Financial stocks break a long streak

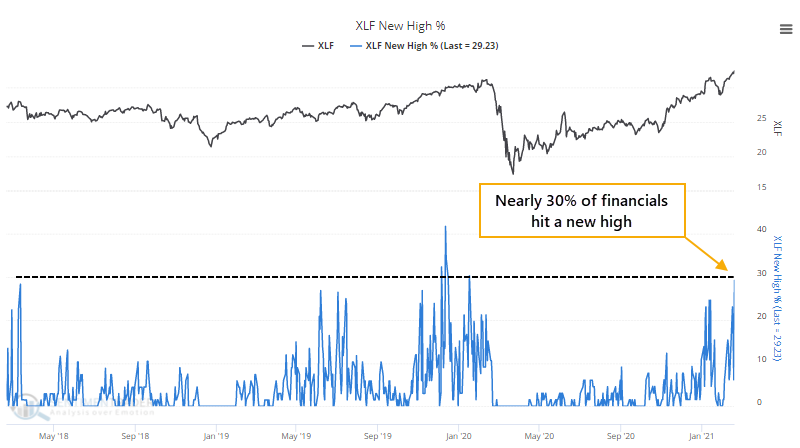

Providing some succor to long-underperforming investors in financials, the sector finally broke out to new highs last week.

Like we've seen market-wide, the sector's move was powered by a pretty good base of stocks. By Friday, nearly 30% of financials tickled new highs, the most in over a year.

There were no financials sinking to a 52-week low, so the net percentage of stocks at new highs, at nearly 30%, was still the most in over a year. While there have been many days with more stocks hitting new highs, and longer stretches without at least 29% of them doing so, this breakout still ranks among the largest, after one of the longest dry stretches, in 70 years.

Textbooks and theories tell us that this is nothing but a good sign for the sector and the broader market. A close look at the evidence suggests otherwise.

What else we're looking at

- Full returns in financials after a jump in 52-week highs

- How that translated to the broader stock market

- In a post-election year, certain months have done much better than others

- For Treasury notes and bonds, February has had a split personality

| Stat Box On Monday, the Nasdaq Composite lost more than 2%, yet more than 8.5% of securities reached a 52-week high on the Nasdaq exchange. That's the most in history for such a bad day, dating back to 1984. |

Sentiment from other perspectives

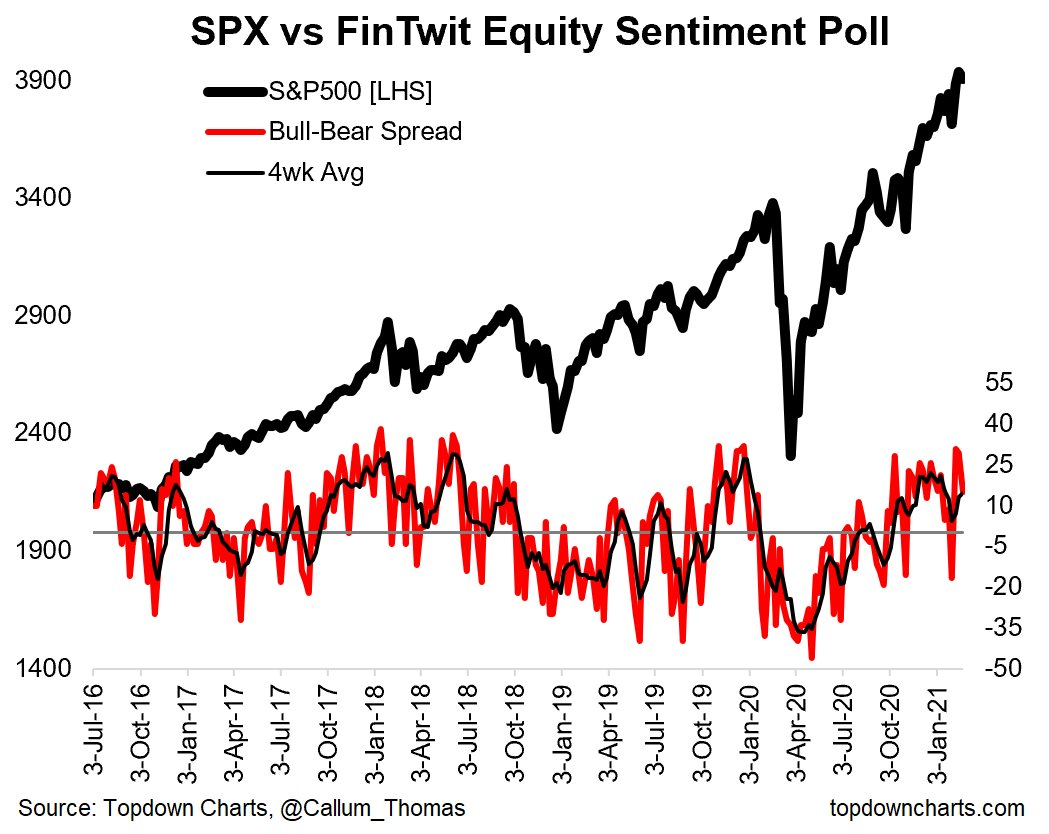

Social people still like stocks. Sentiment among Twitter users is still heavily optimistic that the stock market can keep plugging away. Source: Callum Thomas

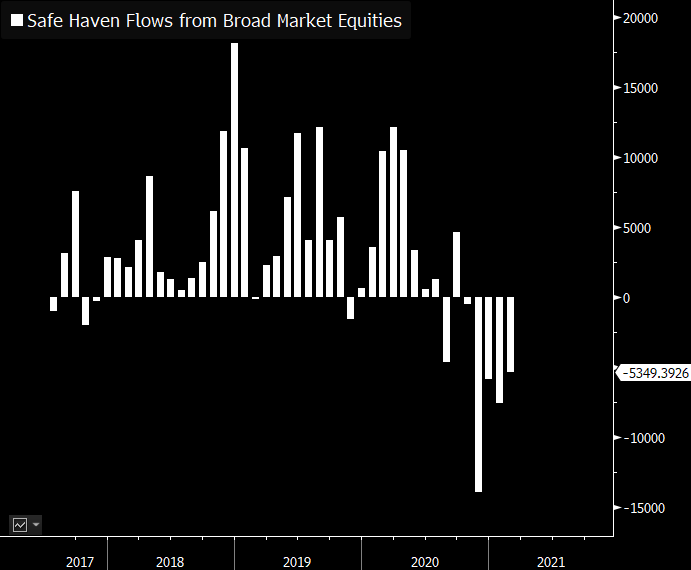

That's why everyone's leaving the safety trade. ETFs that focus on "safe" assets like Treasuries, gold, and low-volatility funds, have seen a record stretch of outflows. Source: Eric Balchunas

Let's see how long they last. With a several-day plunge in some of the riskiest corners of the market, "buy the dip" is the #4 trending topic amid U.S. Twitter users. Source: Twitter