Fear & Greed models triggered new buy signals for stocks and bitcoin

Key points:

- The Fear and Greed Model reversed higher relative to its recent range

- The reversal triggered a new buy signal for stocks

- The S&P 500 has rallied 76% of the time after other signals

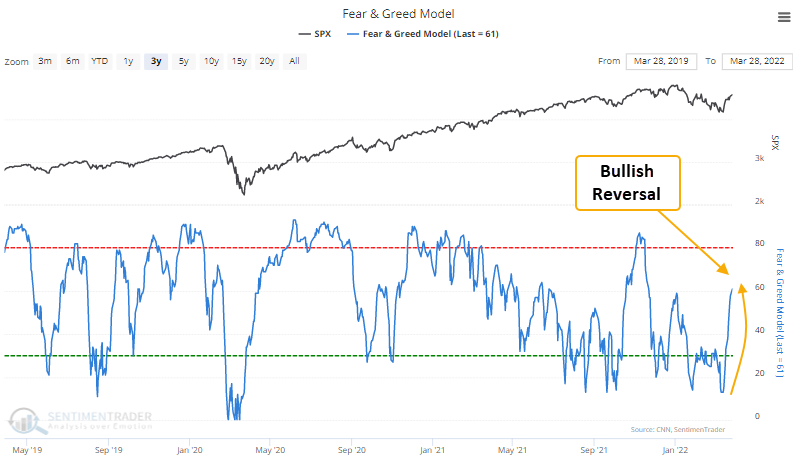

The Fear and Greed Model

This is a model based on the one published by CNN on their public website (we suggest you visit their site to learn more about the model). This is our calculation of the model based on the inputs discussed on their website. It does not reflect the values published by CNN, rather it is our interpretation of the model.

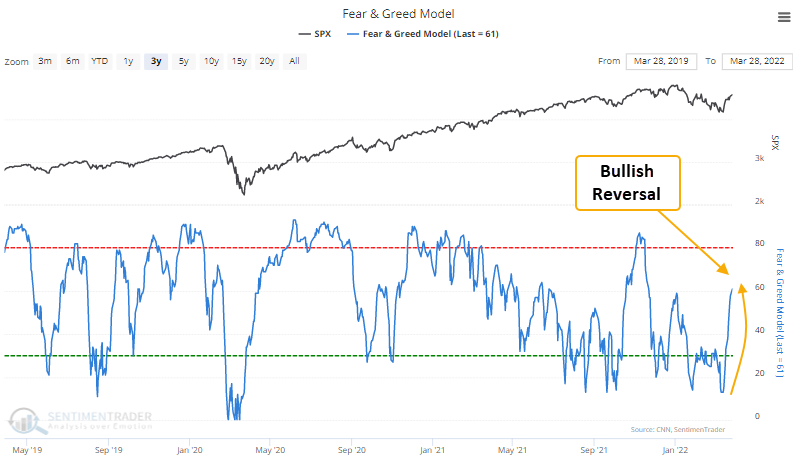

A trading system that identifies a reversal in the Fear & Greed Model

The trading system ranks the fear and greed model range over the trailing 63-day lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition is confirmed when the range rank indicator crosses below the 10th percentile. A new buy signal triggers when the range rank exceeds the 99th percentile. Within 5 days of the cross, the 5-day rate of change for the SPY ETF must be >= 0%. i.e., market momentum is positive.

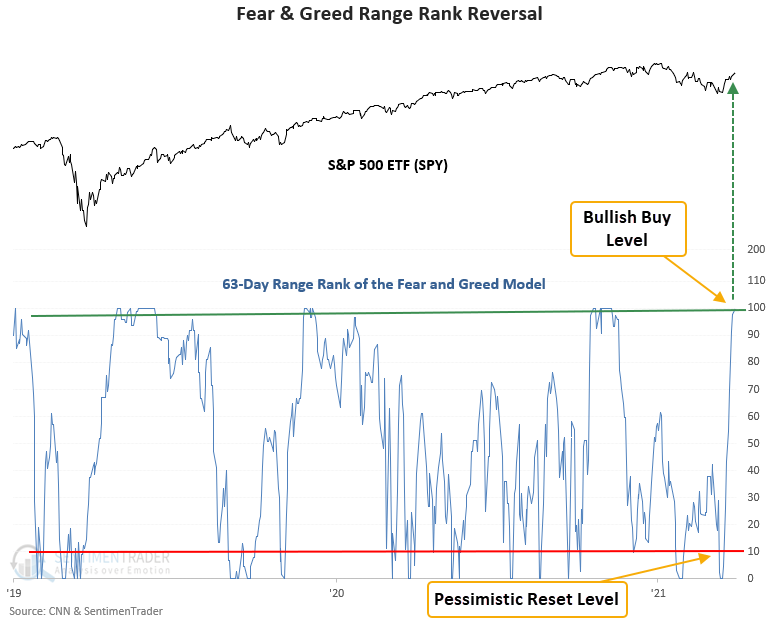

Similar reversals in the Fear & Greed Model have preceded gains 76% of the time

This signal was triggered 41 other times over the past 24 years. After the others, SPY's future returns, win rates, and risk/reward profiles were excellent across all time frames, especially on a medium-term basis. Suppose we look at the signals during unfavorable environments like 2000-02 and 2007-09. In that case, the 1-month time frame shows 5 out of 8 winners. And the drawdowns in that time frame were somewhat benign.

Key points:

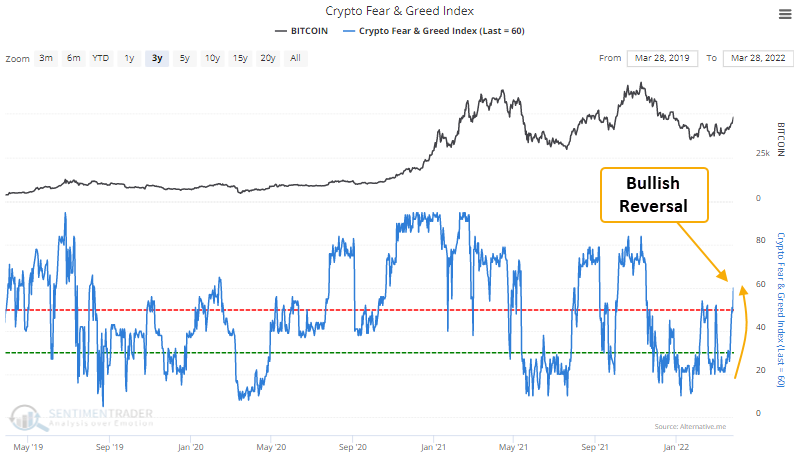

- The Crypto Fear and Greed Index reversed higher relative to its recent range

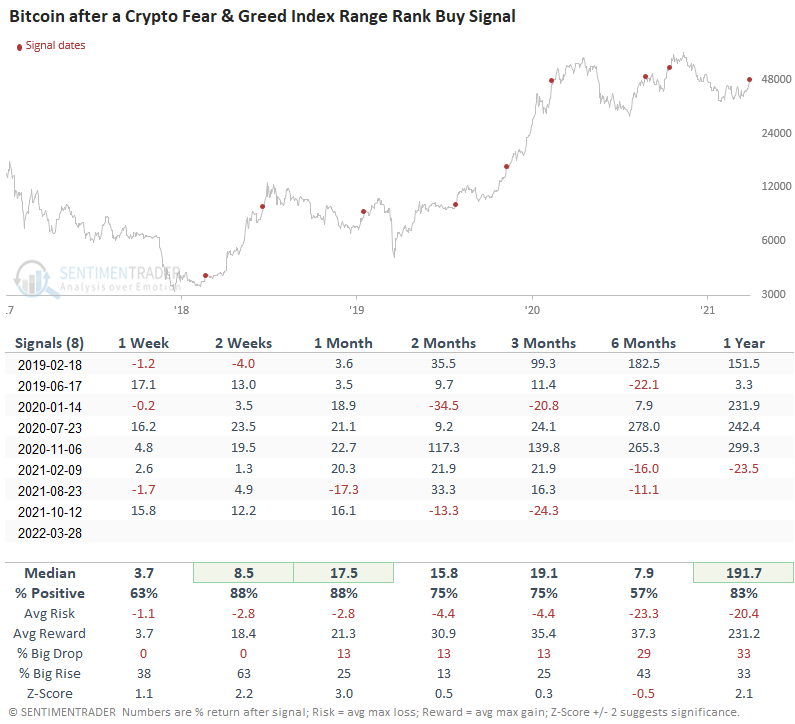

- The reversal triggered a new buy signal for Bitcoin

- Bitcoin has rallied 88% of the time after other signals

The Crypto Fear and Greed Index

This model, created by Alternative.me, calculates a weighted sentiment measure for bitcoin by aggregating five sources: 1) Volatility, 2) Momentum and volume, 3) Social media, 4) Surveys, and 5) Dominance.

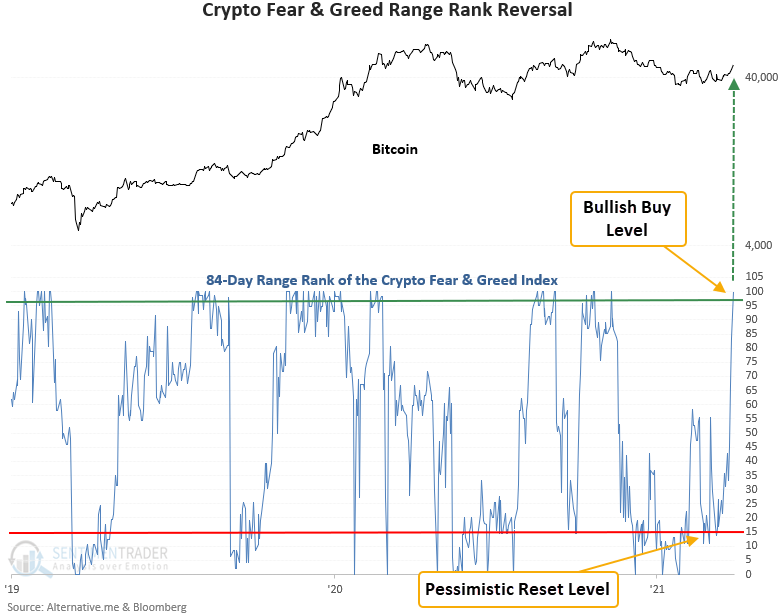

A trading system that identifies a reversal in the Crypto Fear & Greed Index

The trading system ranks the fear and greed index range over the trailing 84-day lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition is confirmed when the range rank indicator crosses below the 15th percentile. A new buy signal triggers when the range rank exceeds the 97th percentile. Within 5 days of the cross, the 5-day rate of change for Bitcoin must be >= 5%. i.e., market momentum is positive.

Similar reversals in the Crypto Fear & Greed Index have preceded gains 88% of the time

This signal was triggered 8 other times over the past 3 years. After the others, Bitcoin's future returns, win rates, and risk/reward profiles were solid in the near term, especially in the 1-month time frame. The signal showed a positive return at some point in the first month in all 8 instances. The crypto index data from _alternative.me is limited. So, the sample size is small.

What the research tells us...

When the Fear and Greed Model reverses from a pessimist level, it signals that traders have become more optimistic about the outlook for stocks. Using the F&G Model to measure that change in sentiment, similar setups to what we're seeing now have preceded rising stock prices, especially in the medium-term.

When the Crypto Fear and Greed Index reverses from a pessimist level, it signals that traders have become more optimistic about the outlook for bitcoin. Using the F&G Index to measure that change in sentiment, similar setups to what we're seeing now have preceded rising bitcoin prices, especially in the near term.