Farrell Sentiment indicator suggests a good year

One of the more curious aspects of sentiment over the past couple of months has been the persistent pessimism, or at least lack of optimism, among individual investors in the AAII survey.

The survey has a lot of weaknesses, but remains very widely followed and isn't without its uses. Most of our models are showing that sentiment, in general, is somewhere between neutral to optimistic, but this is one that is keeping a lid on them showing too much optimism.

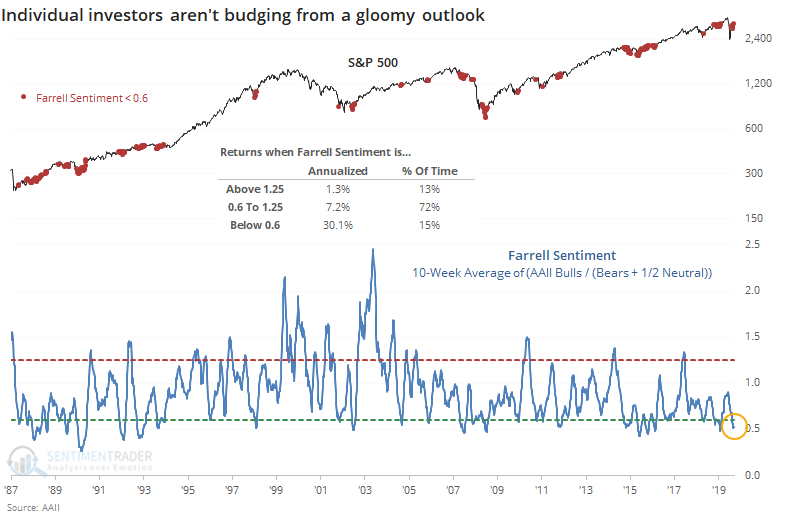

Over the past 10 weeks, the S&P 500 has rallied more than 25% (weekly Wednesday closes) yet the AAII survey shows less and less optimism. That's the conclusion using the Farrell Sentiment indicator, created by Bob Farrell, a respected market analyst from the earlier decades.

It's been nearly a decade since the last time we looked at this measure, which is making the rounds again as it's throwing off a buy signal. To create the indicator, we take a 10-week average of the percentage of AAII Bulls and divide it by AAII Bears plus half the neutral responses. It's currently below 0.6, a very low level historically.

We can see from the chart that the S&P 500's annualized return when the indicator is below 0.6 is an impressive 30.1%, versus only 1.3% when the indicator is above 1.25.

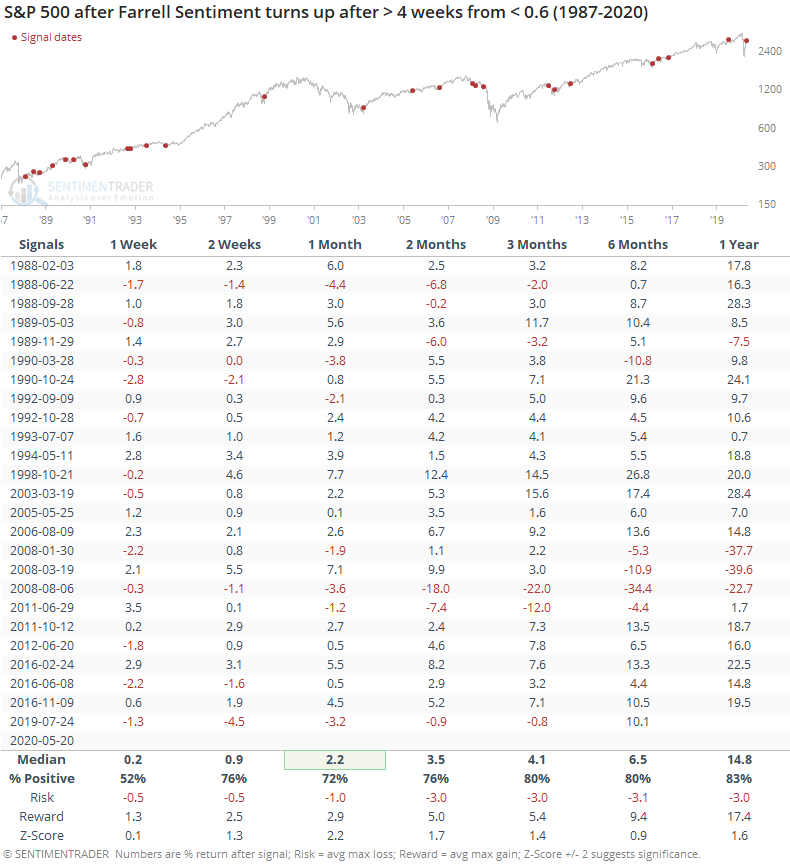

If we use a signal-based approach, when the indicator first turns up from a streak below 0.6, it has led to mostly positive returns.

There were some definite failures in there, most notably in 2008 when it suggested several false starts. Other than that, large losses were rare.

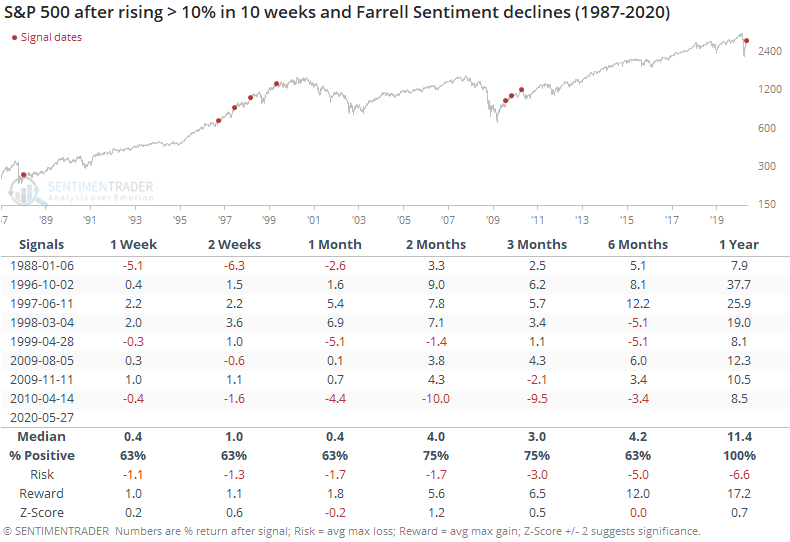

It's also rare to see this kind of behavior during a substantial rally. There haven't been too many times when the indicator declined during a 10% or greater rally.

This happened in early 2010, and stocks peaked shortly after. Other than that, losses were rare, and nonexistent over the next year.

Placing a lot of weight on this particular data is shaky. It's not acting as it has historically, which raises the worry that something underlying the survey has changed. It's way too early to discount it entirely, however, and future returns after relatively similar behavior were consistently positive. We'd rate it as a minor long-term positive and not much more than that.