Failed Bounce And Put Purchases

This is an abridged version of our Daily Report.

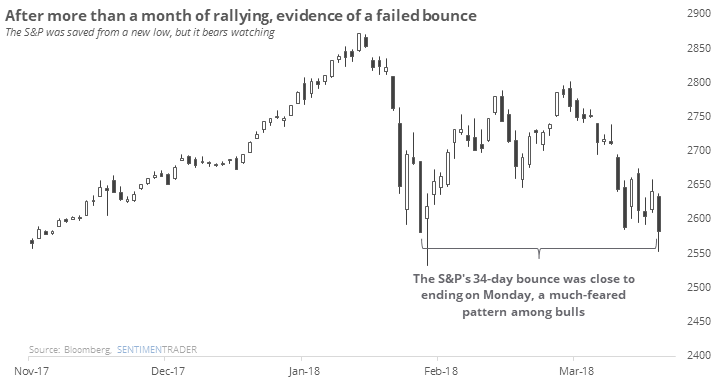

Failed bounce

Before some modest after buying interest, the most important index in the world triggered a failed bounce.

That’s one of the most feared patterns for bulls because it shows a complete lack of buying interest. The S&P did suffer below-average returns after other failed bounces, but it wasn’t a complete disaster.

A big violation

The S&P 500 finally broke its streak of days above its 200-day average and did so with extreme prejudice. Monday’s violation of the long-term average was one of the heavier selling days that ended prior streaks.

No tech goes untouched

Every stock in the Nasdaq 100 index lost value on Monday. In the past 22 years, only 10 other days have seen such one-sided selling pressure.

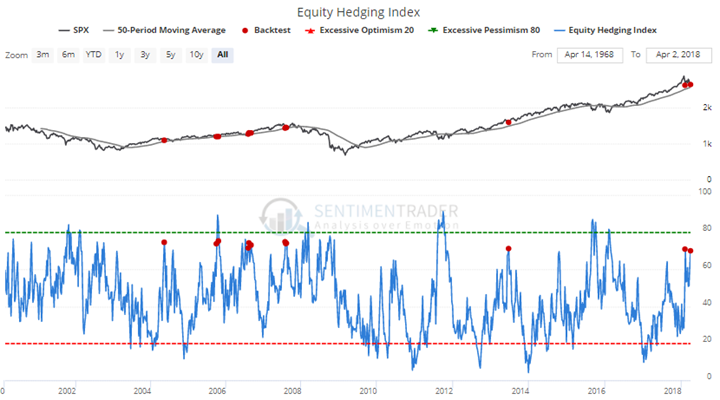

Put purchases prove popular

Last week, options traders spent their most volume on buying put options since October 2015, leading to a rise in the Equity Hedging Index.

Even during the last two bear markets, such heavy put buying led to decent returns over the next 1-2 months.

Few uptrends

For the past week, an average of only 6% of stocks in the Dow Industrials have traded above their 50-day moving averages.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.