Euro area sentiment is recovering from depression

Investors have been pulling a near-record amount of money from overseas mutual funds and ETFs. Sentiment toward non-U.S. stocks has been souring for a while and several measures suggest that pessimism overseas was even worse than what was seen in the U.S.

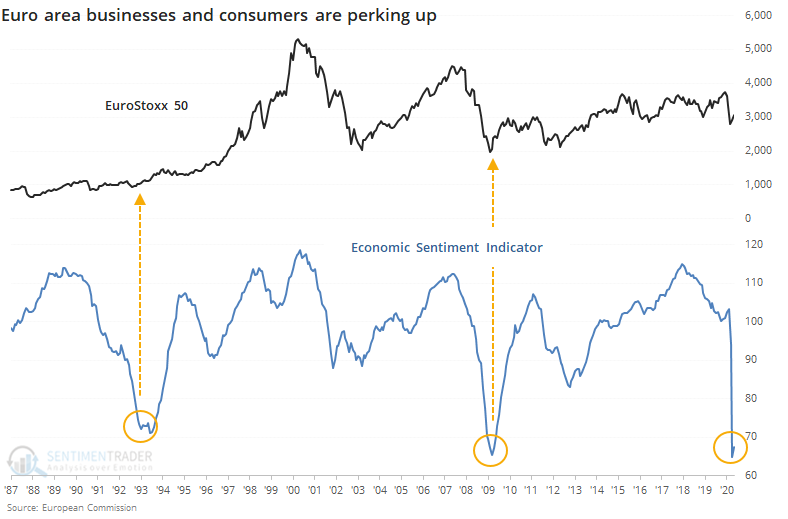

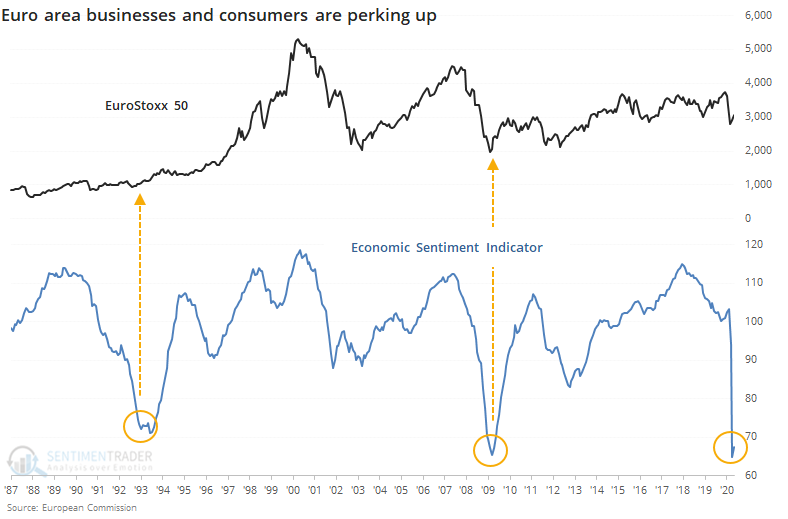

As noted by Bloomberg, a survey of businesses and consumers by the European Commission shows that some of that pessimism might finally be wearing off. Their Economic Sentiment Indicator has just now started to turn from an extremely depressed level.

According to the European Commission (via Bloomberg), this should reflect a broad base of sentiment:

"The Economic Sentiment Indicator is calculated from the European Commission's Business and Consumer Surveys. It is constructed from the following indicators: the industrial confidence indicator (40%), the service confidence indicator (30%), the consumer confidence indicator (20%), the construction confidence indicator (5%), and the retail trade confidence indicator (5%)."

Clearly, there isn't a big sample size to draw on here. But the two other times that sentiment turned up from such depressed levels led to impressive long-term returns in the EuroStoxx 50 index.

While sentiment in the U.S. has mostly recovered from exceptionally depressed levels (on some measures) in March and April, it has either continued to decline or is only now curling up overseas. That has been a very good long-term sign for most major overseas indexes.