Financial stocks break out, broadly

Providing some succor to long-underperforming investors in financials, the sector finally broke out to new highs last week.

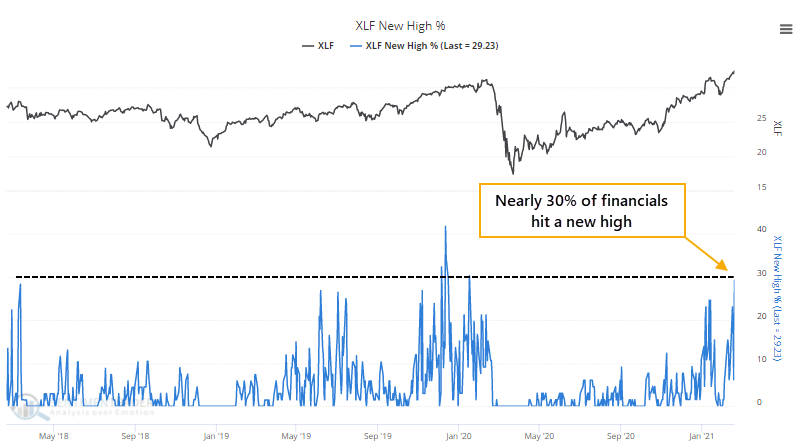

Like we've seen market-wide, the sector's move was powered by a pretty good base of stocks. By Friday, nearly 30% of financials tickled new highs, the most in over a year.

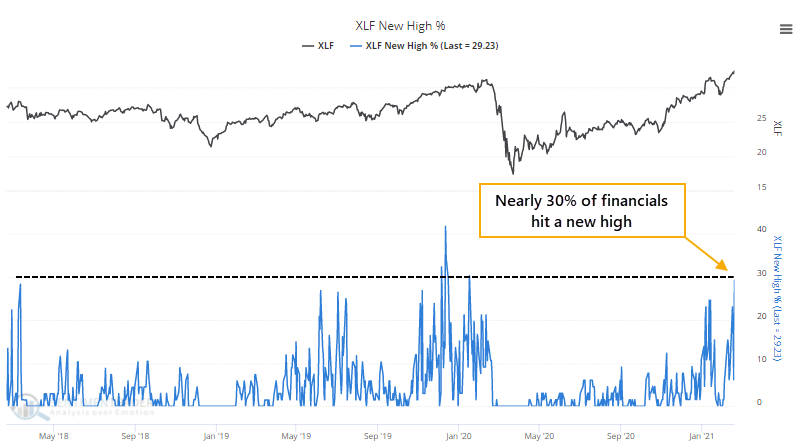

There were no financials sinking to a 52-week low, so the net percentage of stocks at new highs, at nearly 30%, was still the most in over a year. While there have been many days with more stocks hitting new highs, and longer stretches without at least 29% of them doing so, this breakout still ranks among the largest, after one of the longest dry stretches, in 70 years.

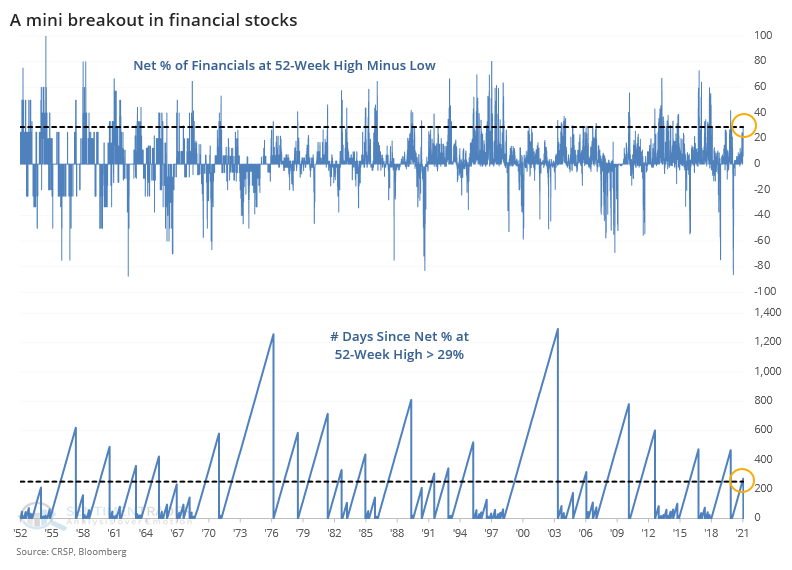

We use total return (price gains + dividends) for sector performance going back decades, and below we can see how an investor in this sector would have fared after buying these broad breakouts in financials.

Overall, it was "meh." The sector showed a median total return over the next 3 months of only +0.8%, which was more than a standard deviation below any random 3-month span. It was positive barely half the time, and with risk that was about even with reward. Out of the last 5 signals, 4 of them preceded losses.

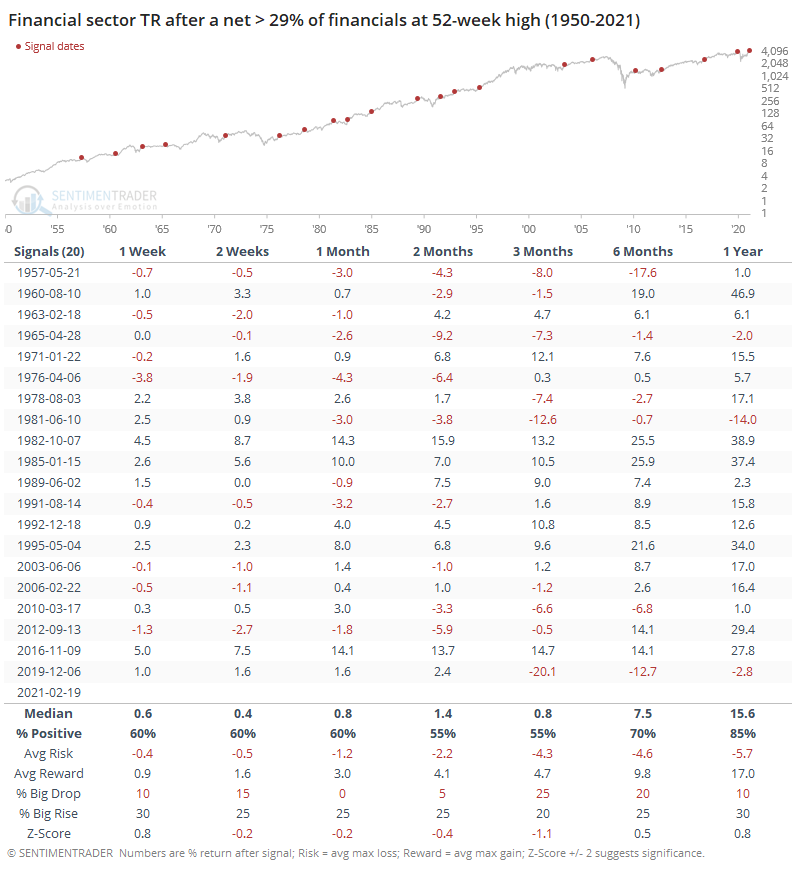

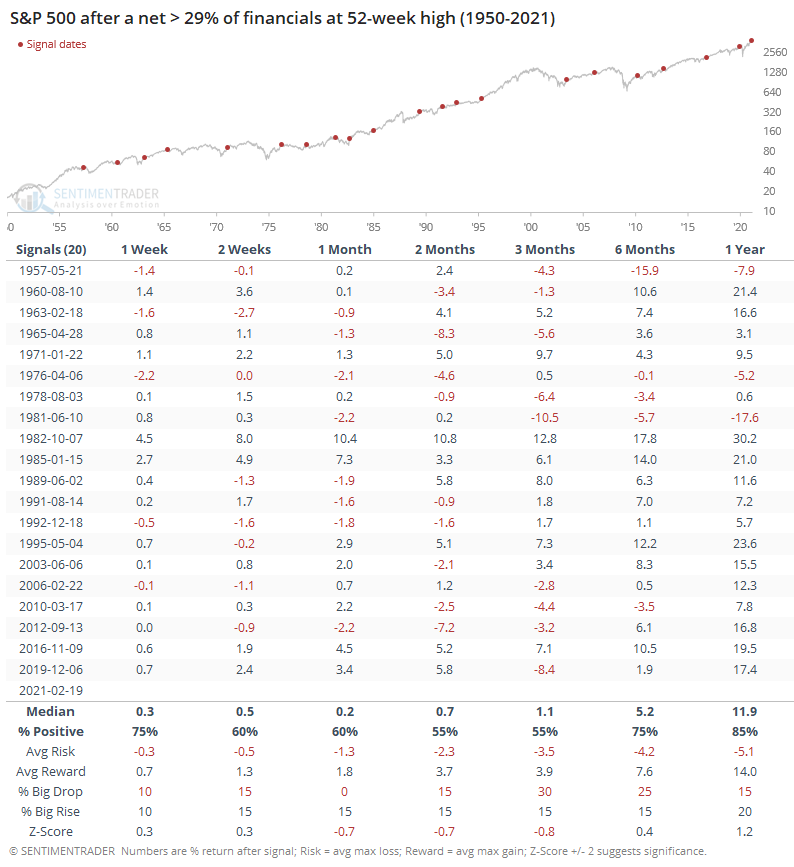

This kind of move, in this kind of sector, is supposed to be a good sign for the broader market, so below we can see returns (price only) in the S&P 500 after nearly a third of financial stocks broke out to new highs.

Again, forward returns over the medium-term were okay, but nothing special. Not even particularly positive. Returns were barely positive, barely half the time, with risk about equal to reward, and a larger probability of suffering a big drop than enjoying a big gain.

We test so much because it helps to generate a base case and serves as a check against assumptions and theories that always sound good, but rarely have sound evidence backing them. A big, broad breakout in financials is universally considered to be a great sign for that sector, and the market as a whole. Maybe it will be - it has several times in the past. But just as often, it has preceded average, or even weaker-than-average, returns, and we wouldn't consider it consistent enough to be a positive for investors here.