Epic (short term) rally

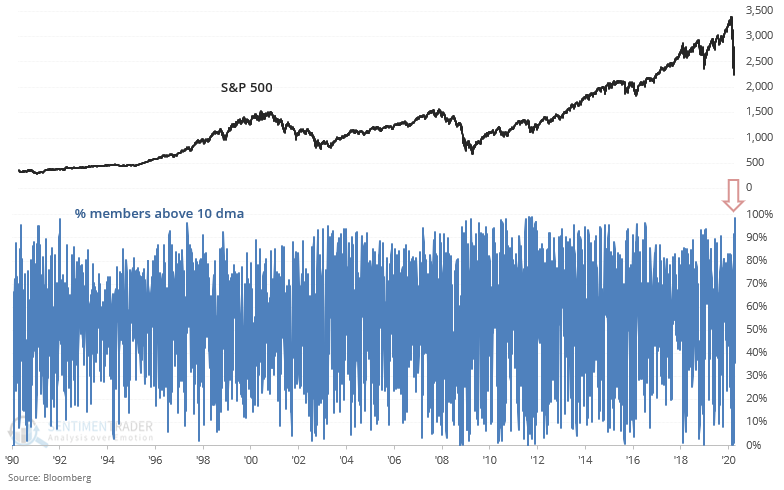

The S&P 500 has staged a very strong short term rally. In a way, this is a "historic / epic / core / extreme / critical / powerful / massive / record shattering / truly rare" (or whatever hyperbole grabs peoples' attention) rally, at least from a short term perspective.

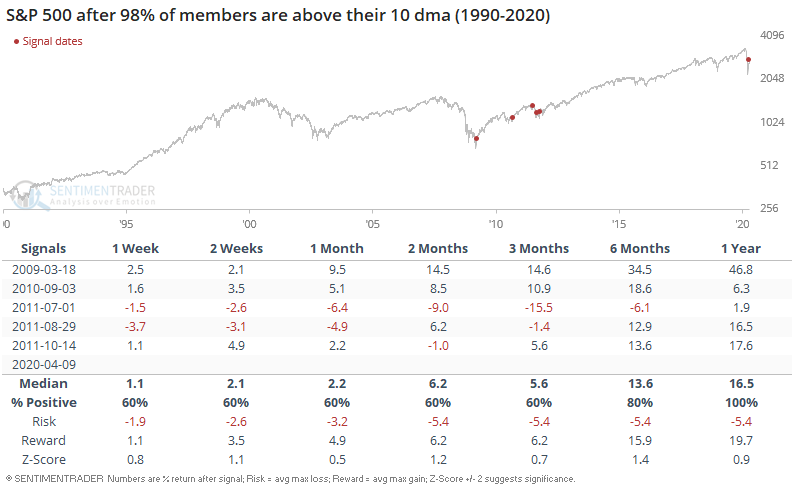

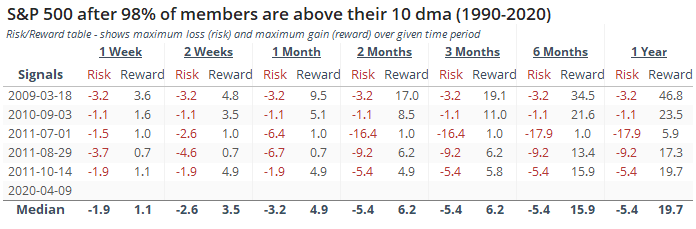

There have only been a few historical cases when so many S&P 500 stocks were in a short term uptrend. The first came in March 2009, after the 2007-2009 bear market ended. Several others came in 2010-2011. While this wasn't a consistently short term bullish or short term bearish sign for stocks, this usually led to more gains over the next year.

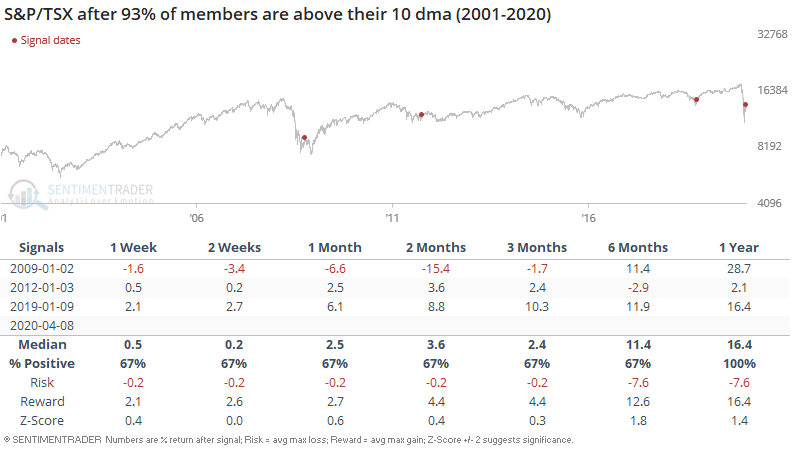

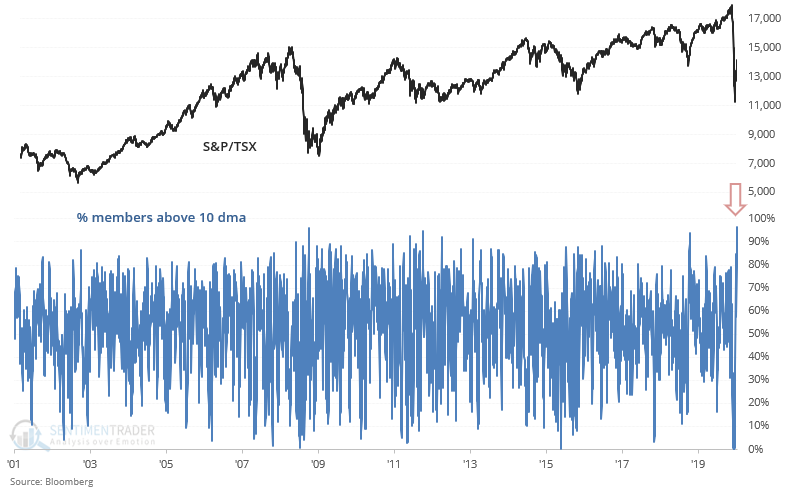

It's not just U.S. markets that are experiencing a strong short term rally. In Canada, 96% of S&P/TSX Composite members are in a short term uptrend:

This happened in January 2009 (stocks fell more in the short term) and January 2019 (bottom already in). Overall, this is a bullish sign for stocks over the next year.