Energy Stocks - Oversold in an Uptrend

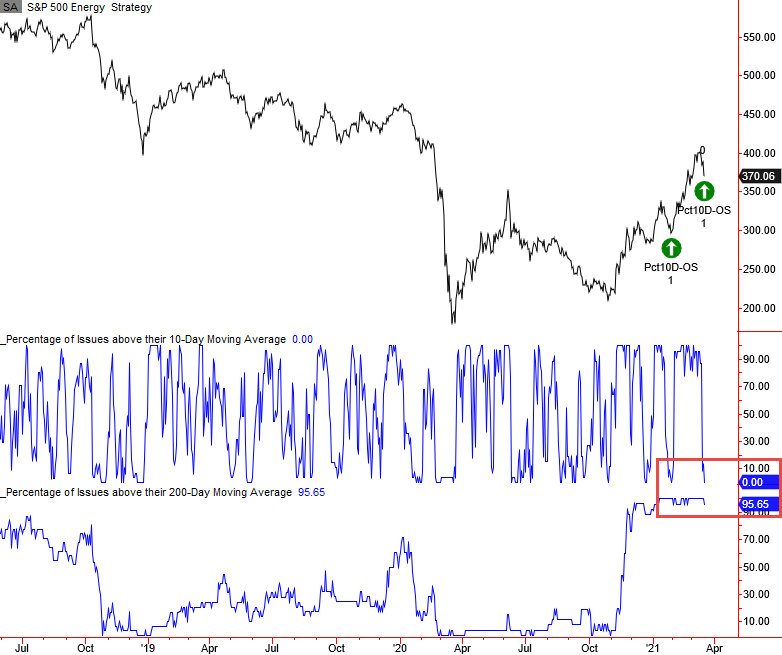

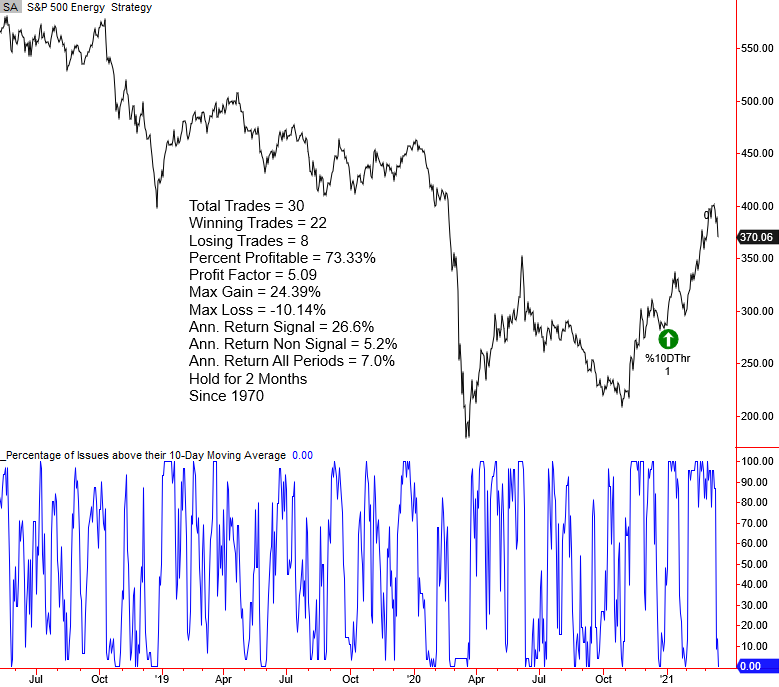

After closing at a new 252-day high last Friday, energy stocks have reversed down this week. On Thursday, I noticed that zero S&P 500 energy sector members closed above their respective 10-day moving average. Simultaneously, over 95% of the energy members are trading above their respective 200-day moving average.

The group is short-term oversold in an uptrend.

Let's review the forward return outlook for energy stocks under the current scenario and take a look at some other signals I'm keeping an eye on.

Current Energy Chart

As the chart below shows, this is the second signal in less than 2 months.

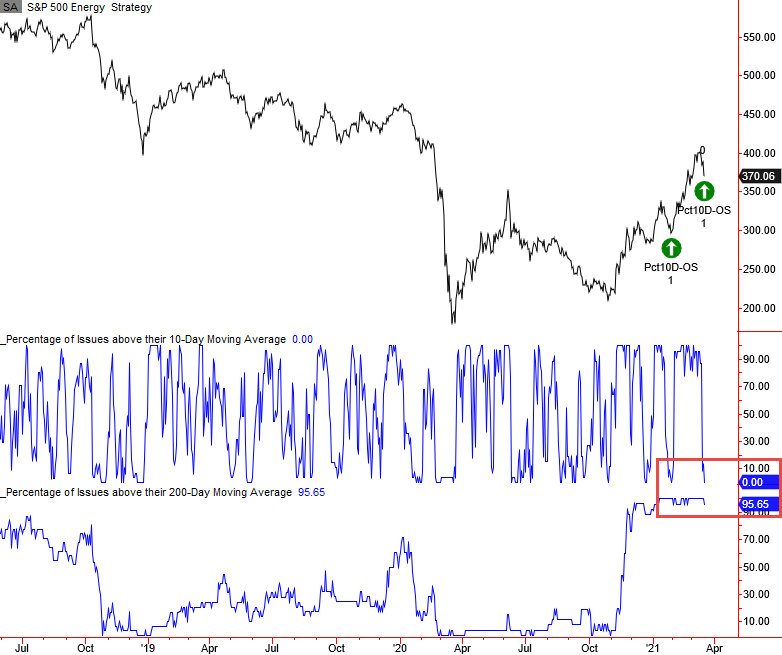

Energy Signal Performance

Excluding the 1980 signal, forward returns look solid across all timeframes.

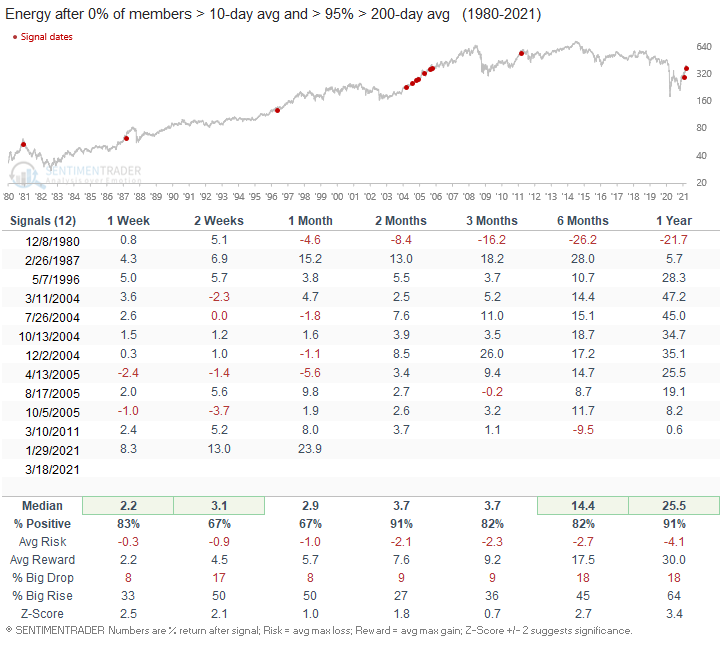

Percentage of Issues above the 10-Day Moving Overbought to Oversold

The reversal this week from an overbought to oversold condition for the percentage of members above the 10-day moving average occurred in a short period of time. I show a reversal from greater than 95% to less than 1% in 5 days. Let's drop the overbought threshold to 90% and keep the other parameters to see what happens to energy stocks when that setup has occurred in the past. I did not include the percentage of members above the 200-day moving average in this study. As the table below shows, performance looks good even with the quick move from overbought to oversold.

Let's look at some mean reversion models that could signal that the energy group's corrective action is reversing course.

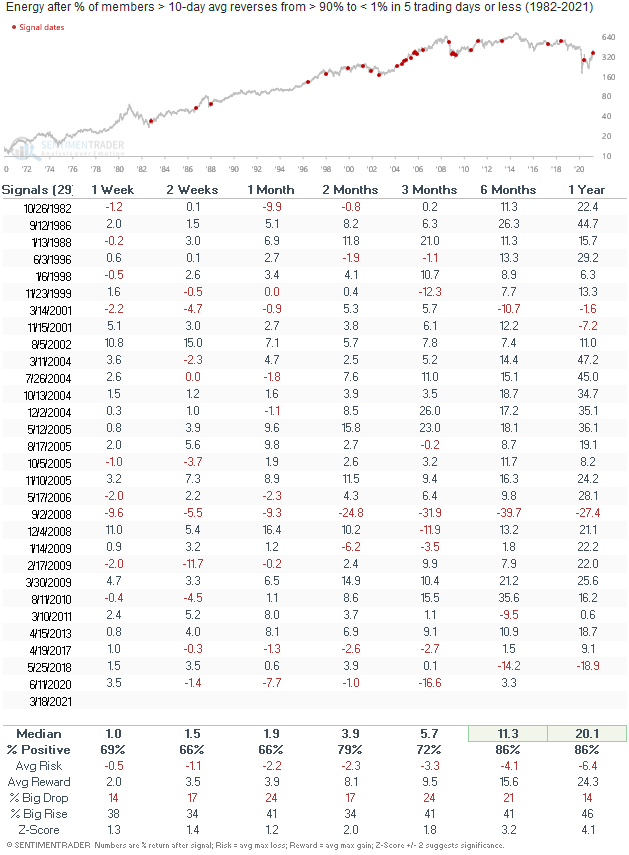

Percentage of Issues above the 10-Day Moving Average Oversold to Overbought Signal

The model in the following chart uses the same technique as the previous study but reverses the scenario. It seeks to identify instances when the percentage of issues above the 10-day moving average cycles from oversold to overbought in a user-defined number of days or less.

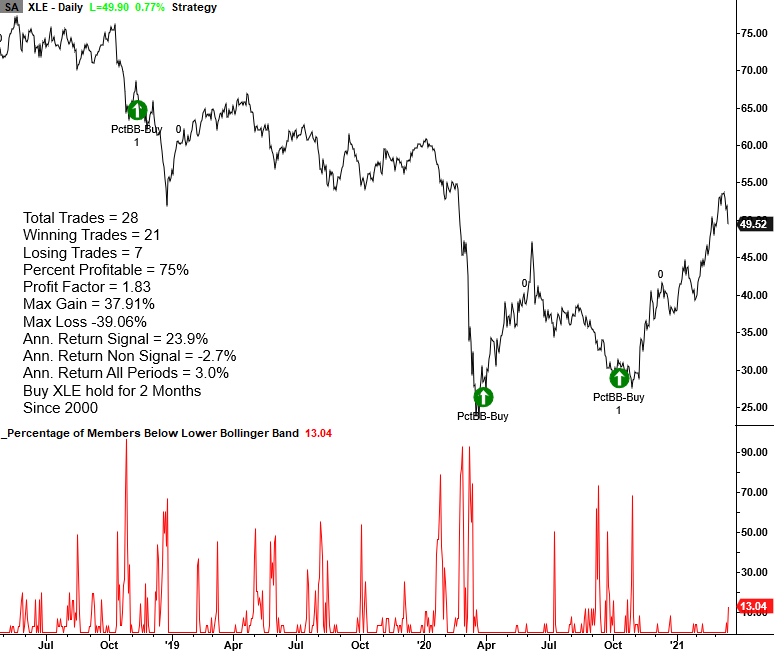

Percentage of Issues Below the Lower Bollinger Band Buy Signal

The model in the following chart seeks to identify instances when the percentage of energy issues trading below their respective lower Bollinger Band cycles from a high percentage to a low percentage and Index momentum turns positive.

Conclusion: The corrective action in energy has moved the group to a short-term oversold condition in a strong uptrend. I never want to catch a falling knife, so I'll be monitoring several models for signals that would suggest that the uptrend is resuming.