Extreme sentiment across multiple countries

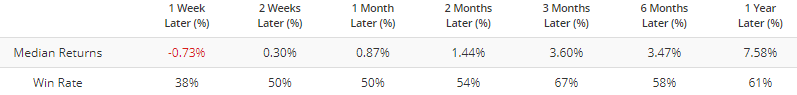

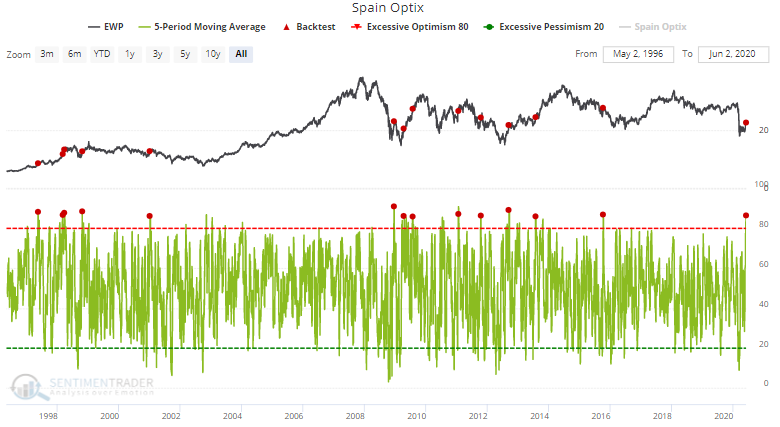

The nonstop rally in global equities has pushed sentiment in various countries to the highest level in years. Our Spanish Optix's 5 day average is at 86.

When Optix was this extreme in the past, Spanish equities experienced mixed returns over the next few weeks and months.

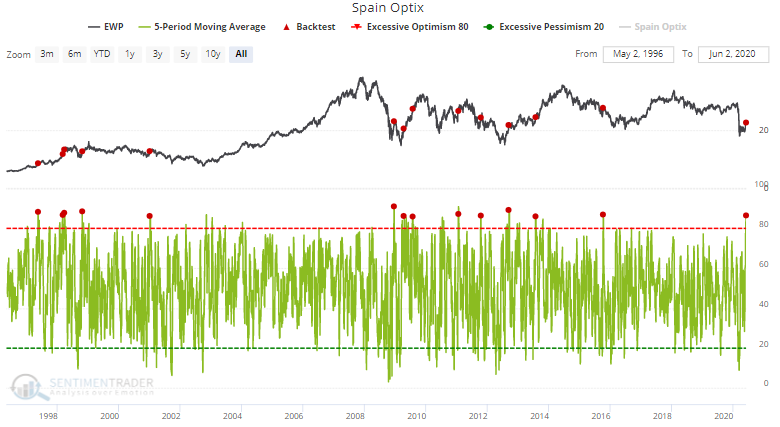

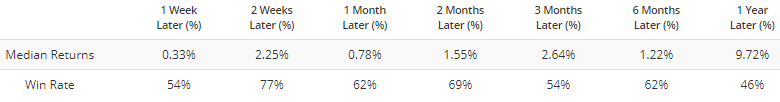

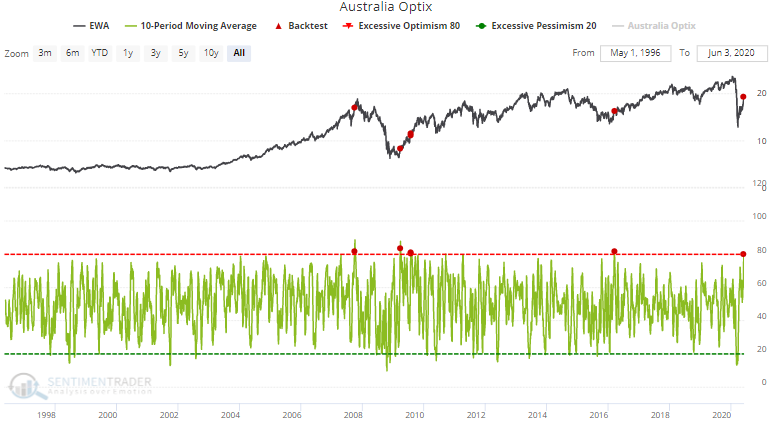

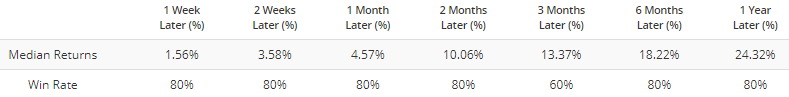

Our Australian Optix's 10 day average is at 80:

When Optix was this extreme in the past, Australian equities didn't always pullback in the coming weeks and months. This occurred in 2009 when equities rallied nonstop higher:

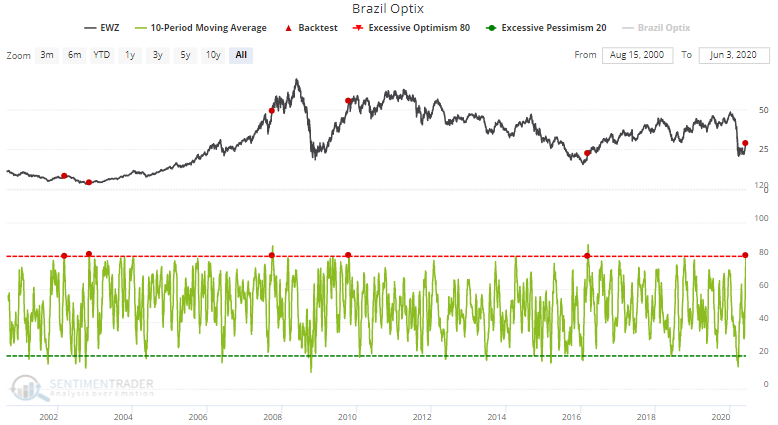

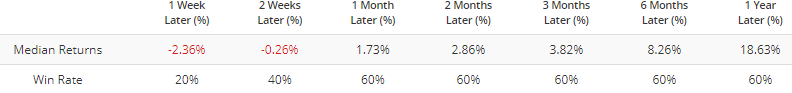

Our Brazilian Optix's 10 day average is at 80:

When Optix was this extreme in the past, Brazilian equities usually suffered over the next week:

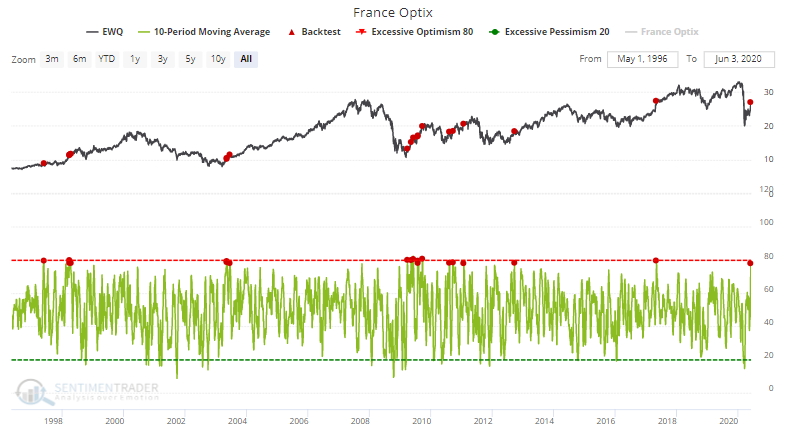

Our France Optix's 10 day average is at 78:

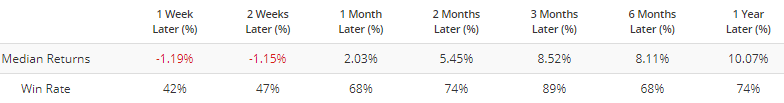

When Optix was this extreme in the past, French stocks witnessed worse than random returns over the next 2 weeks:

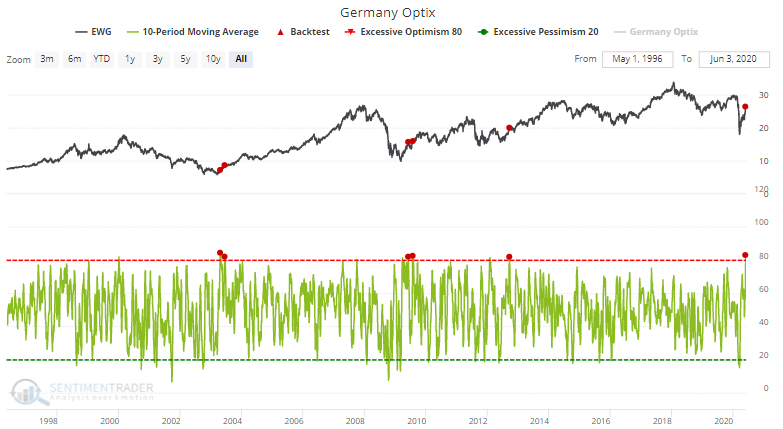

Our Germany Optix's 10 day average is at 83:

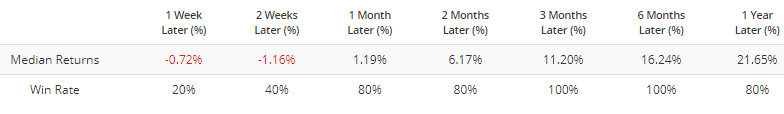

Similar extreme readings usually led to a pullback in German equities over the next 1-2 weeks:

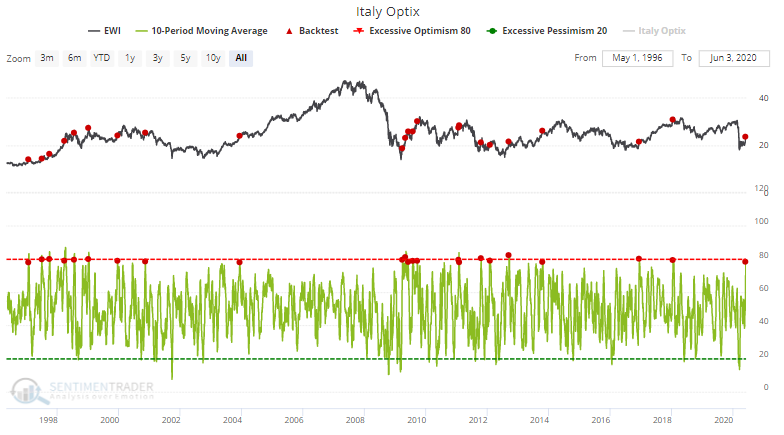

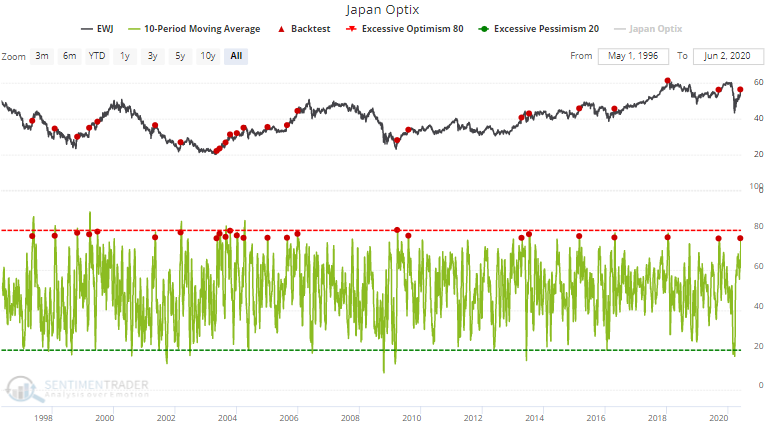

Our Italy Optix's 10 day average is at 78:

When Optix was this extreme in the past, Italian equities experienced worse than random returns over the next 2 weeks:

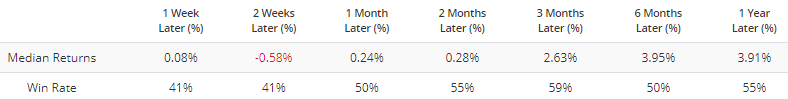

And our Japan Optix's 10 day average is at 76:

When Optix was this extreme in the past, Japanese equities usually suffered over the next week: