Equal-weighted S&P 500 finally starts to shine

Investors keep wanting to believe in new cycles. This is finally the time when value is going to outperform. Or small caps. Or anything not tech-related.

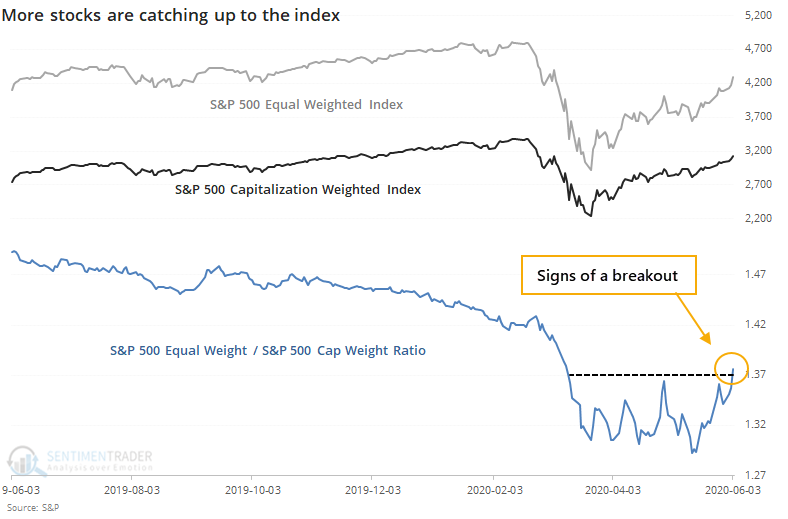

With the latest thrust, more and more stocks are performing well, so the version of the S&P 500 that weights all 505 member stocks equally is starting to outperform the index everyone follows, which weights the members based on their market capitalization.

After hitting a multi-year low a few weeks ago, the ratio between the equal-weighted (EW) and the cap-weighted (CW) index just hit a 50-day high.

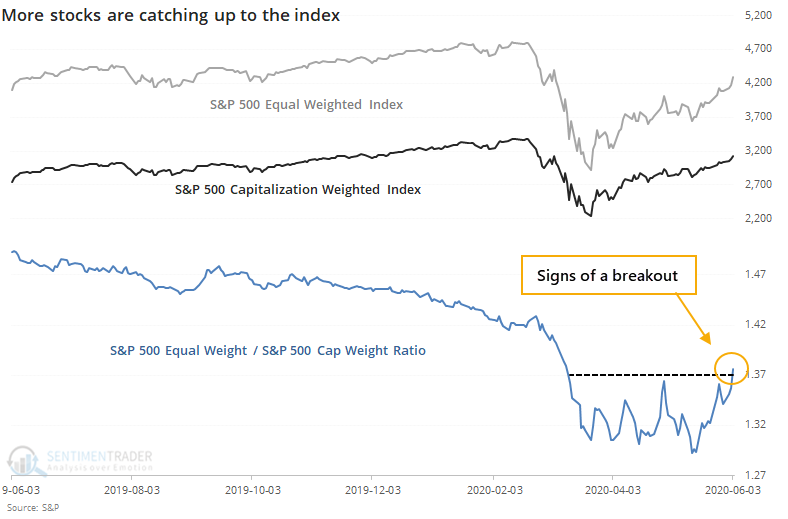

This kind of reversal has been good for the equal-weighted version of the index. Over the next three months, it rose every time but twice, though one of those losses was large (it was too early in 2009).

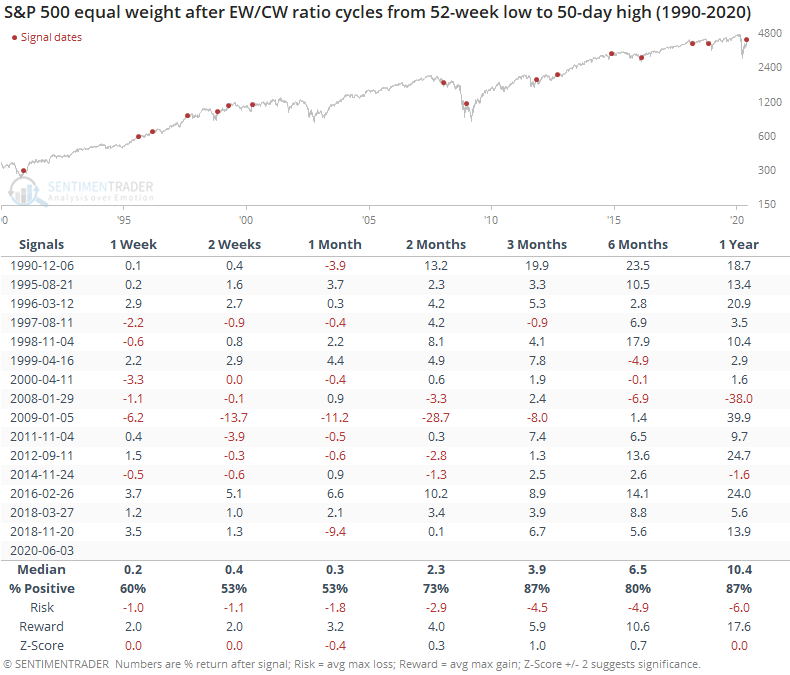

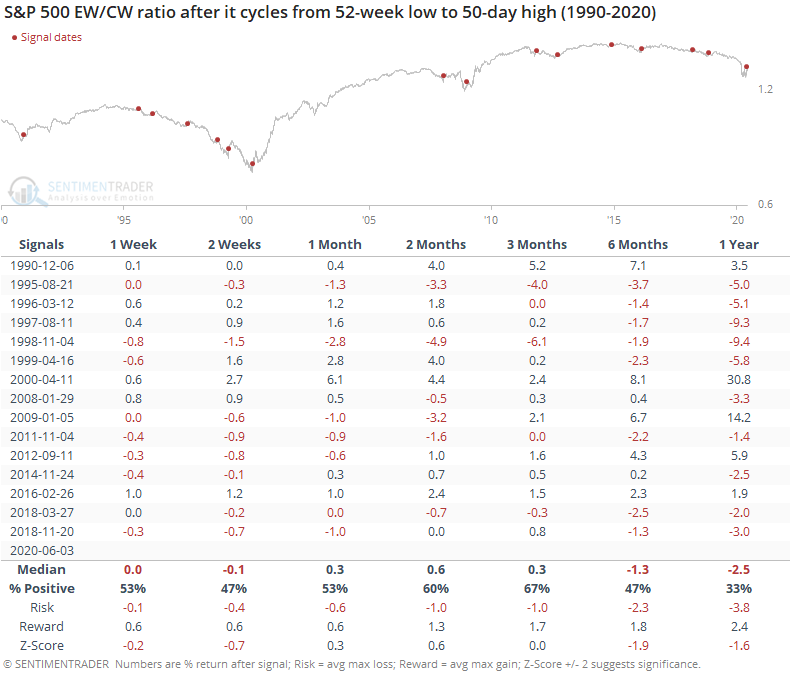

The ratio, though, saw a mixed performance.

It was modestly negative shorter- and longer-term, while modestly positive over the medium-term. That makes it hard to bet that the equal-weighted version of the index is necessarily a better one than the traditional cap-weighted one. While the chart makes it look like the trend has changed, it has been so persistent, and there have been so many false starts, that there is little evidence yet to support it.