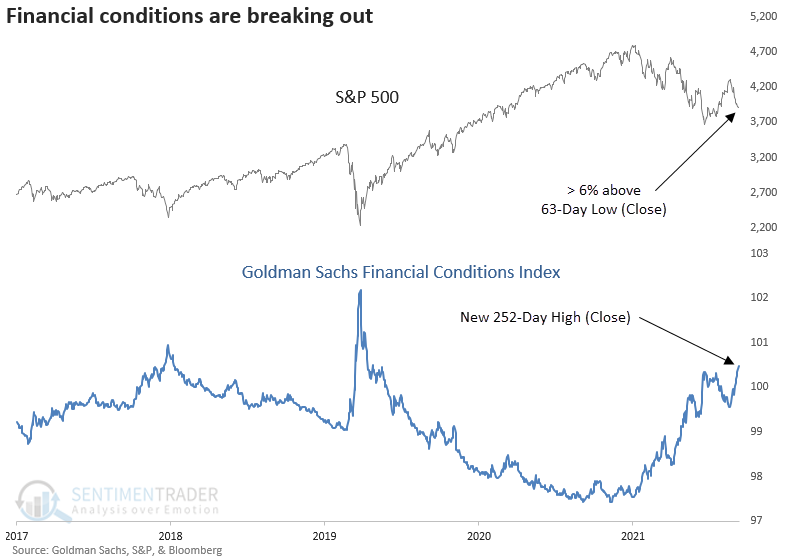

Financial conditions are breaking out to a new high

Key points:

- The Goldman Sachs financial conditions index closed at a new 252-day high

- At the same time, the S&P 500 closed 6% above a 63-day low

- After similar conditions, S&P 500 performance was flat to negative

Tighter financial conditions typically slow the economy and suppress inflation

Financial conditions are getting tighter, but stocks haven't totally collapsed.

The Goldman Sachs financial condition index, which combines riskless interest rates, an exchange rate, equity valuations, and credit spreads, closed at a new 252-day on Tuesday. At the same time that financial conditions broke out to a new high, the S&P 500 remained more than 6% above its June low.

Typically, financial conditions and the S&P 500 move in opposite directions - when conditions tighten, the S&P 500 declines and vice versa. The current disconnect is the most significant in history. The previous record occurred in May 2000, when the S&P 500 closed more than 6% above a 63-day low as financial conditions recorded a 252-day high.

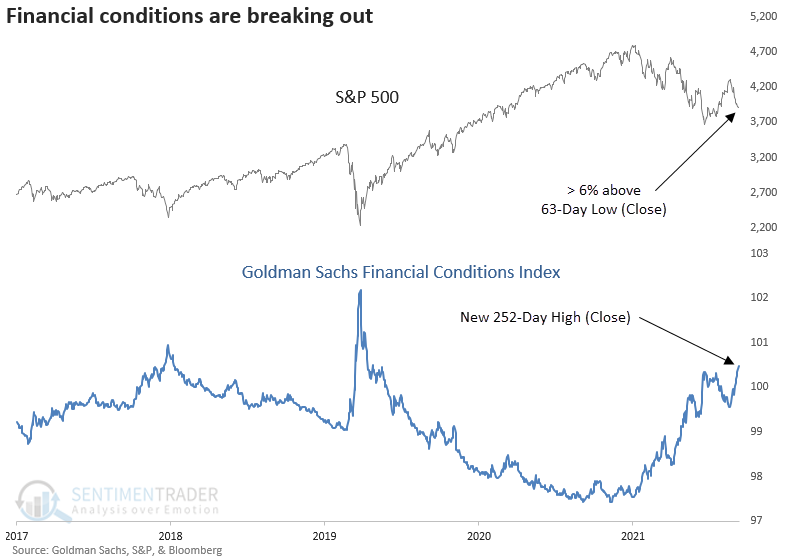

Let's assess the outlook for the S&P 500 after similar conditions. I will lower the S&P 500 threshold above the low from 6% to 2% to increase the sample size. And to screen out repeats, the study will identify the first instance in a month.

Similar breakouts in financial conditions preceded flat to negative returns

A breakout in financial conditions as the S&P 500 hovers above a low doesn't bode well for the market across most time frames.

The S&P showed a negative return at some point in the first six months in all but one instance. After 12 out of 16 signals, the S&P closed at a new 63-day low before it hit a new 252-day high.

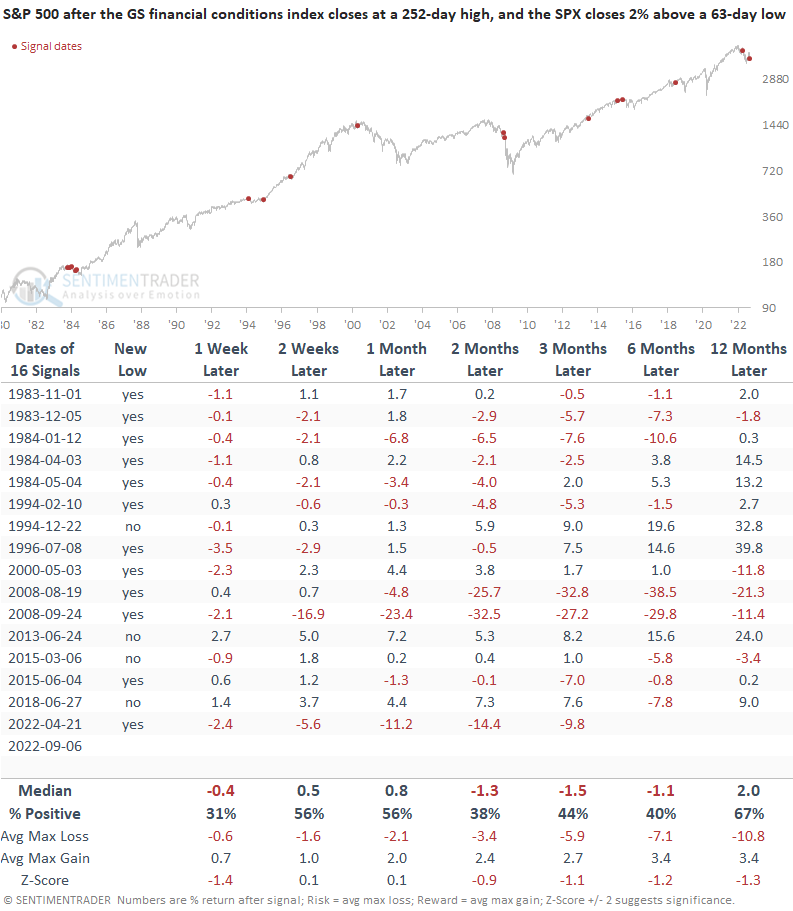

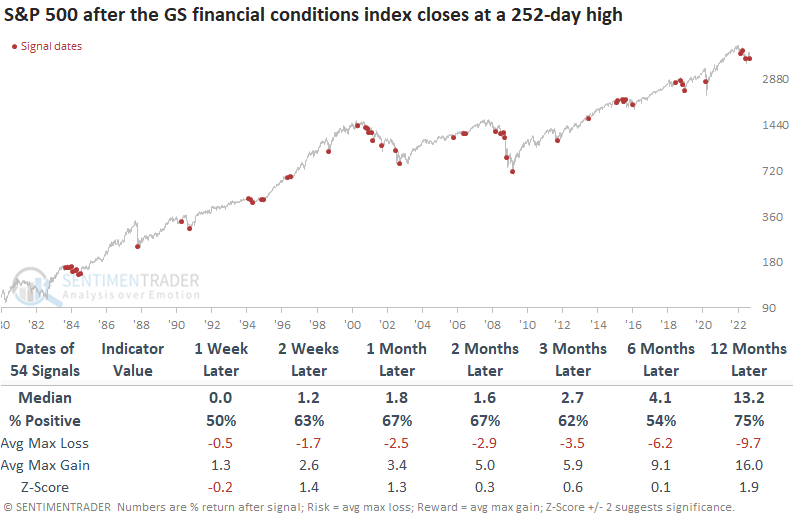

Suppose we remove the S&P 500 condition that requires the index to be 2% above a low. In that case, we see 55 instances when the GS financials conditions index closed at a 252-day high (once again, screening out repeats).

Returns, win rates, and z-scores were more favorable when there's no disconnect between financial conditions and the S&P 500.

What the research tells us...

The Federal Reserve remains steadfast in its commitment to slow the economy to bring inflation down from multi-decade highs. Financial conditions, which recently eased as the S&P 500 rallied from an oversold condition, have now reversed higher to close at a new 252-day high. The disconnect between the new high in financial conditions and the lack of a new low in the S&P 500 is a concern. Historically, when this occurs, stocks struggle.