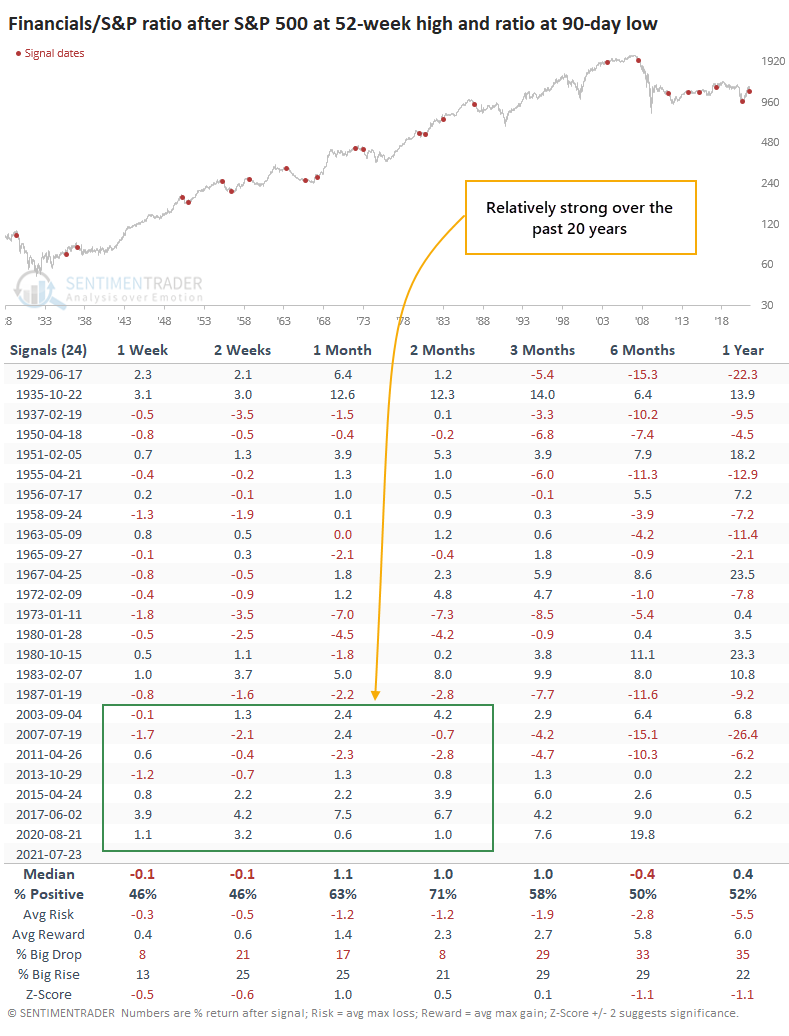

Financial stocks have been lagging, too, going more than 30 days without setting a fresh high. Even more notably, the ratio of Financials to the S&P 500 just sagged to its lowest point in more than 90 days. The last time the two diverged to this wide of a degree was last August.

After that bout of relative weakness, it bled into the broader market, and the S&P ended up following Financials lower.

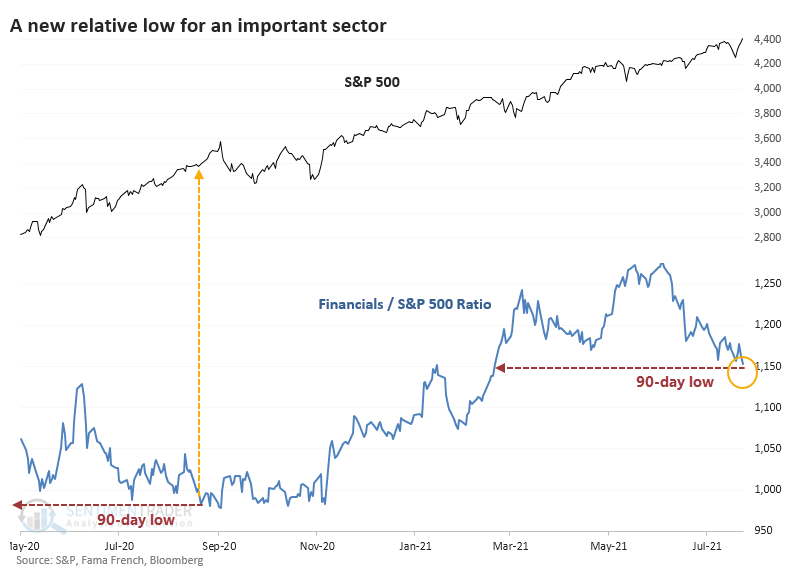

WEAK FINANCIALS AS A PRECURSOR

Since the Great Financial Crisis in 2007-08, this kind of relative divergence has preceded weakness in the S&P each time over the next 2-4 weeks.

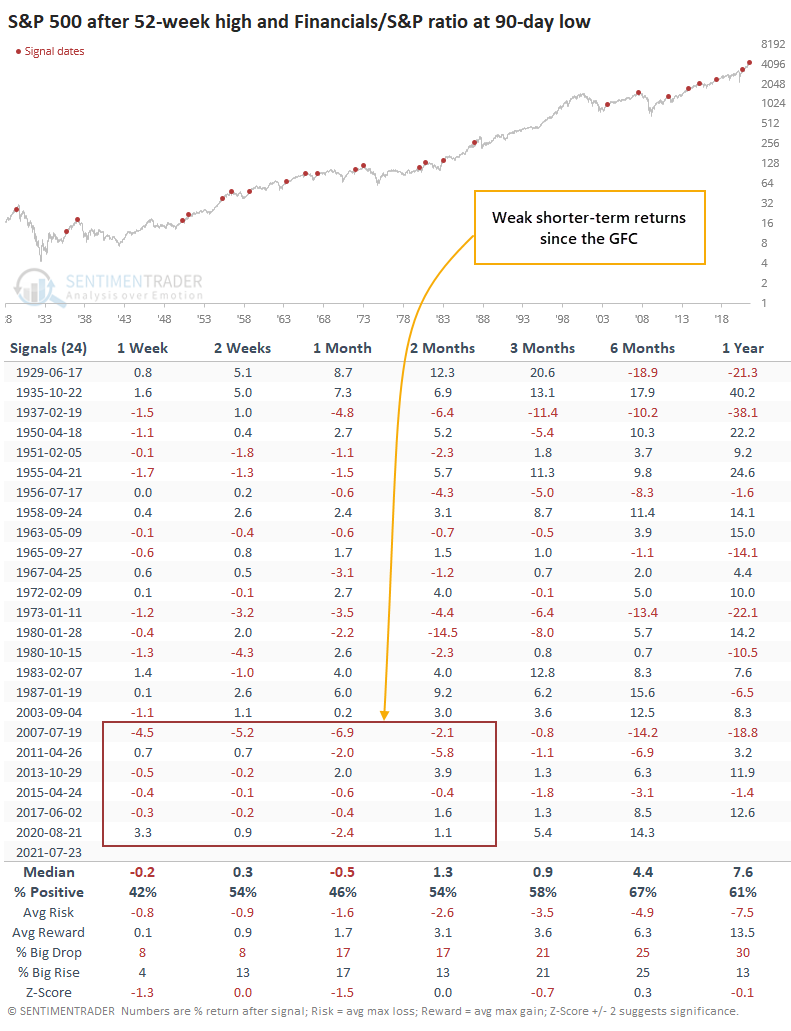

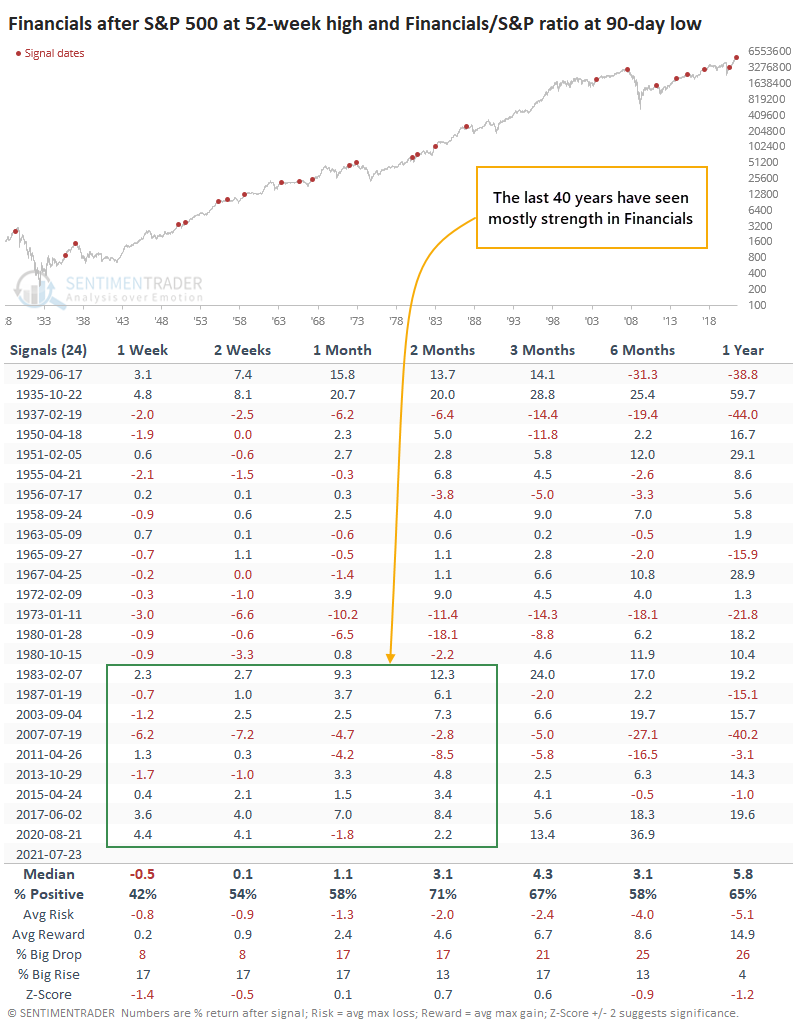

We've all been taught to buy the strongest groups and sell the weakest ones, and generally, that's probably good advice. In this particular situation, though, Financials tended to rebound quite strongly during the past four decades.

TIME FOR FINANCIALS TO SEE A RELATIVE REBOUND?

Relative to one another, Financials mostly outperformed after the very short-term. During the past 20 years, Financials outpaced the S&P during the next month after 6 out of 7 signals. The medium-term time frame of 1-3 months saw the biggest outperformance.

Ideally, bulls would see sectors, industries, and individual stocks mostly trading in line with major indexes like the S&P 500. That has been shaky in recent weeks, and that's a warning, though the overwhelming buying pressure mid-week last week alleviates some of that concern. If we focus specifically on the relative weakness in Financials, it has been a worry for the broader market over the past decade, but wasn't consistent prior to that. For Financials specifically, it has been more of a good sign than bad for the current generation of investors.