Everything is risk-off

Key points:

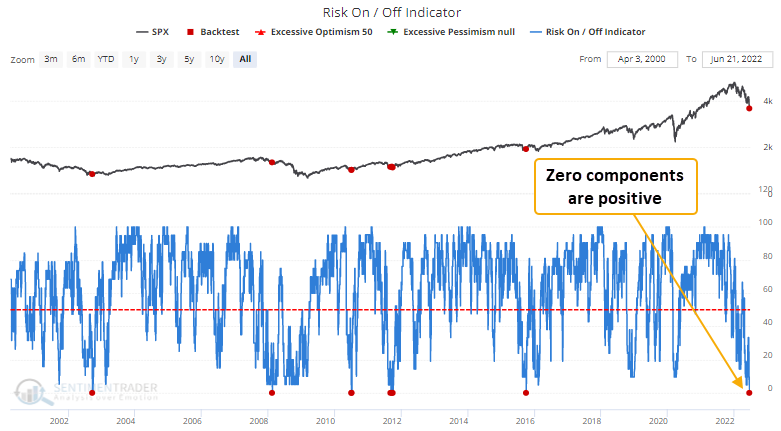

- The SentimenTrader risk on/off indicator declined to zero on Friday

- After other signals, the S&P 500 ETF rallied 100% of the time

Using the risk on/off indicator to identify capitulation lows

For only the 6th time in the last 23 years, the SentimenTrader risk on/off indicator declined to zero. As a reminder, the indicator utilizes a weight-of-the-evidence approach by combining 21 diverse components into a single model to assess the current market environment.

Let's assess the outlook for the S&P 500 after similar signals. I created and saved today's study using our backtest engine. If you would like a copy, please click here. Repeat signals were screened out.

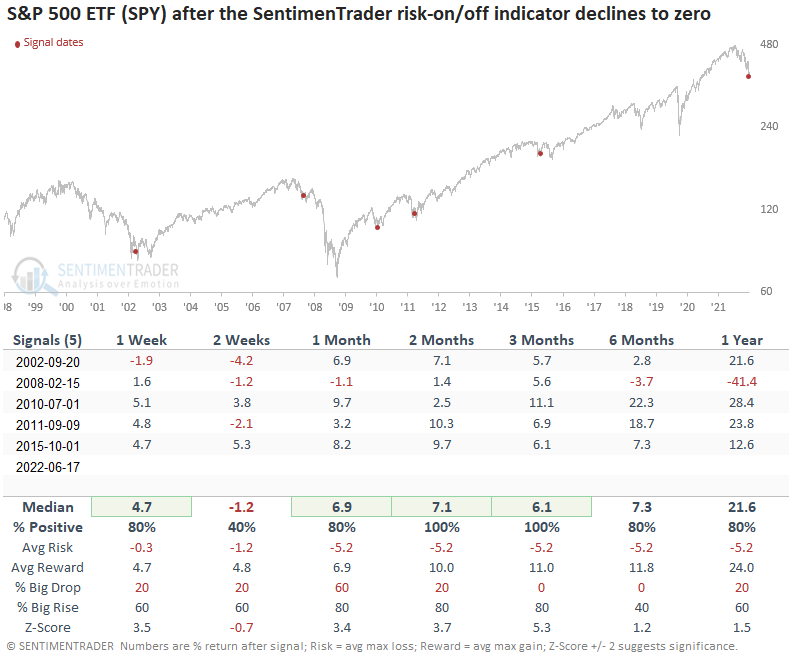

Similar signals preceded gains 100% of the time

This model generated a signal 5 times over the past 20 years. After the others, the S&P 500 ETF's future returns, win rates, and z-scores look excellent across almost all time frames. The 2-week window should be a friendly reminder that markets typically chop around and retest capitulation lows. Interestingly, the indicator did not fall to zero after several severe risk-off periods like September 2001, December 2018, and March 2020. And after the first signal in February 2008, the indicator failed to reach zero again.

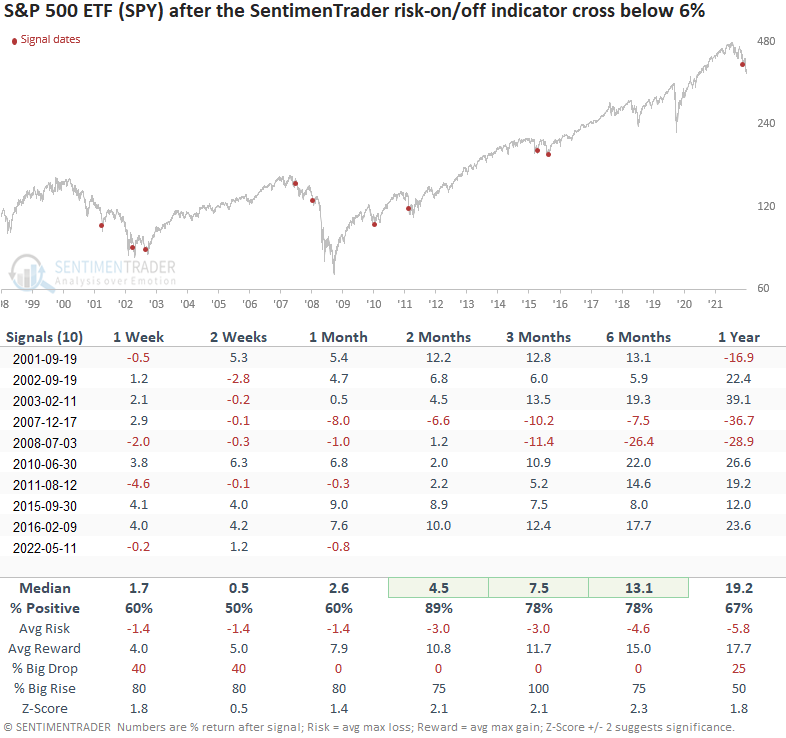

What happens if we increase the threshold level

If I increased the threshold level for the indicator to identify a cross below 6%, the study generated 10 other signals. After the others, SPY future returns, win rates, and z-scores were solid across medium-term time frames. The signal generated a positive return 2 months later in 4 out of 5 cases during the 2000-02 and 2007-08 bear markets. Once again, we should keep an open mind to choppy conditions and a potential retest of the lows based on the 2-week window

What the research tells us...

When the SentimenTrader risk on/off indicators declines to zero, history suggests a washed-out market, leading to a mean-reversion bounce. Similar setups to what we're seeing now have preceded positive gains across almost all time frames, especially the 2-month window. However, we need to be aware that the market could be choppy and potentially retest the lows based on the 2-week time frame.

The market remains exceptionally hostile as the Federal Reserve continues to tighten policy in a decelerating growth environment. One can make a strong argument that we are in uncharted territory. For example, when the Federal Reserve raised the fed funds target rate last week, the S&P 500 was down 21% from its high. That's the worst drawdown at the time of a 1st to 3rd rate increase since my data started in 1959. So, while the market is washed-out and appears ripe for a bear market bounce, we need to keep an open mind to all outcomes and manage risk appropriately.