Everything Is Rallying On FOMC Decision

After the FOMC announcement on their rate policy and outlook, pretty much everything is rallying. It's odd to see stocks, bonds, gold and commodities all enjoying relatively large gains, because they tend to react differently to economic inputs.

Regardless, there have been 12 times since the inception of the SPY (stocks), TLT (bonds), GLD (gold) and USO (oil) funds that all of them rallied on the day of a FOMC decision. Barring large reversals in the next 30 minutes, today will mark the 13th.

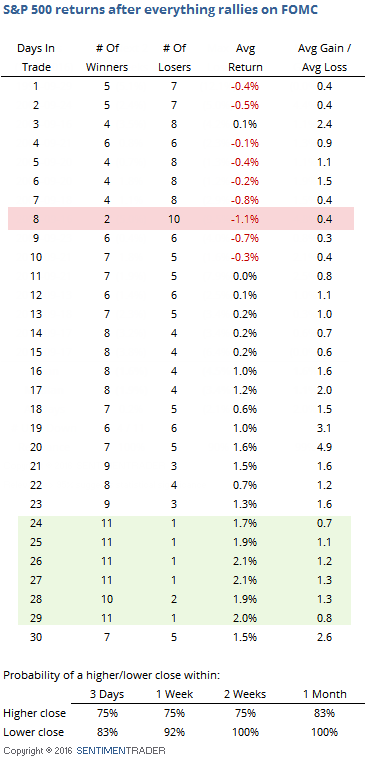

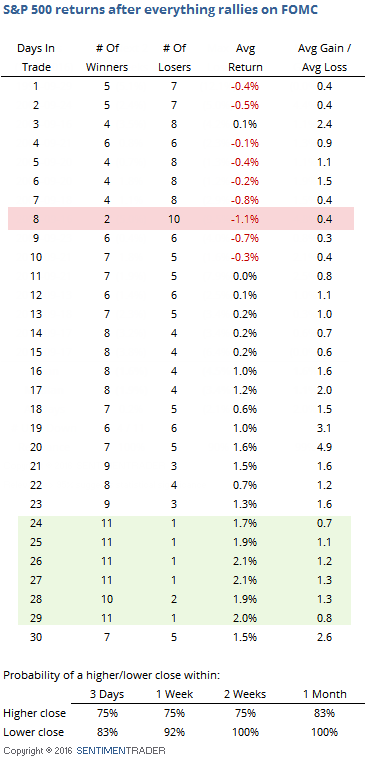

Stocks have showed a negative short-term tendency after the other instances. The worst was 8 days later, when SPY was positive 2 times and negative 10 times, with a heavily skewed risk/reward ratio to the downside. It had at least one lower close over the next two weeks every time.

Given the mostly uptrending market over the past decade, by a little over a month later, the instances were mostly positive. The other markets were mostly mixed to higher across most days, especially TLT which was up 9 of the 12 times over the next 5-10 days.

Here are the dates:

| 06/29/06 |

| 10/25/06 |

| 01/31/07 |

| 03/21/07 |

| 03/18/09 |

| 03/16/10 |

| 08/09/11 |

| 09/18/13 |

| 06/18/14 |

| 03/18/15 |

| 03/16/16 |

| 04/27/16 |