Fading Confidence; Historic Kick-Off Breadth; High-Yield Bond Buying

This is an abridged version of our Daily Report.

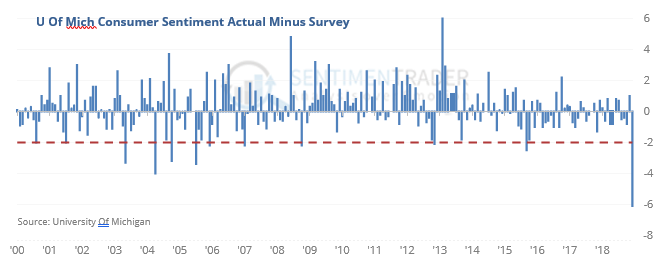

Fading confidence

Preliminary readings on Consumer Confidence were well below economists expected, and showed a large decline from the recent peak.

Fading confidence tends to be more of a negative than positive until it reaches an extreme, and the S&P’s risk was higher than normal when seeing readings like this.

Kick-off breadth

There has been ample evidence since January 4 that we were seeing something different this time in terms of the eagerness of buyers. That has persisted. As a result, over the past month, we’ve seen breadth swing from one extreme to the other, to an extent that has been matched only twice since 1940, and which both kicked off major bull markets.

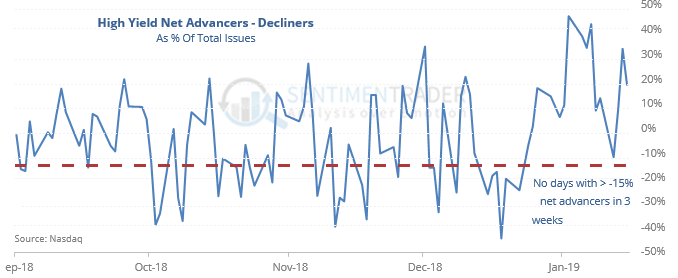

High yield keeps going higher

Like in the stock market, the high-yield bond market has enjoyed exceptionally broad-based buying. For the past 3 weeks, there has only been one day with more declining bonds than advancing ones, and at least one session when more than a net 40% of the junk bonds advanced.

As much as we can read into a sample size of four, the behavior following these stretches was relatively consistent. Each of them saw the HYG fund pull back over the next 2-4-weeks, and those pullbacks served as excellent staging areas for the next phase of a longer-last rally.

Contracting debt

Margin debt declined in December and is now down 17% from its peak. Cash levels rose, shrinking investors’ negative net worth by about a third. None of these are abnormal given the move in stocks and none are yet extreme in any sense.