Euro Death Cross As Down Days Swamp Up Days, Staples Stabilize

This is an abridged version of our Daily Report.

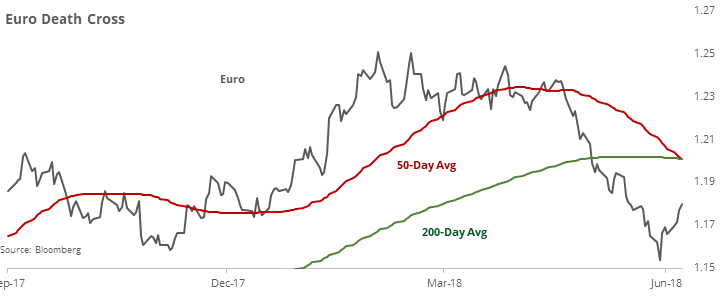

Euro Death Cross

For more than a year, the euro’s 50-day average has been above its 200-day average.

That trend has now ended, after one of the longest streaks in the currency’s history. The end to other long streaks led to further weakness in the euro and gold, while the dollar did well (see inside).

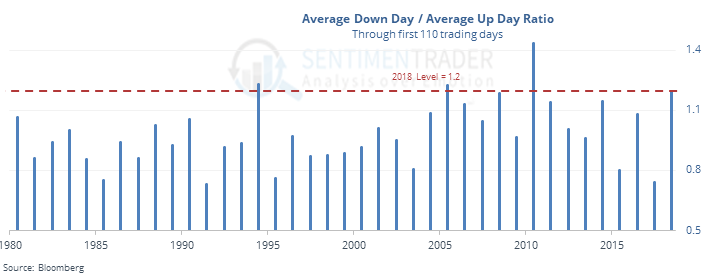

Down days have more oomph

So far in 2018, the average down day has been 20% larger than the average up day.

That’s among the worst ratios since 1928. It has been an inconsistent warning sign, though stocks did struggle through August (see inside).

Staples stabilize

Consumer Staples finally rallied above the 50-day average after hitting a multi-year low. That has led to an excellent risk/reward in the sector over the long-term (see inside).

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers continued to add to their decade-long high exposure to the Swiss franc. Same with hogs, where they are below a record long position by just a hair.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |