ETFs Trading At A Discount

We routinely scan for closed-end funds and ETFs that are trading at extreme premiums/discounts to net asset value, as they often highlight opportunities for mean reversion. Due to the "risk free" chance to arbitrage away any differences between market prices and underlying values, funds will often take advantage of these temporary dislocations.

There haven't been many interesting divergences between price and value lately, but two popped up this morning.

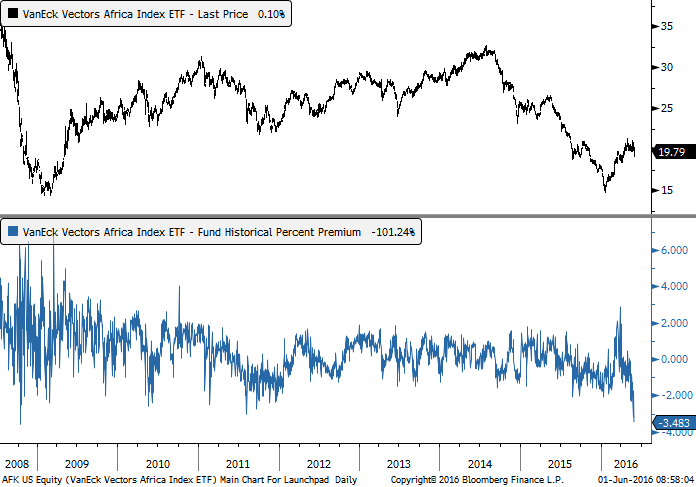

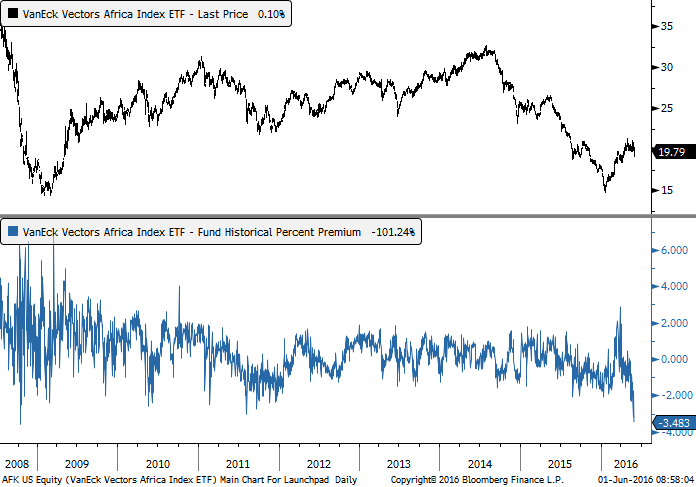

First, the VanEck Vectors Africa Index ETF (AFK) is trading at more than 3% below the value of its underlying securities. That's the largest discount in the fund's history. The only other time it traded consistently below net asset value as it has done lately was in late 2011 as it was forming a long-term low.

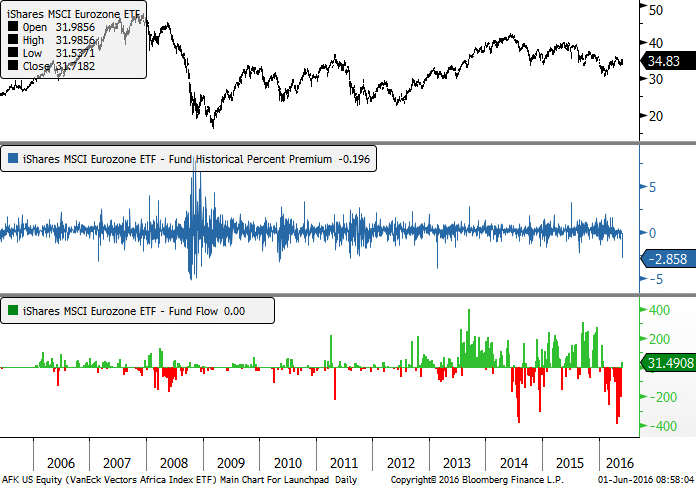

Perhaps even more interesting is the iShares MSCI Eurozone ETF (EZU). The fund has a high concentration in French and German equities, which make up nearly 60% of its assets.

It is currently trading at a 2.9% discount to net asset value, its most extreme since February 2013. Not only that, traders have been abandoning the fund at a record pace, with the past month seeing record outflows.

For those looking for foreign exposure, these two funds are showing up as opportunities, the starting point for a potential trade/investment.