Equity Risk Premium Collapses; A Day Of Notable Moves; VIX Not Jumping

This is an abridged version of our Daily Report.

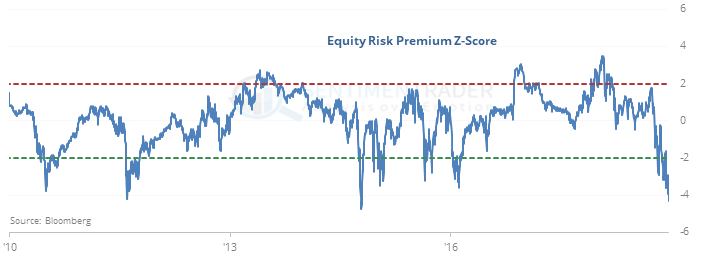

Equity premium collapses

The premium that investors are willing to pay for stocks’ earnings has collapsed relative to the yield available on bonds. The one-year z-score of the Equity Risk Premium is now 4 standard deviations below average, a rarely-achieved extreme since 1972 with positive implications.

When the ERP was +2 or higher, the S&P’s annualized return was -4.0%, versus 6.8% when it wasn’t extreme at all. And when it was below -2, the annualized return shot up to 40.1%.

Quite a day

Wednesday’s drop triggered a number of notable moves.

* The Dow Transportation Average fell into a bear market, which has not been the negative signal it’s suggested to be.

* Nearly 60% of Financials fell to a 52-week low, 5th-most out of all days since 1990.

* A big intraday gain turned into a big closing loss for the first time since 2009.

* And stocks fell by one of the largest amounts in more than 20 years on a day the FOMC announced their rate policy.

Where’s the fear?

People tend to obsess on the VIX as a measure of “sentiment” and while it can be a good tool, it’s not the end-all, be-all, especially since the explosion in volatility ETFs may be impacting how the entire volatility complex may be trading. Regardless, there have been 32 days since 1992 when the S&P 500 was down 1% or more than the VIX was either unchanged or down. Over the next month, the S&P rose 81% of the time, averaging 2.4%.