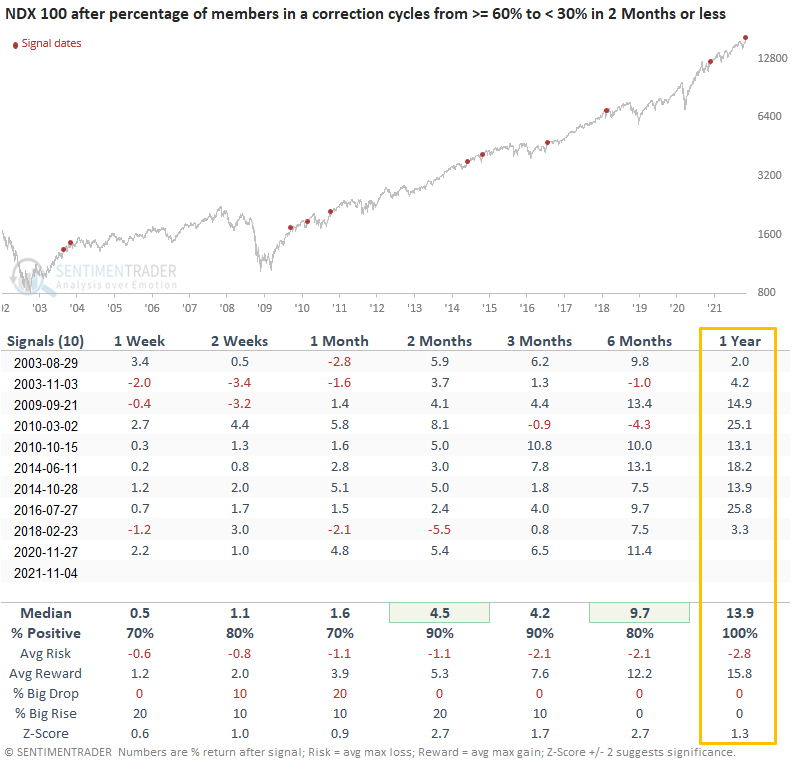

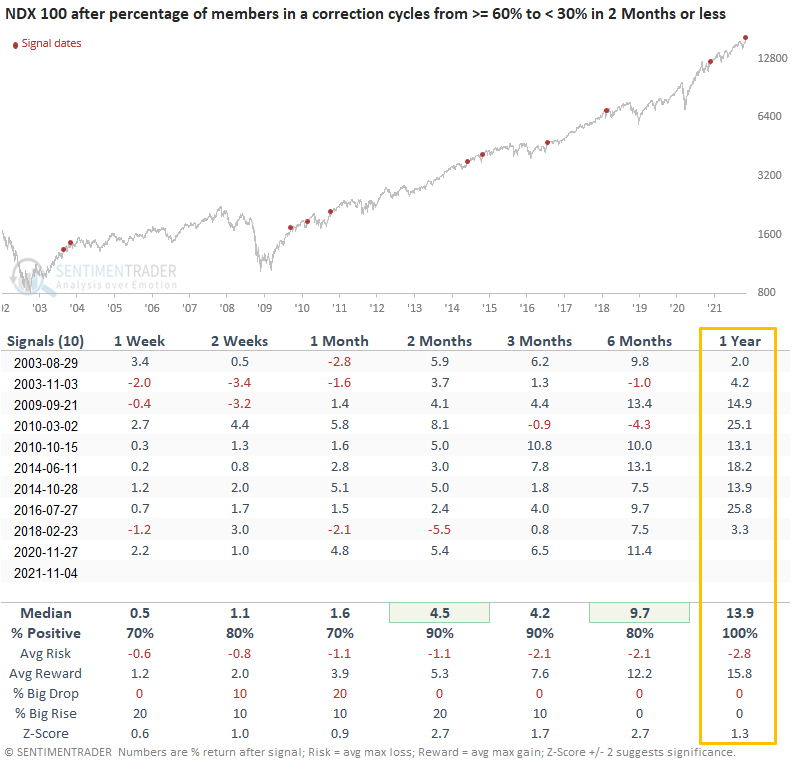

Fewer NDX stocks in correction signals higher prices

Key points:

- The percentage of Nasdaq 100 stocks in a correction have reversed from a high to a low level

- The Nasdaq 100 has rallied 100% of the time over the next 12 months after other signals

Using stocks in a correction to identify a bullish market reversal

The percentage of Nasdaq 100 (NDX) members in a correction has dropped sharply from just a few weeks ago. We use the widely accepted definition of "correction" as being down 10% or more from a 52-week high.

When the percentage of stocks in a correction reaches an extremely high number, it is typically a sign of selling exhaustion. However, I'm not a fan of catching a falling knife; I like to see an indicator like this one reverse as confirmation that the worst of the drawdown is over.

Similar reversals in NDX stocks in corrections preceded gains every time

Let's conduct a study to assess the outlook for the Nasdaq 100 when the percentage of stocks in a correction is at least 60% then subsequently falls below 30% within 2 months. The last time this triggered was in November 2020, leading to a substantial rally.

This signal has triggered 10 other times over the past 19 years. After the others, future returns and win rates were solid across all time frames, especially on a medium- to long-term basis. A year later, the NDX was higher each time, and its risk/reward ratio was very positive over the next 6-12 months.

What the research tells us...

When the percentage of stocks in a correction cycle from a high to a low level in a relatively short period of time, it suggests that the market is transitioning from a risk-off to a risk-on environment. Similar setups to what we're seeing now have preceded rising prices for Nasdaq 100 over all time frames.