Energy stocks show another washout

We saw on Monday how financials have been lagging so badly in 2020, second only to energy among the worst-performing sectors.

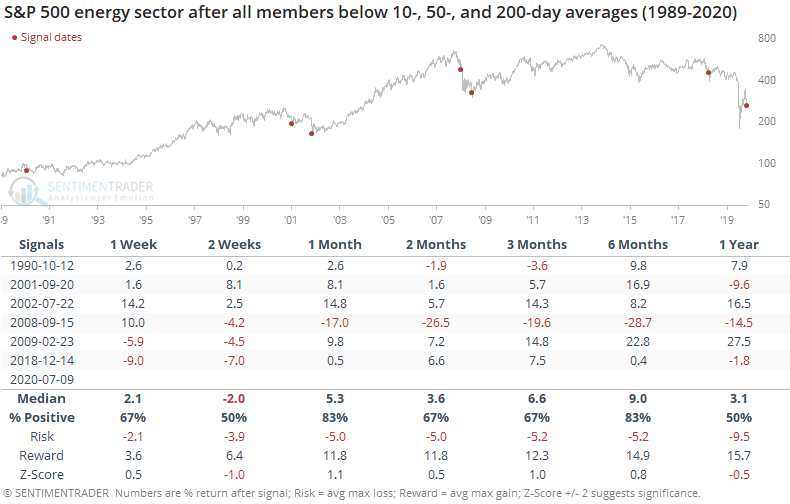

By late last week, those energy stocks had gotten hit so hard that every member of the S&P 500 Energy sector was below its short-term 10-day moving average. And medium-term 50-day average. And long-term 200-day average.

When every member of the index was below all three moving averages, it was usually near the ends of major declines.

The only really painful failure was 2008 when it triggered in the middle of the financial crisis. All the others showed a positive return over the next 6 months, with a very good risk/reward ratio.

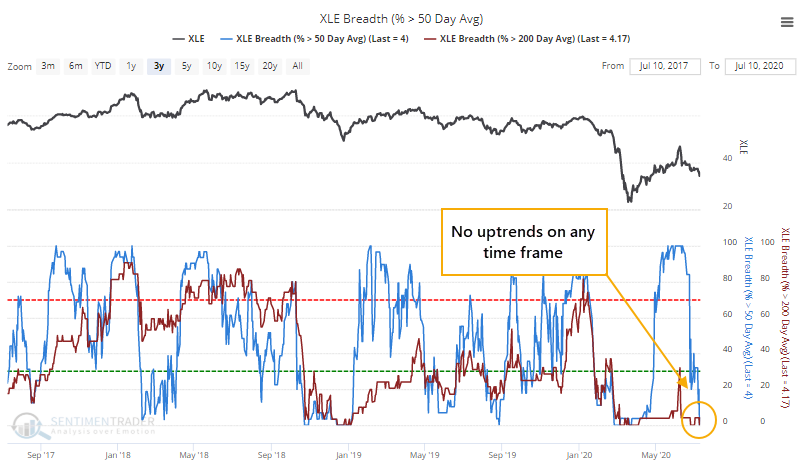

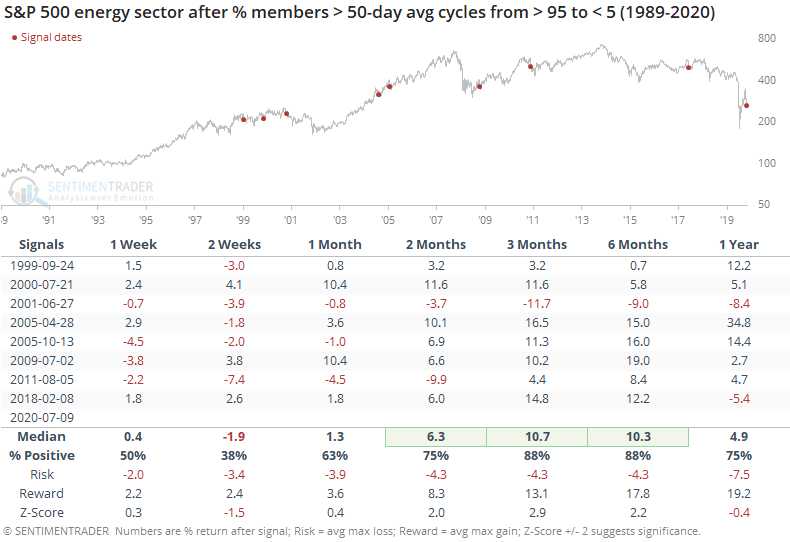

It's also worth noting how quickly the medium-term trend has reversed in many of the stocks. Within the past 30 days, more than 95% of them had been trading above their 50-day averages. That cycled all the way down so that fewer than 5% of them were above average by late last week, continuing into this week.

When the medium-term trends had fully cycled like this in the past, energy stocks rallied every time but once over the next 3-6 months, though that 2001 failure was painful.

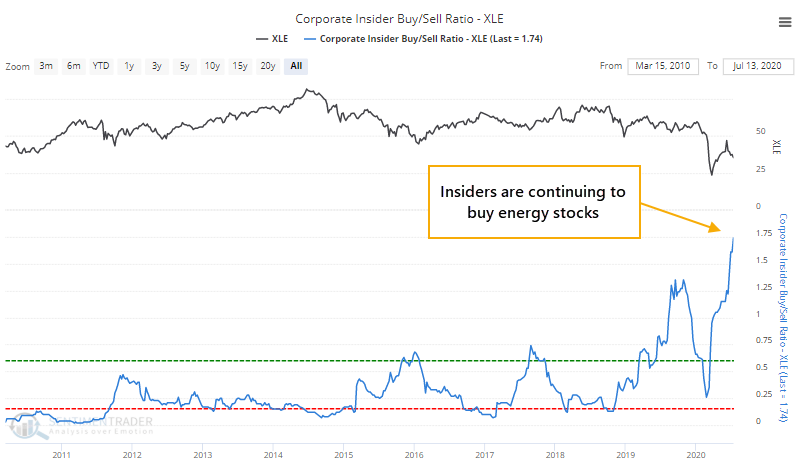

Another positive sign is that corporate insiders keep backing off selling shares. The buy/sell ratio among energy stocks moved to another decade-high over the past week.

At the end of February, breadth among energy stocks was as washed out as it had ever been. Other times it was that skewed, the sector rallied every time...except this one. The spat between Russia and Saudi Arabia overrode any historical precedent and the signal failed miserably. So there is always the chance that "something" can happen to violate historical precedent. Assuming the sector behaves at least somewhat in line with history, the current lack of uptrends among any of the stocks should be a decent medium-term positive.