ETF Traders Add To Silver Even While It Falls

A recent Bloomberg blurb on silver has triggered quite a few questions about prospects for the metal.

According to the article, shares in the SLV silver ETF have jumped to a new record high even while silver has been slumping. Indeed they have.

One caveat about ETF assets is that they don't necessarily rise because investors are buying them - shares outstanding can also increase if there is a high demand for selling the shares short. That's why we can see some funds' assets spike exponentially higher even when it's in freefall.

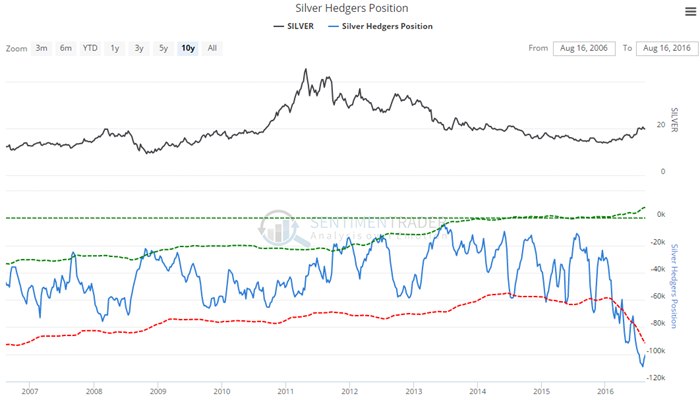

Given that speculators are about the most net long they've ever been in silver futures, though, it seems unlikely that short selling is causing the spike in ETF assets in SLV. The chart below shows commercial hedger positions in silver futures, and speculators hold the exact opposite position.

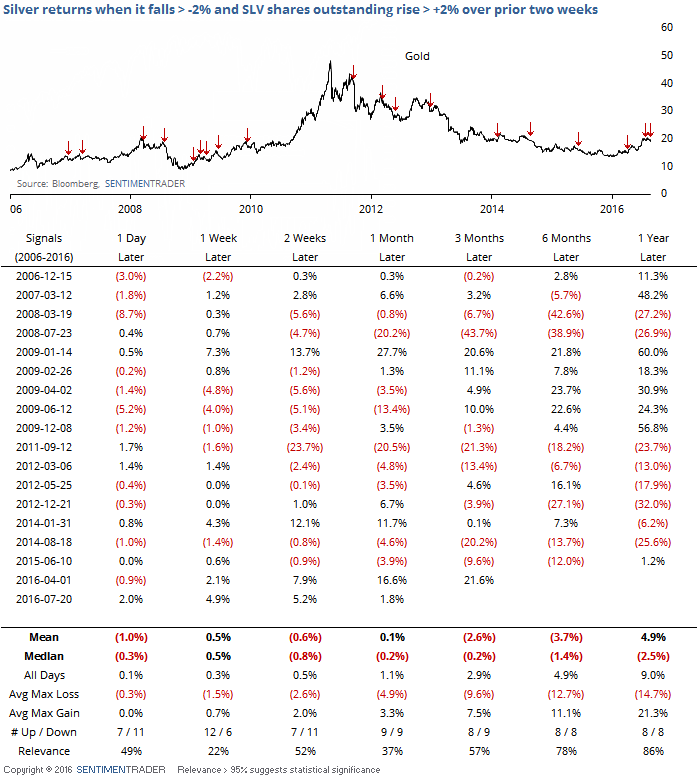

To see if this has meant anything in the past, let's go back over the past decade and look for any time that silver declined 2% or more over the past two weeks while assets in SLV rose at least 2% over the same time period.

We can see that returns going forward were fairly weak, especially over the next couple of weeks. Even three months later, silver was negative more often than positive.

Silver is a volatile contract, so there is a wide dispersion among the results. Even though it was more consistently negative than positive going forward, the returns were volatile enough that they were not considered significant. Looking at the risk/reward rows, though, the average maximum loss was larger than the average maximum gain across every time frame except one year.

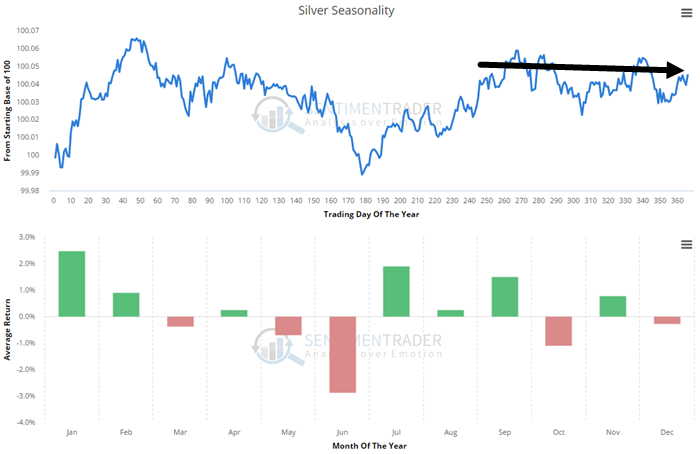

Silver has stayed somewhat true to its seasonal pattern in 2016, and if that continues it would argue for a relatively flat rest of the year.

The main concern from silver traders has been that the rise in ETF assets is a sign that traders are trying to bet on a resumption of the rally, and that's a bad sign from a contrarian perspective. They're mostly right in that concern, at least judging from the prior instances when assets rose while silver fell.