Even as stocks become more volatile, they're less correlated

The historic shift between factors hasn't really let up since they were jolted out of a slumber last week. The continued outperformance in small-cap stocks is triggering some other oddities, as well.

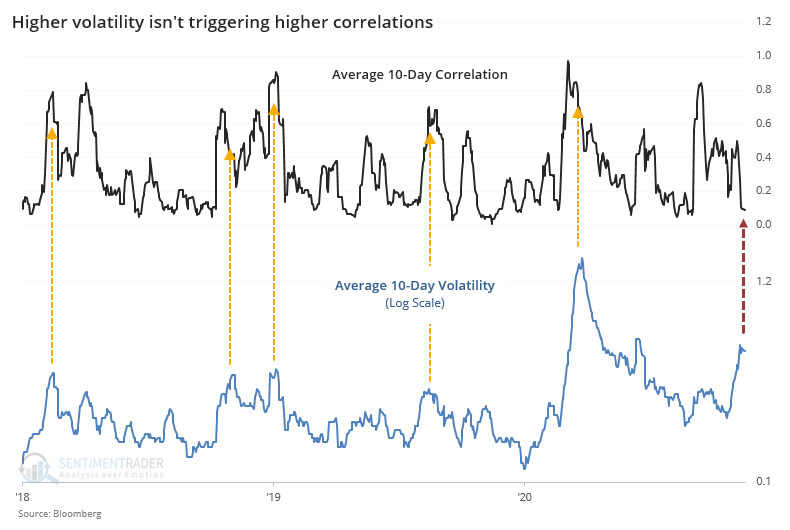

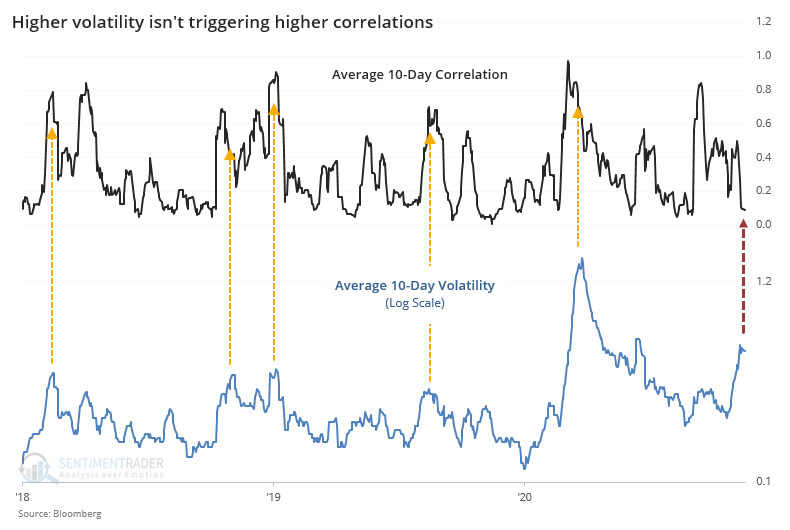

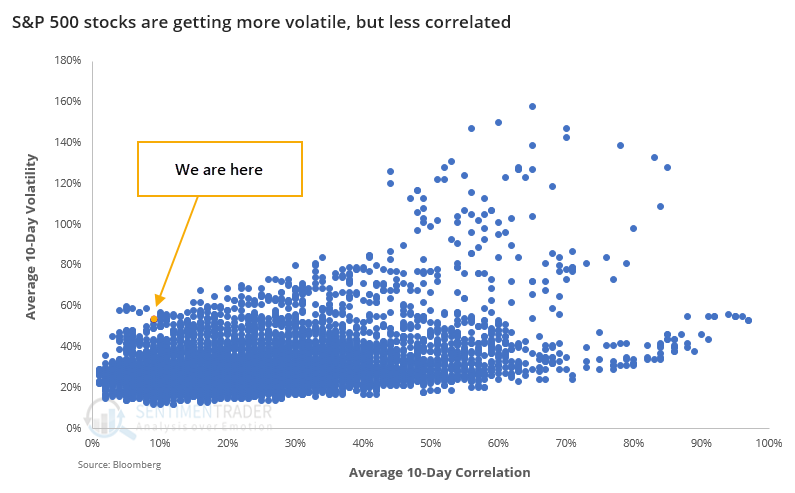

Bloomberg notes that while the average 10-day volatility among stocks in the S&P 500 has jumped along with big price moves over the past two weeks, the average 10-day correlation among stocks in the index has plunged.

This is extremely unusual. Most of the time, higher volatility means higher correlation and vice-versa.

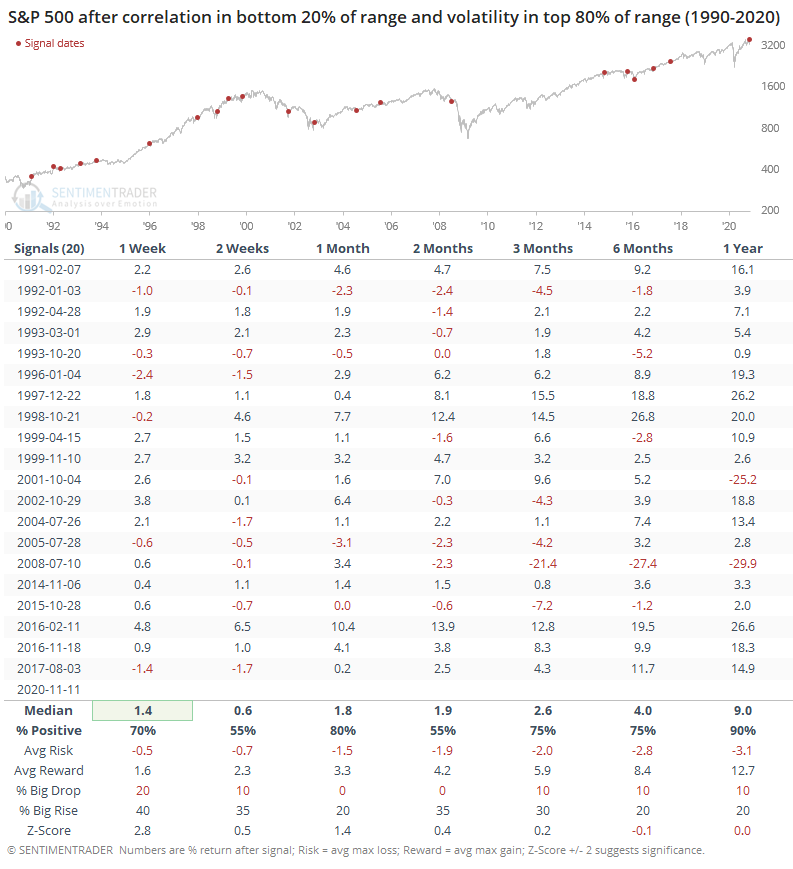

For the S&P 500, this was a mixed-to-positive sign, with gains over the next month and longer-term, but less-positive performance over the next 2 months.

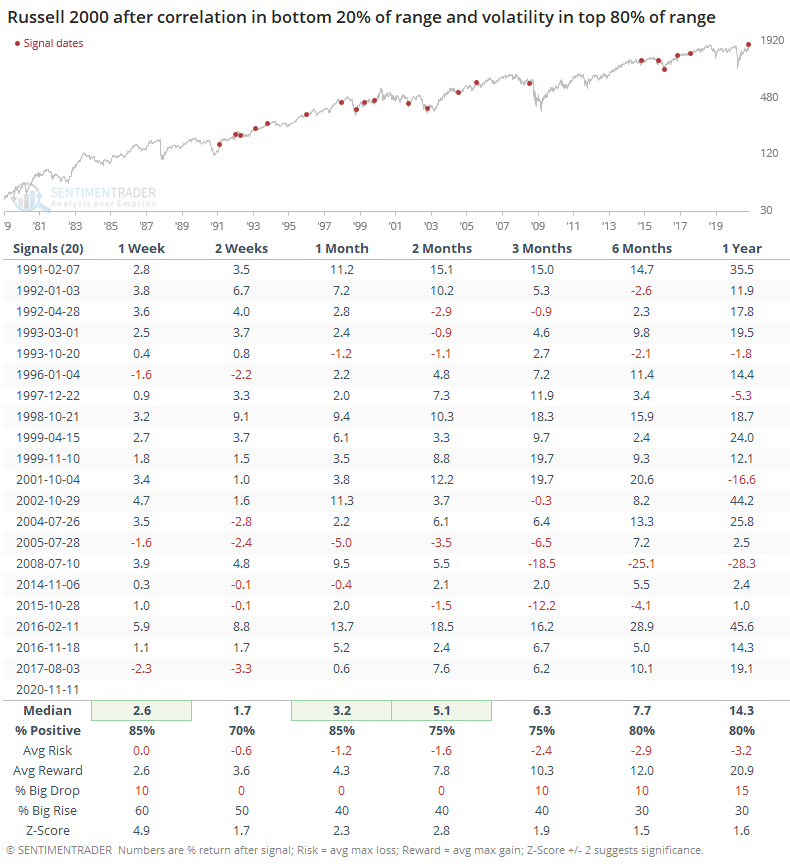

This phenomenon is likely mostly triggered by smaller stocks within the index suddenly becoming more volatile. And, for the most part, that was a good sign for those smaller stocks. Look at the Russell 2000's returns after those same signals.

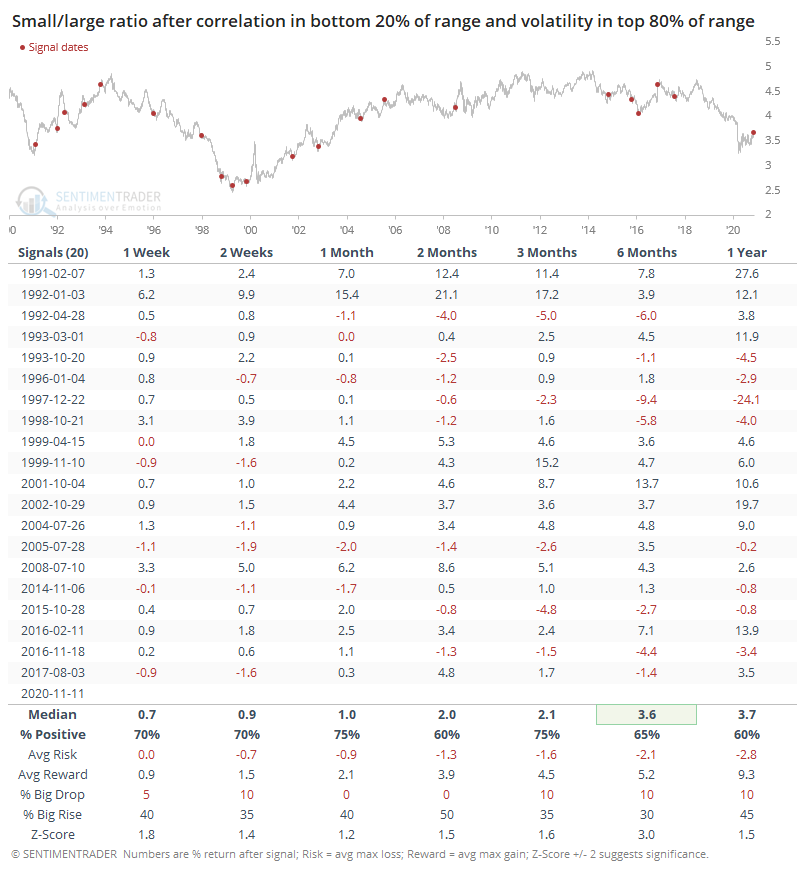

This means the ratio of small to large stocks typically rose.

The thrusts in breadth and violent rotation in left-behind sectors over the past 1-2 weeks has been historic, and that has preceded even-higher prices over the medium- to long-term with consistency, especially for many of those formerly left-behind factors. This drop in correlation even with increased volatility is another modest sign that perhaps this rotation is more likely to stick around.