Falling interest rate volatility

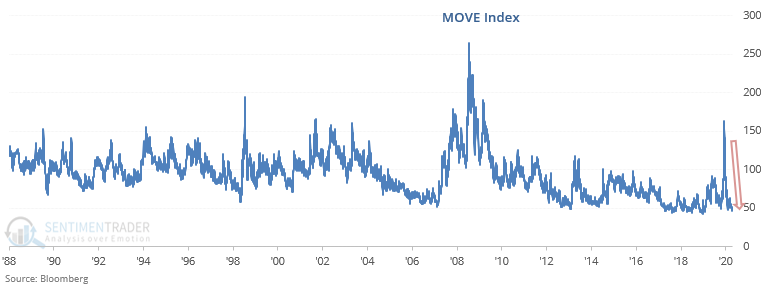

The Market Ear noted that the MOVE Index, which measures U.S. interest rate volatility (similar to VIX for equities), has dropped to the lowest level in over a year.

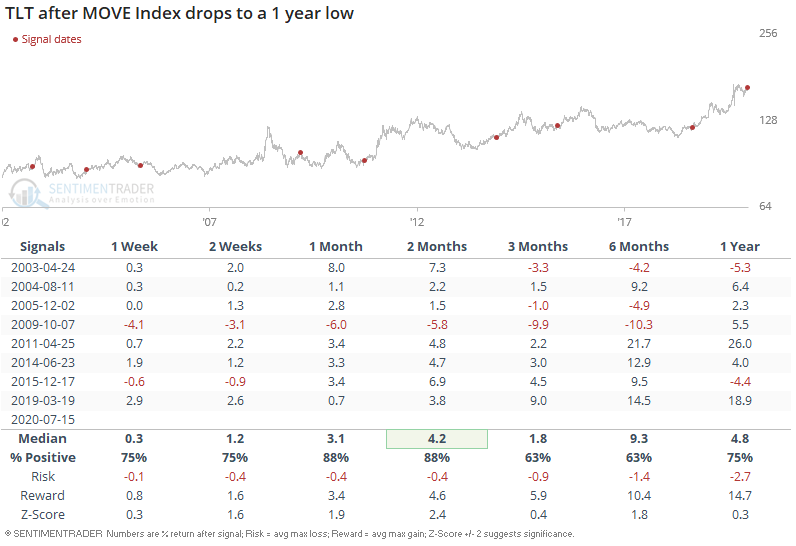

Low VIX is often seen as a bearish sign for U.S. stocks. But in the bond market, MOVE dropping to a 1 year low was not consistently bearish for TLT on any time frame. On the contrary, it usually led to more gains for TLT over the next 2 months:

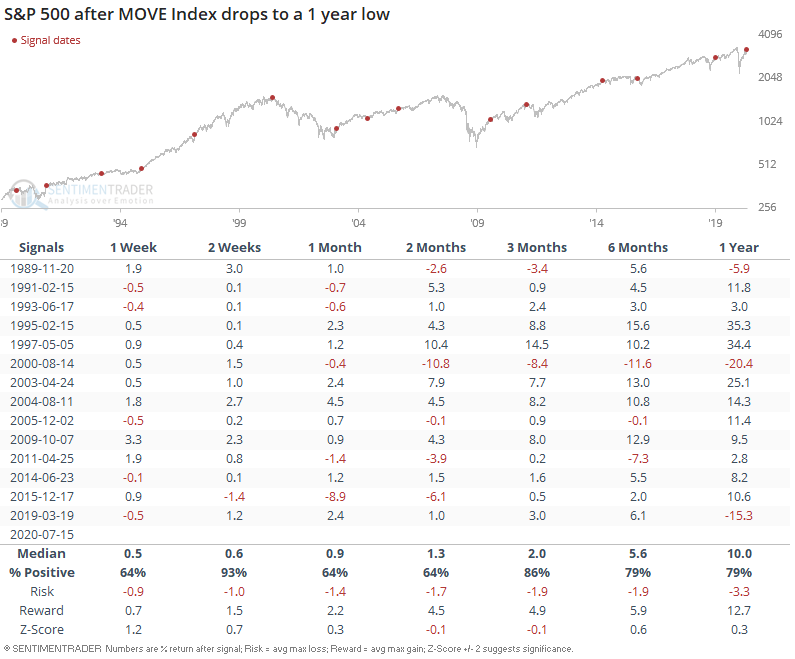

Here's what the S&P 500 did next: