Financials hit hard as they start to report earnings

This week is going to be a big one for banks. If share prices are based primarily on earnings power, and analysts have been left in the dark over the past quarter, then ostensibly these reports will be the most important in at least a decade.

More than a quarter of members in the S&P 500 Financials sector are reporting this week, including the largest ones.

The sector is one of the worst-performing so far this year, down more than 22% year-to-date, which is second only to energy among the laggards.

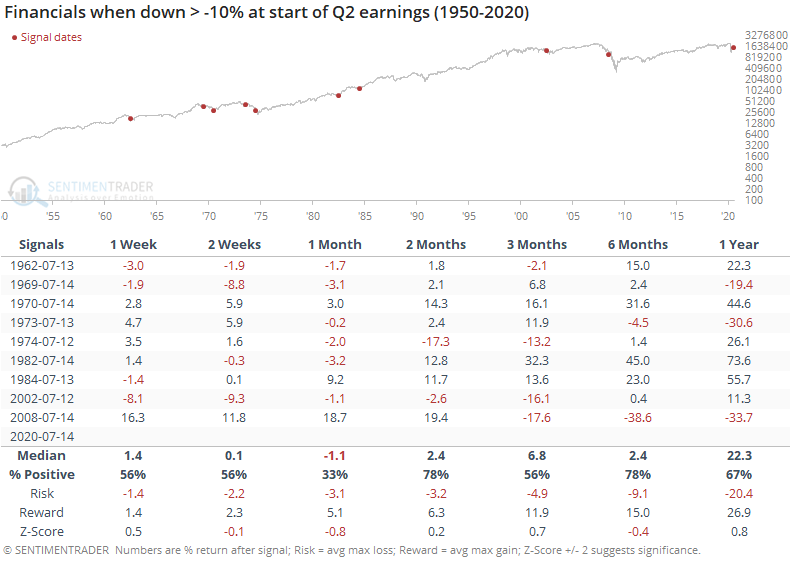

The table below shows every year since 1950 when financials were down 10% or more through the 9th trading day of July, which is roughly when banks start to report their Q2 earnings results.

The next month wasn't great, even though they bounced hard in 2008 before failing. The next 2-6 months were more consistently positive, though there were large losses in 1975 and 2008.

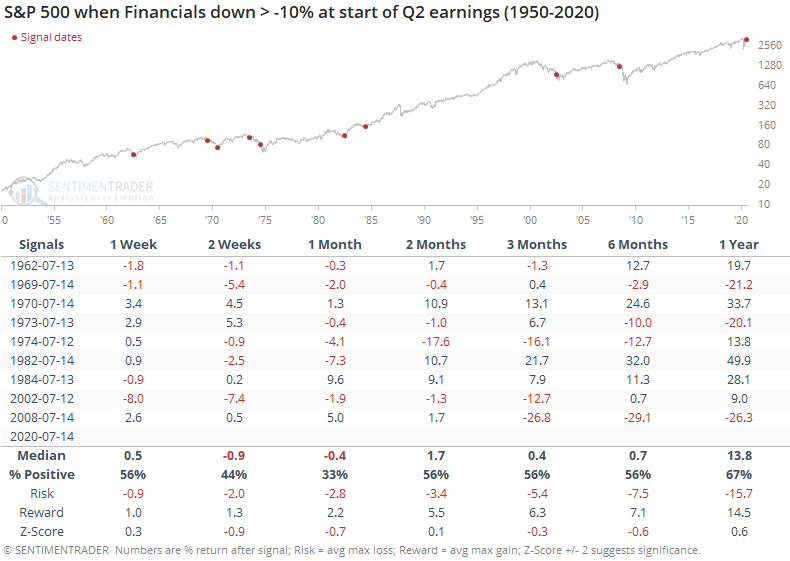

For the broader market, it was more troubling, with the S&P 500 failing to bounce back as often as financials themselves.

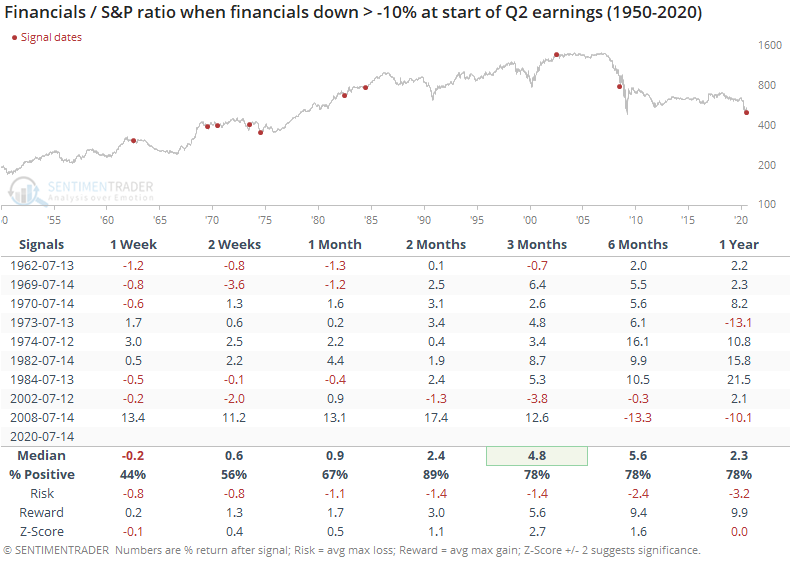

That means the ratio between them tended to rise. Over the medium-term, financials consistently outperformed the broader market, with only one or two small exceptions.

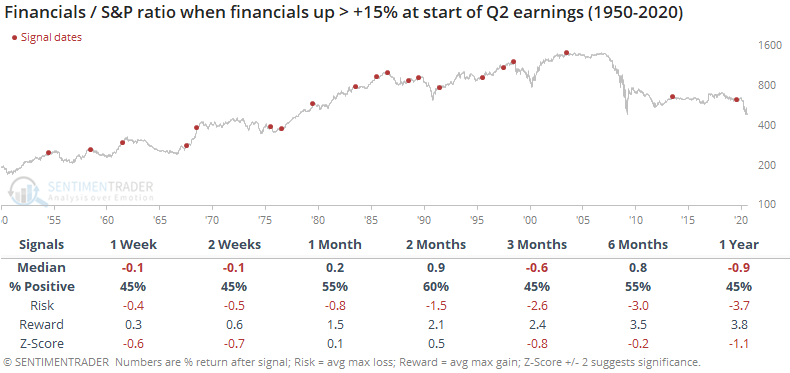

If we look at the opposite scenario, when financials rallied hard into Q2 earnings season, then the sector had less of a tendency to outperform the market going forward.

Trend persistence can be a powerful force, and sometimes there are fundamental factors that overwhelm anything and everything else. Maybe this is one of those times. Historically, though, when this particular sector was hit hard through mid-year, this is about when it started to pick up again relative to other sectors.

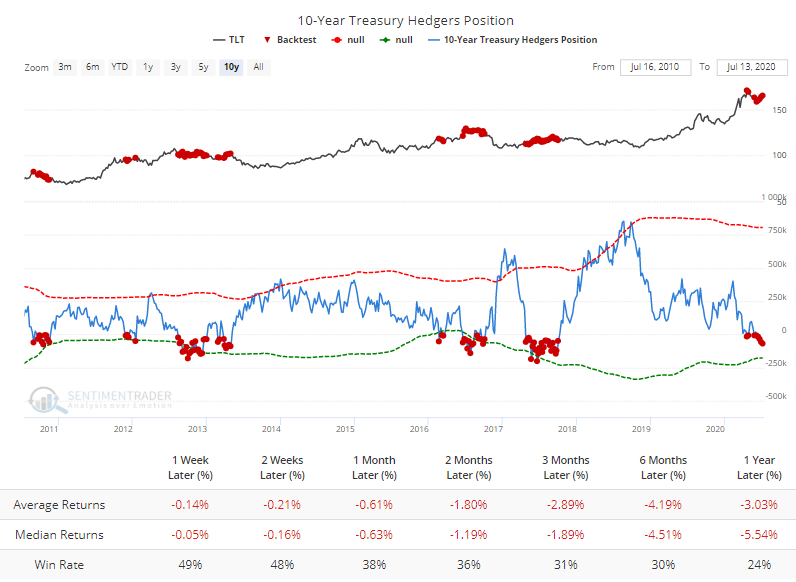

It's interesting to note that "smart money" hedgers have now established a net short position against 10-year Treasury note futures. Over the past decade, this has preceded losses in funds like TLT as interest rates rose.

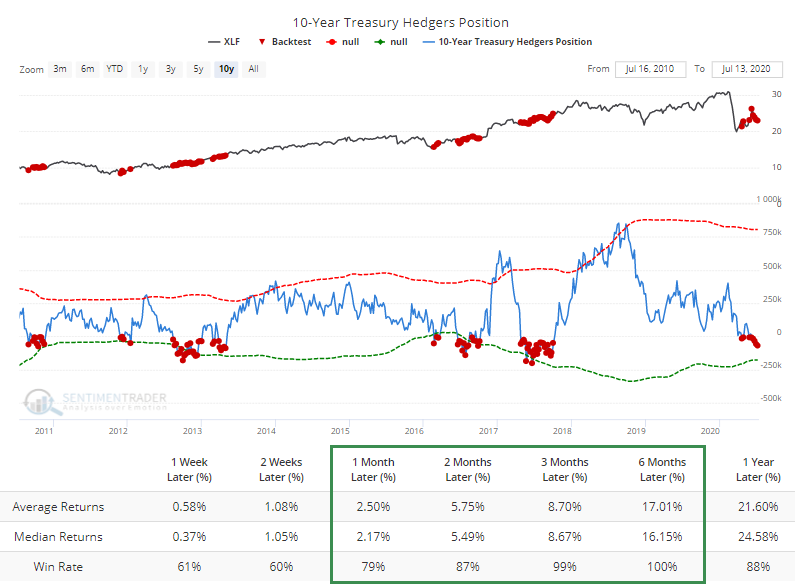

The Backtest Engine shows us that what was bad for bond funds was good for financial funds, like XLF.

While not a major factor, these bets on rising rates should be good for banks in the months ahead.