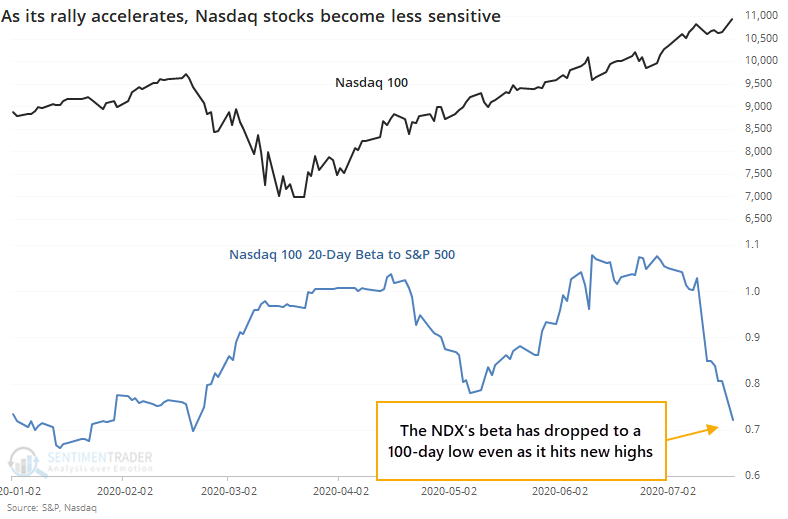

Even as big tech soars, they become "safer"

On the Nasdaq's march to new highs, a curious thing has happened - they've become the "safe" stocks.

As the Wall Street Journal noted, starting during the pandemic, many stocks that would be considered highflying flipped their usual patterns. As indexes like the S&P 500 rose and fell, these stocks rose or fell less than the S&P or even moved in the opposite direction.

On four out of the last seven sessions, the Nasdaq 100 (NDX) has moved less than the S&P 500. Over the past 20 sessions, its beta has plunged to 0.74 relative to the S&P 500, its lowest in more than 100 days.

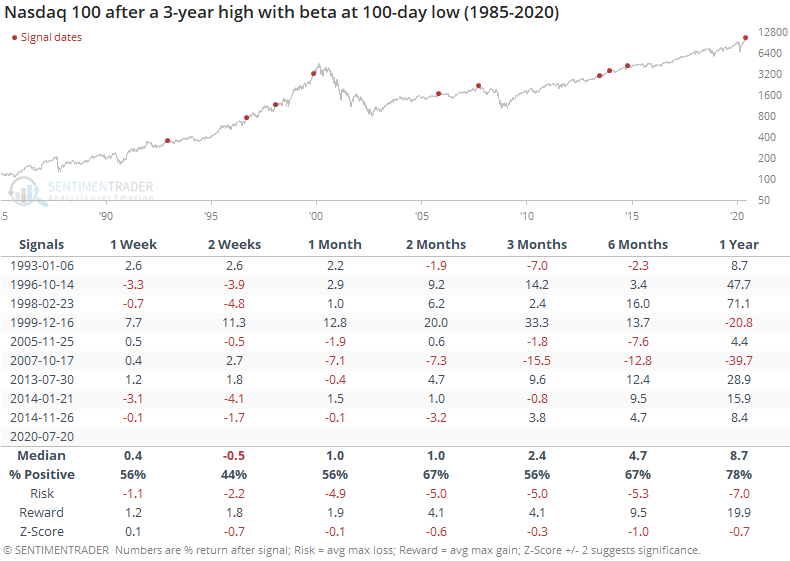

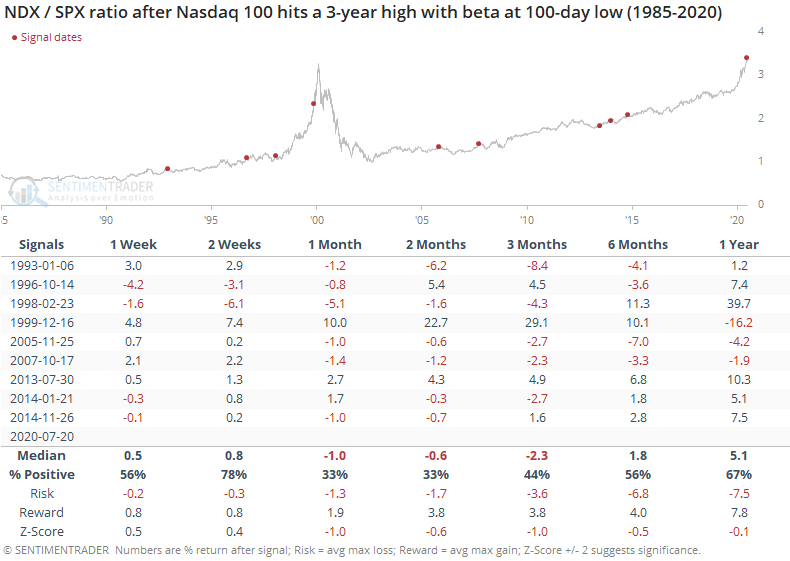

This has been a modest negative for the Nasdaq 100 going forward, with below-average returns and a poor risk/reward ratio, especially up to three months later.

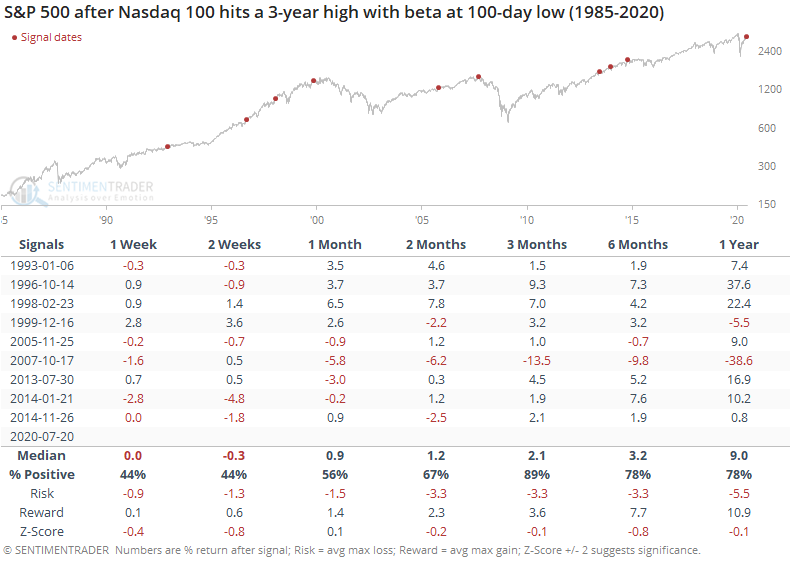

It hasn't been as much of a negative for the broader market, especially over the medium- to long-term. Three months later, the S&P showed only a single loss, though it was a large one.

Taken together, this means that the ratio of the Nasdaq 100 to S&P 500 tended to decline, as the big tech stocks took a breather relative to other parts of the market.

Over the next 1-3 months, the ratio consistently dropped as the S&P outperformed the NDX. There have been other signs in recent weeks that incessant outperformance of these stocks might start to falter, and this is another (minor) one.