Energy stocks have recaptured their long-term uptrends

Key points:

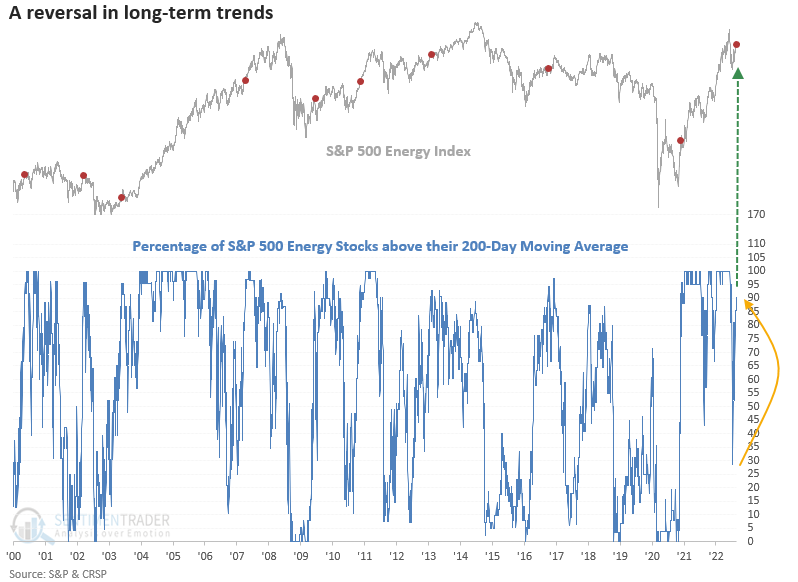

- More than 90% of S&P 500 energy stocks are now above their 200-day average

- The broad-based participation occurred after fewer than 30% closed above their average

- After similar reversals, the S&P 500 energy sector was higher 86% of the time

Energy stocks have recaptured their long-term uptrends

After dropping over 20% in seven days, one of the swiftest bear markets in history, the energy sector has reversed course. It now looks poised to reassert itself as a market leader.

Let's assess the S&P 500 energy sector outlook when the number of stocks trading above their 200-day moving average reverses from < 30% to > 90%.

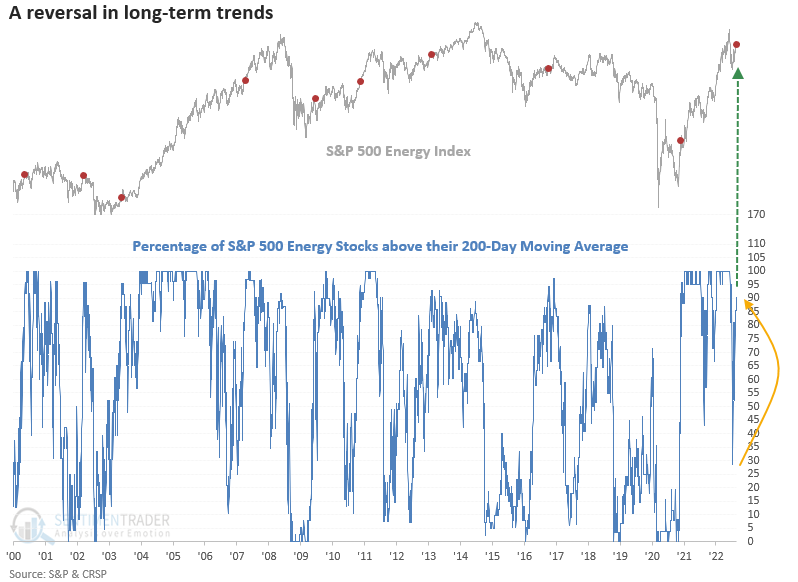

Similar trend reversals preceded positive returns

A reversal in long-term uptrends looks bullish across medium and long-term time frames with significant z-scores in the three and six-month windows. Besides March 2002, drawdowns were relatively benign across the long-duration time frames. The near-term looks mixed, especially more recent signals.

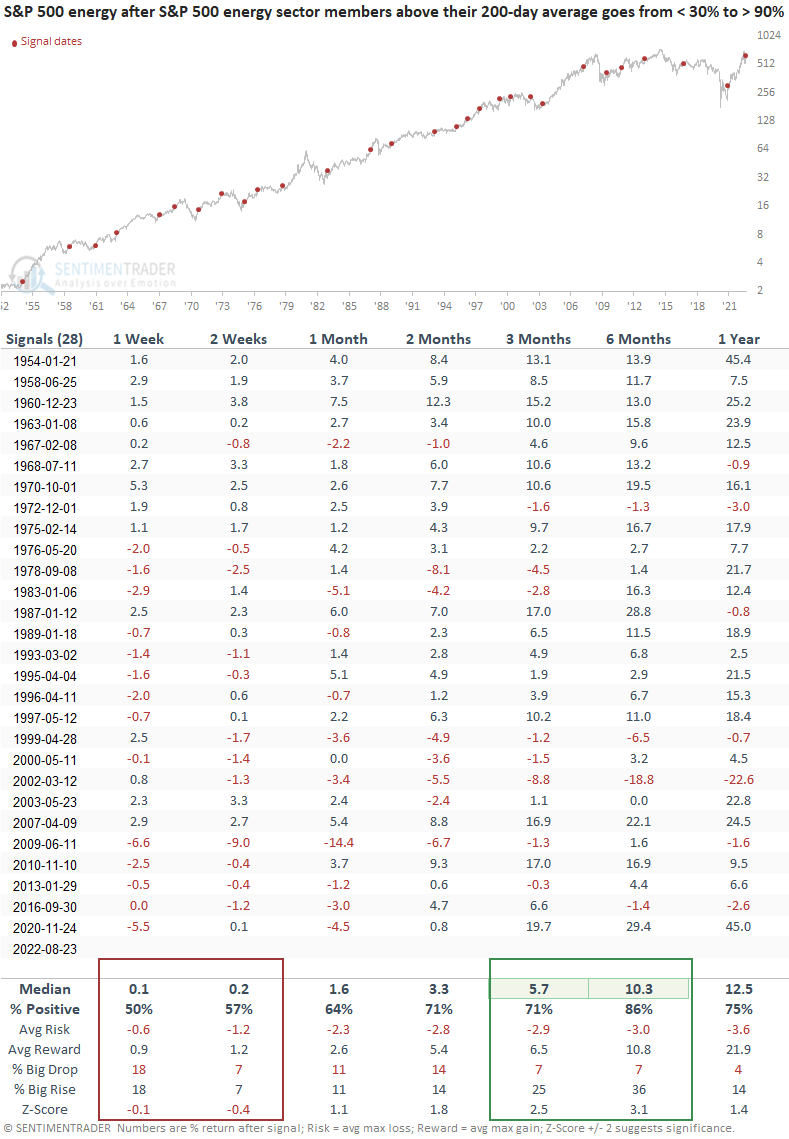

With the ability to invest in a market-capitalization or equal-weighted index methodology via sector ETFs, let's apply the signals to the equal-weighted version of the S&P 500 energy sector. The return profile looks similar. However, the near-term results look weaker, whereas the long-term windows show slightly higher returns when compared to the cap-weighted version.

The equal-weighted outlook table contains one less signal.

Relative trends for the energy sector look constructive

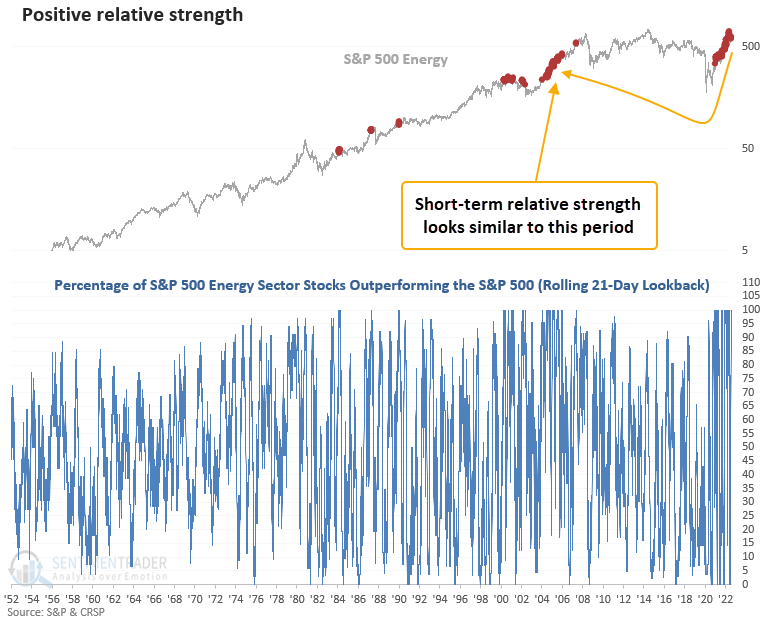

S&P 500 energy sector stocks outperforming the S&P 500 on a rolling 21-day basis fell to zero as recently as mid-July. As of Monday, 100% of the energy sector stocks are now outperforming the world's most watched benchmark.

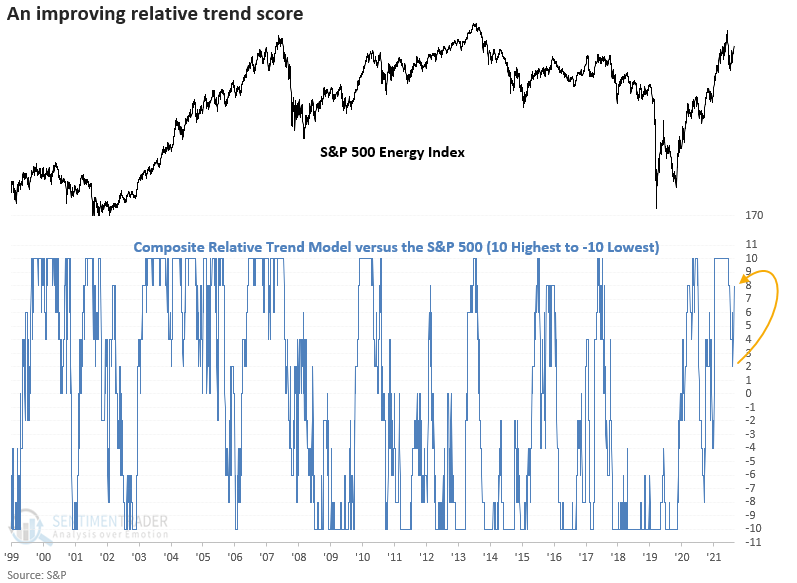

Suppose I compare the S&P 500 energy sector to the S&P 500 using a composite containing ten trend-following indicators. In that case, the model shows a reversal from a score of two to eight. So, a broad measure that uses a diverse set of duration inputs to measure trend strength or weakness shows an improving relative profile.

What the research tells us...

The energy sector has been a market leader for the better part of the last two years. After a gut-wrenching 20% decline in a matter of days, long-term participation trends have reversed from fewer than 30% of stocks trading above their 200-day average to more than 90%. The recovery in absolute trends is also accompanied by improving relative trends, which is always an important factor when investing in a sector.