ETF investors leave dividend stocks in favor of momentum

Despite the assumption that investors are starved for yield and will invest in anything with a pulse, that's hard to prove given how investors are allocating their money.

As the Wall Street Journal notes (emphasis added):

"The [Dividend Aristocrats Index] recently offered a dividend yield of about 2.7%—humble in nominal terms, but still greater than the S&P 500’s dividend yield of about 1.7% and more than triple the yield of the 10-year U.S. Treasury note. Even so, that hasn’t been enough to persuade investors who have yanked more than $40 billion from global dividend-focused mutual and exchange-traded funds in 2020 through Wednesday, according to data from EPFR. That surpasses the more than $3 billion that was pulled during the same approximate period in 2019. With the new coronavirus having upturned the economy, many investors have instead sought returns from highflying tech stocks amid worries that many of the long-established dividend payers aren’t guaranteed to deliver in the coming year."

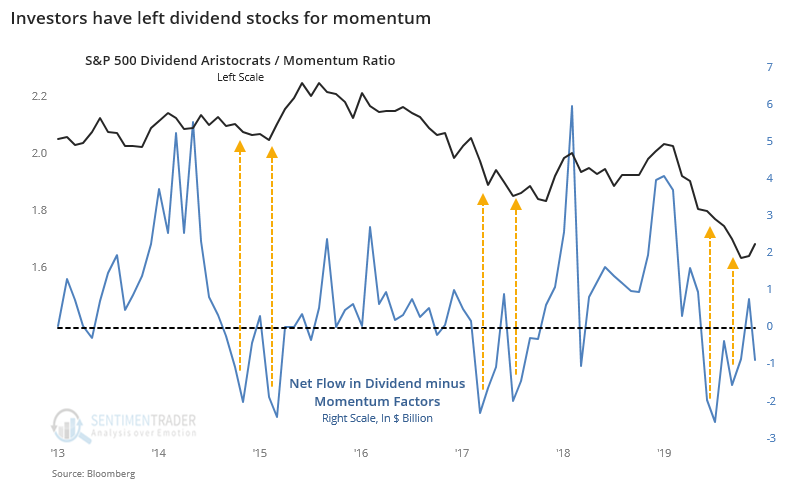

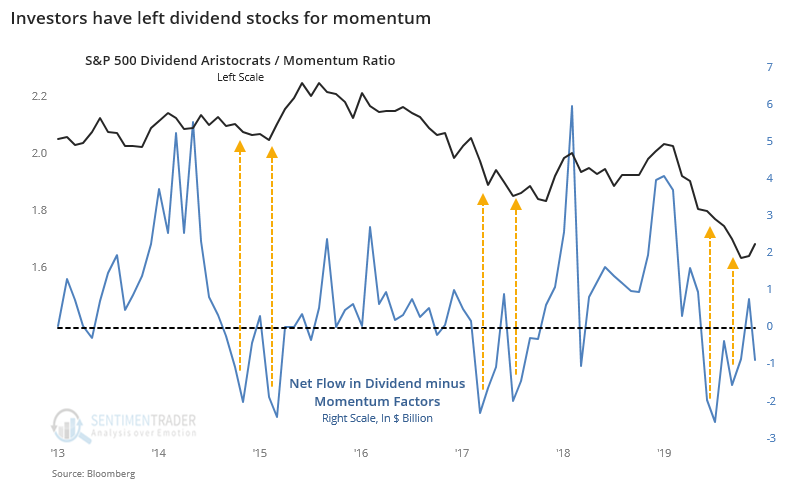

According to Bloomberg data, this is certainly the case when looking at the behavior of ETF traders. Flows into momentum strategies has far outpaced that of dividend strategies. Since April, an average of $788 million per month has flowed out of dividend ETFs while an average of $263 million per month has flowed into momentum.

This kind of outflow rivals that of stretches in 2015 and 2017 when dividend ETFs trailed momentum. Soon after these big outflows, the tide turned more toward dividend stocks.

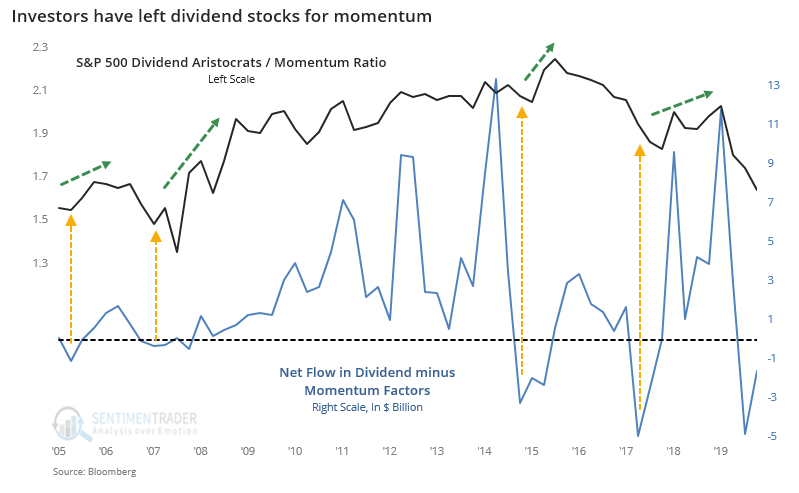

We can go back further on a quarterly basis and see the same pattern over the past 15 years.

Once again, recent quarters rival the most extreme on record. Other times when there was a flow away from dividend stocks and toward momentum, it was after those dividend stocks showed relative underperformance. And in the quarters ahead, they reasserted themselves relative to momentum.