Finance sector golden cross and bullish active managers

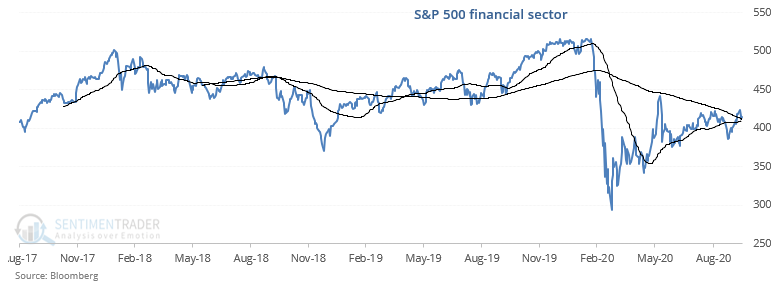

The S&P 500 financial sector is finally on the verge of forming a golden cross (50 dma crossed above 200 dma) after bouncing sideways for months while the broad S&P 500 and tech stocsk rallied:

*Depending on whether you look at total-return indices or non-total return indices, a golden cross has already formed.

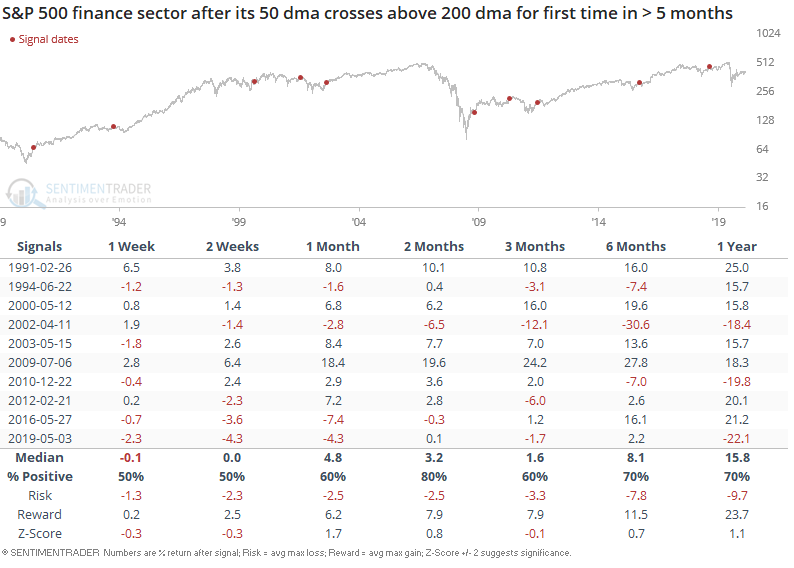

When the finance sector formed a golden cross for the first time in more than 5 months, the sector usually pushed higher over the next 2 months:

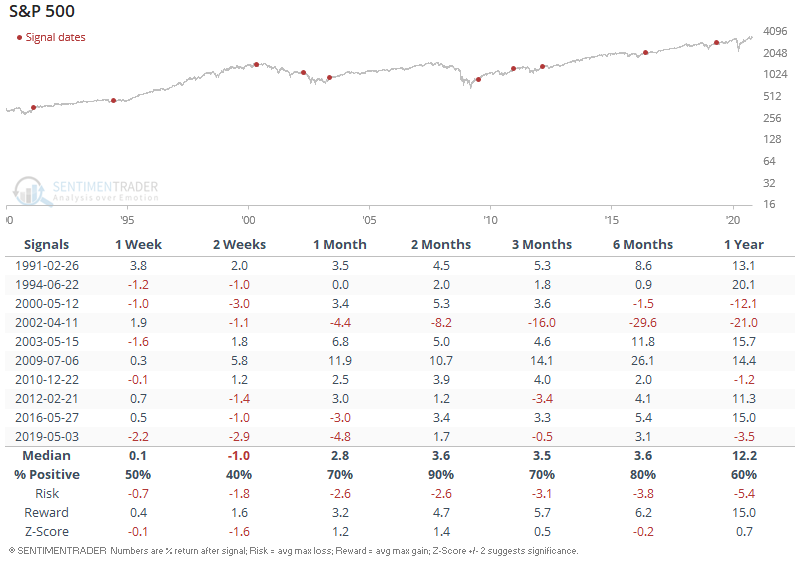

This also usually led to more gains for the S&P 500 over the next 2 months. The one big exception was in 2002, when stocks fell to fresh bear market lows despite the recession being over by then:

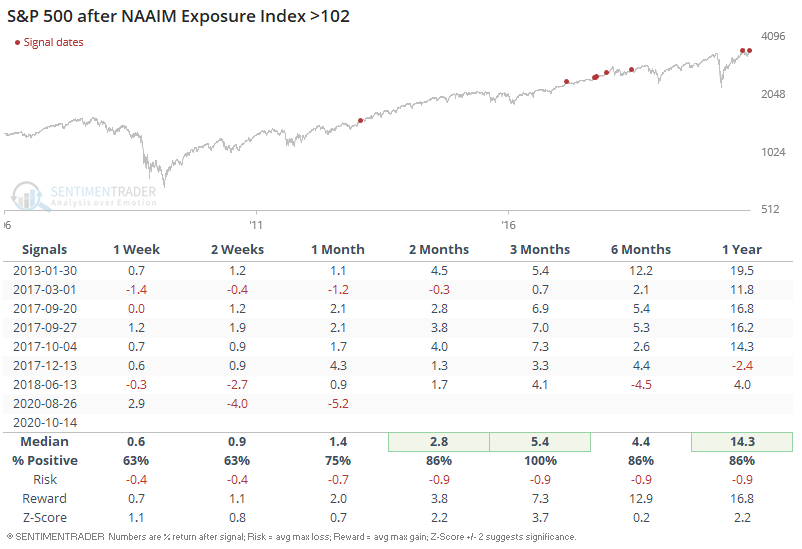

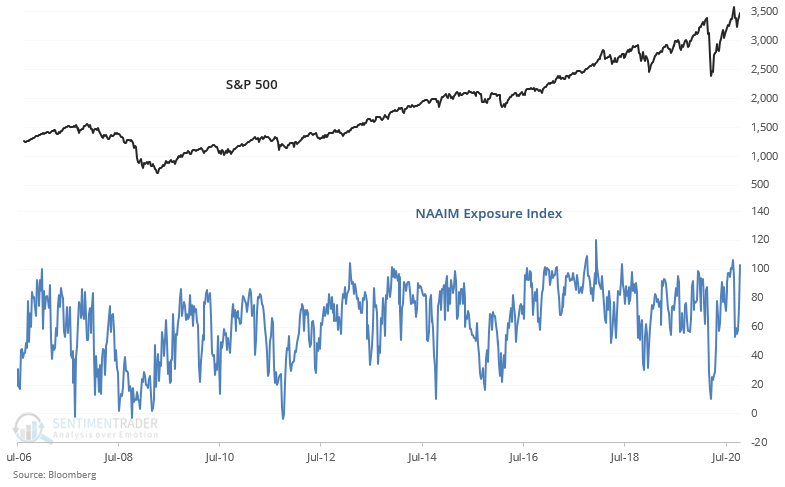

Meanwhile, the NAAIM Exposure Index has bounced back to one of the highest levels over the past 15 years:

This isn't a clear contrarian sign, since in the past it always led to more gains for the S&P 500 over the next 3 months: