Energy Stocks Worst Breadth In 4 Years; Traders Keep Selling The Open

This is an abridged version of our Daily Report.

At least Financials are worse

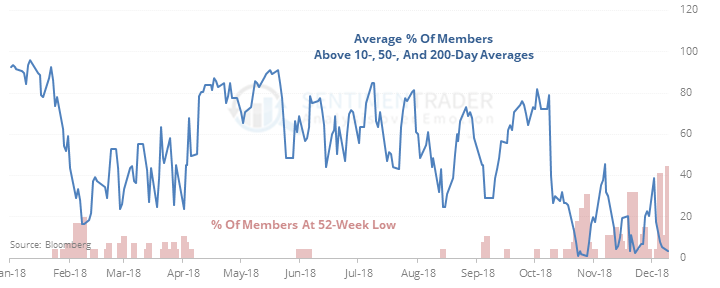

Breadth in the S&P 500 Energy Sector is the worst in four years. Few of the stocks are above even their shortest-term moving averages, and there has been a spike in the percentage of stocks at a 52-week low.

This has, in the shorter-term, been a decent sign for Energy stocks. There were some losses in 2008, but outside of a collapse in the worldwide economic system, these kinds of readings led to universally good returns over the next few weeks.

Sell at the open

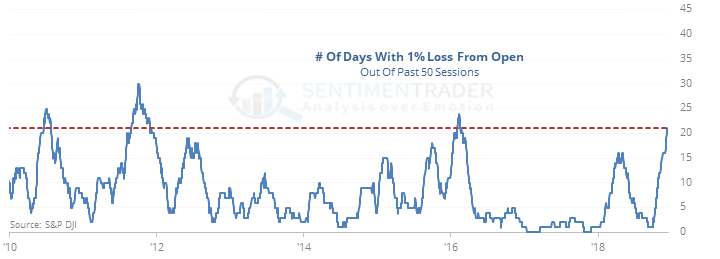

For a week straight, the S&P 500 sold off more than 1% from its open, adding to a cluster of such days, the 3rd-most since the financial crisis.

This kind of downside volatility was a mixed blessing, and during bear markets it paid to wait until there were half as many days that saw this kind of intraday selloff.

Gold rush

The NYSE Arca Gold Miners index (upon which the popular GDX fund is based) closed at a 3-month high while still below its 200-day average. It has done this 14 times since 1994. Over the next month, it continued to rally only 5 times and averaged a -2.7% return.

Out of whack

The 5-day average of the Stock/Bond Ratio is now below -2.4. According to the Backtest Engine, it has been this low on 82 days over the past 20 years.