Energy slips into one of the most-hated sectors of all time

Energy stocks have lagged. That's a shocker to exactly nobody.

The sector has been so bad that they've been the worst-performing stocks out of all sectors for 69 days out of the past 200, per the fine folks at Bespoke. That's an awful lot of days of sucking the hind teat as my grandpa used to say.

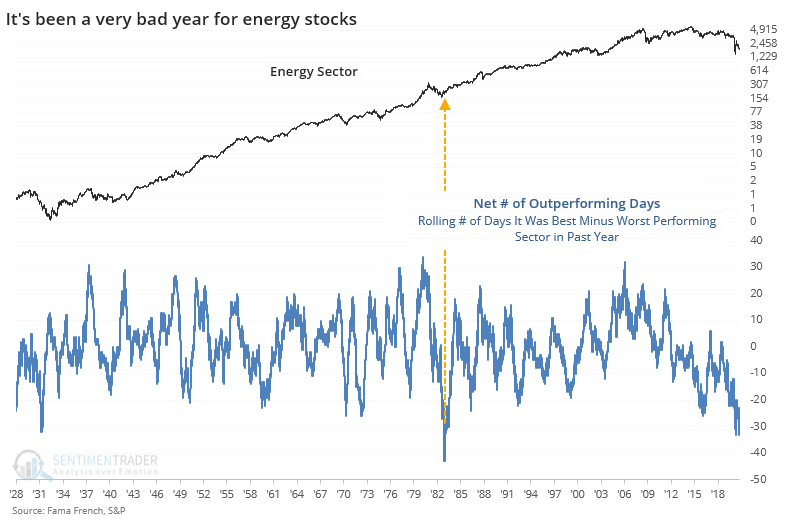

It's worse than that. On a daily basis, the percentage change in energy stocks has lagged all other sectors for 85 sessions out of the past 252 (roughly one year). This can be misleading, however, because a sector that underperforms so much tends to be extremely volatile, so it often sees a lot of days when it outperforms all other sectors as it bounces along with swings in investor emotions. Indeed, energy stocks have been the best-performing sector on 54 days in the past year.

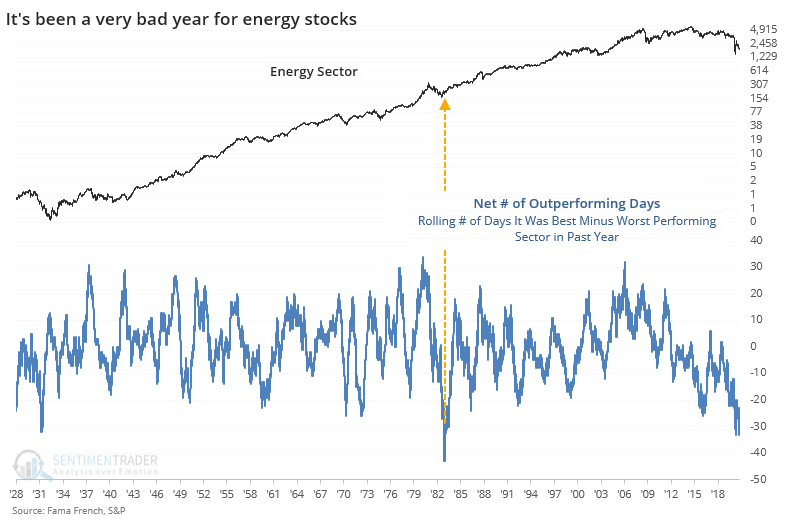

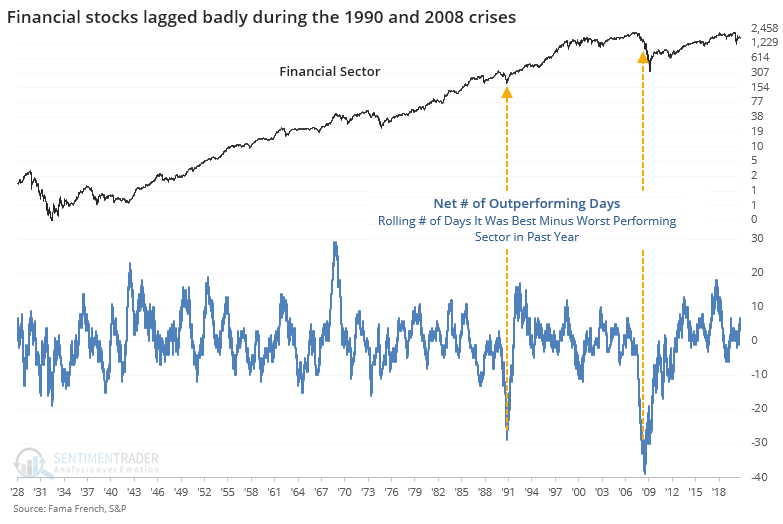

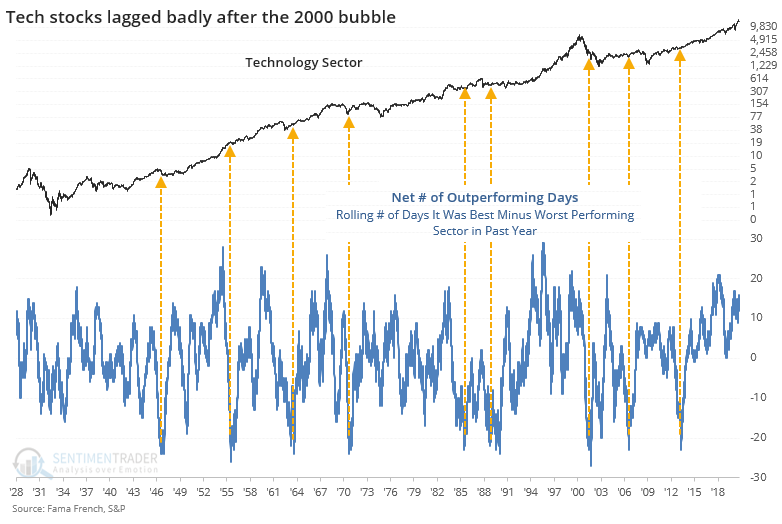

If we net out the number of days in the past year when energy was the worst-performing minus best-performing sector, the spread is still extremely negative at more than -30 days. Going back to 1928, this is one of the widest spreads ever. The only time it got worse than this was in late 1982.

Relative to the broader market, that was also about when energy stocks started to see some interest from investors. The ratio of energy stocks to the S&P 500 turned higher soon after and continued for a couple of years.

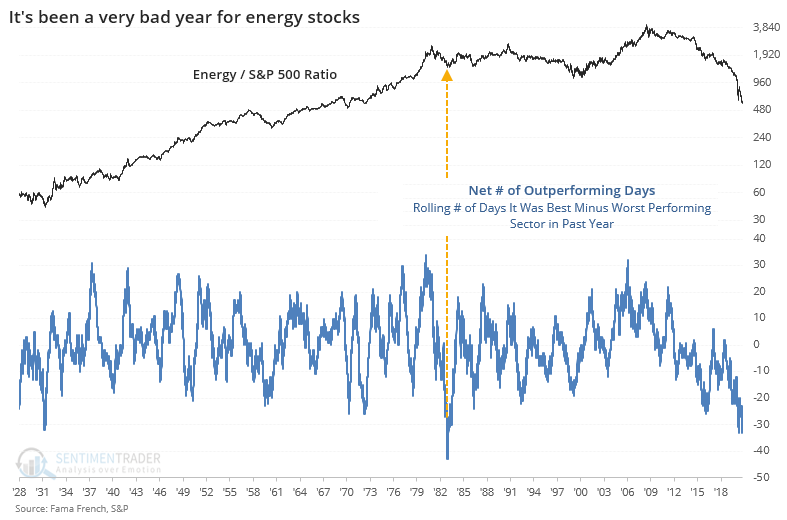

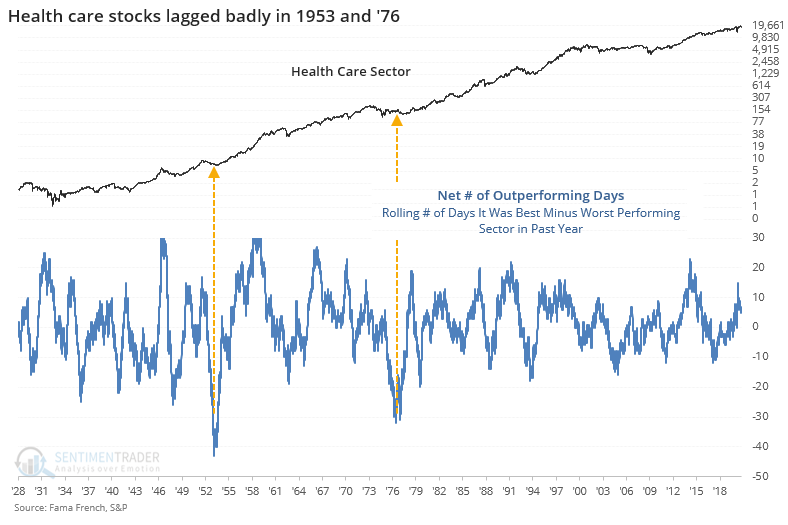

What's remarkable about this give-up on energy stocks is that it's among the most extreme among all sectors in more than 90 years. The only sectors that saw more than a net -30 days of performance over a year's time frame were health care stocks (twice) and financials during the Savings and Loan and Global Financial crises.

It happened to health care in 1953 and 1976, both of which preceded massive gains in the sector.

Same for financials in 1990 and 2008, but it was early in 2008 as the crisis unfolded into the worst since the Great Depression.

As hard as it is to imagine in our current environment, no sector has suffered the swing from love to hate as often as technology. While there was never a period when it endured the ignominy of a net -30 days of performance, it went more than -20 a multitude of times. It was rare to see it continue to underperform much longer.

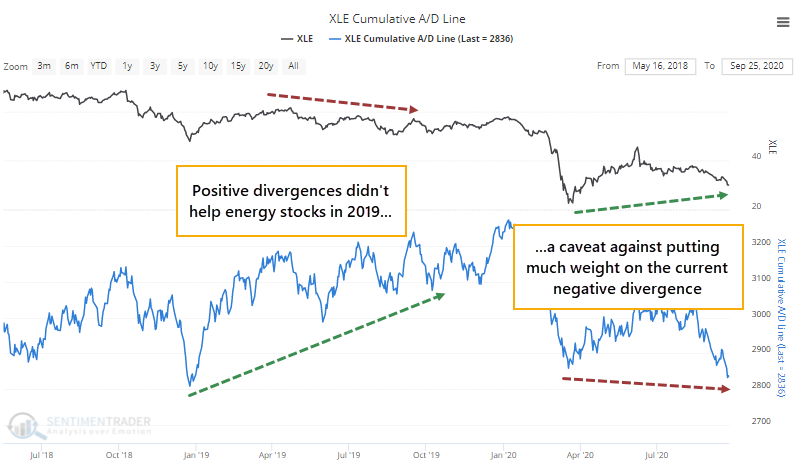

Unlike the broader market, which has been driven in large part by relatively few stocks, the decline in energy has been broad-based. The Cumulative Advance/Decline Line for the sector has plunged below its March low and is forming a negative divergence with funds like XLE.

This should be a worry, but positive divergences in 2019 didn't help at all. Even though the A/D Line kept registering higher highs and higher lows, XLE did not respond. So we wouldn't put too much weight on this potential negative.

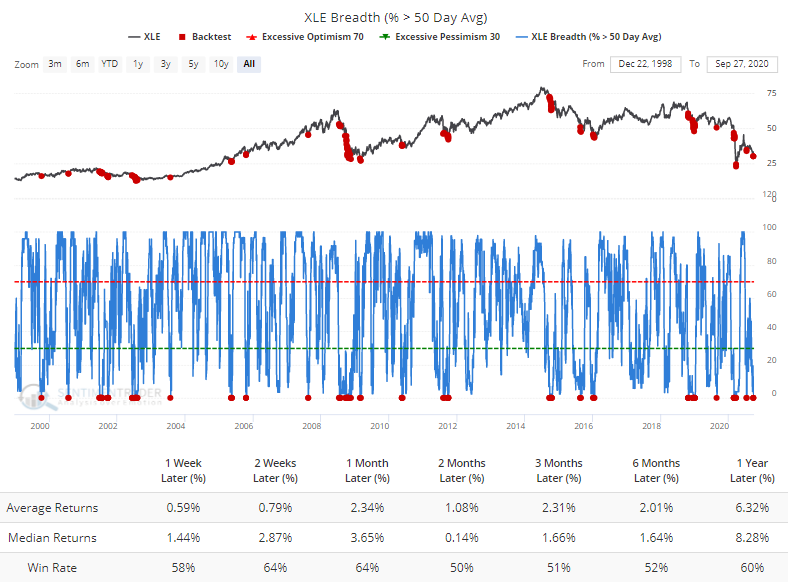

So many stocks have been hit that not a single energy stock has managed to hold above its 50-day moving average. The Backtest Engine shows mostly positive, but tepid, forward returns when every one of the stocks fell into medium-term downtrends. While most bottoms saw a reading this weak, it also triggered early in too many major declines.

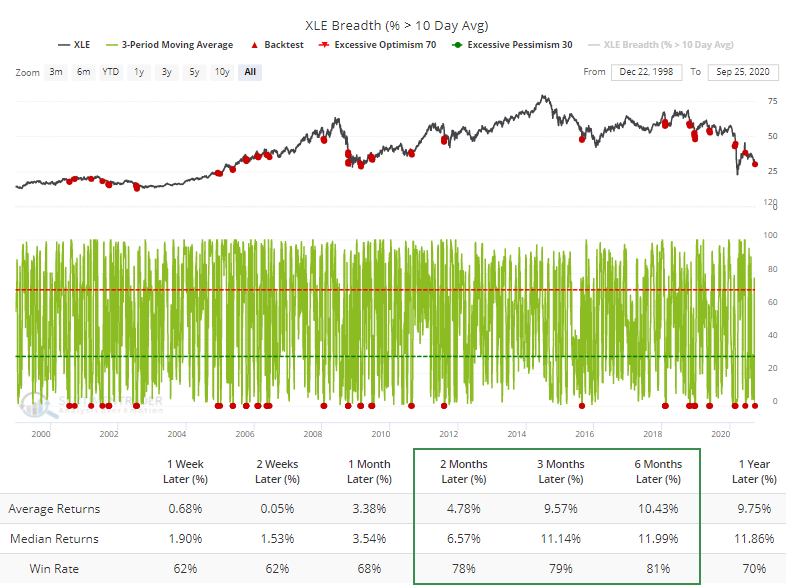

More compelling is that the selling has been intense enough to push every energy stock below even its short-term 10-day moving average, and that's been the case for 3 straight days. Fairly rare according to the Backtest Engine.

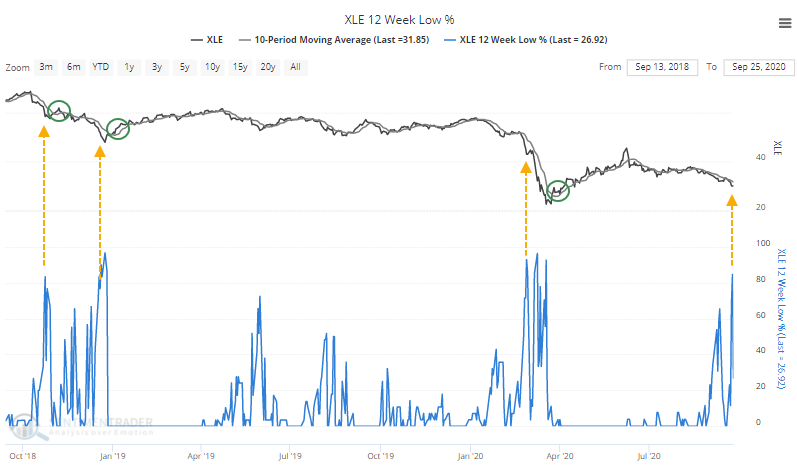

Last week, the declines were enough to push more than 80% of these stocks to at least a 3-month low. Historically, this has triggered during the meat of the worst declines, during the "puke" phase. The trouble is that sometimes a lot of shareholders need to puke, and while not perfect by any stretch, waiting for some kind of recovery, like for XLE to cross above its 10-day average, helped to avoid the worst drawdowns.

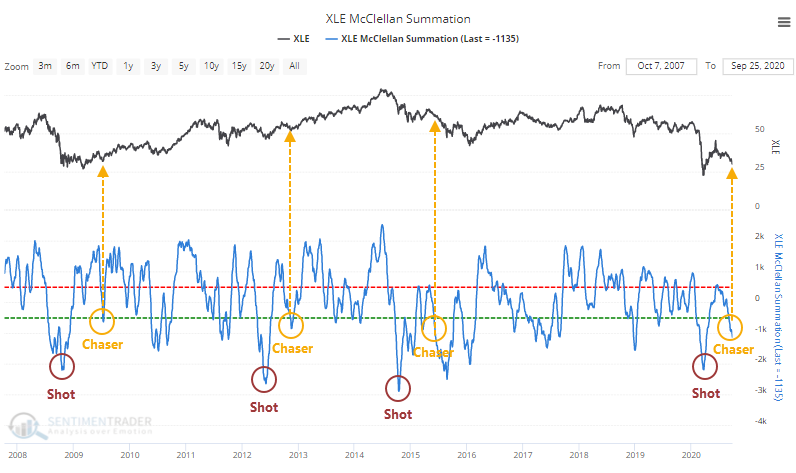

This internal selling pressure has been so great, for so long, that the McClellan Summation Index for the sector has registered another extremely oversold reading. This comes on the heels of a massively oversold one in March, setting up a kind of shot-chaser pattern.

That didn't help much in 2015-16, but the general tendency is that when there is a truly extreme oversold reading, a recovery, then a follow-up extreme, that 2nd one tends to trigger more sustained buying interest.

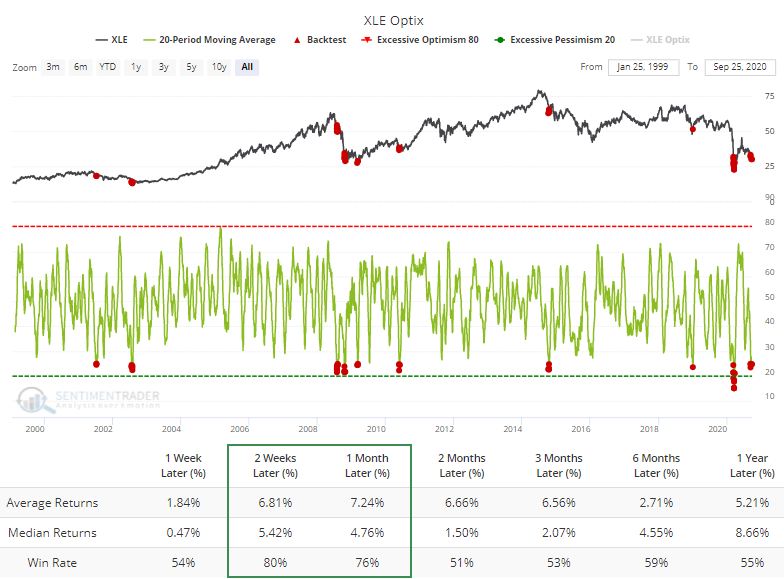

All of this selling has pushed the 20-day average of the Optimism Index below 25, a relatively rare reading over the past 20 years that tended to preceded some bounces.

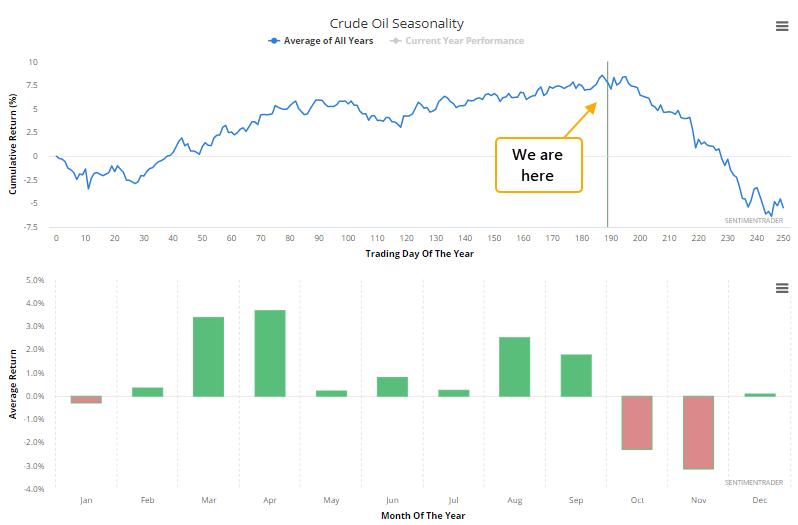

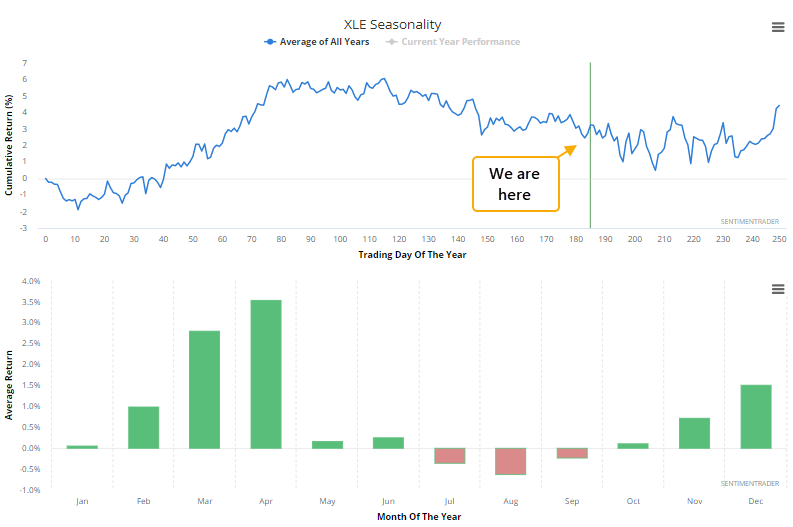

Energy stocks tend to follow the price of oil, like gold miners tend to follow the price of gold. A tiny worry right now is that after the summer driving season, oil does not have a great history of rising.

The correlation between oil and energy stocks is not perfect, however. Energy stocks are, after all, stocks, and those are close to entering the most positive months of the year. Those conflicting forces mean that the seasonal window for XLE isn't as bad as that for oil.

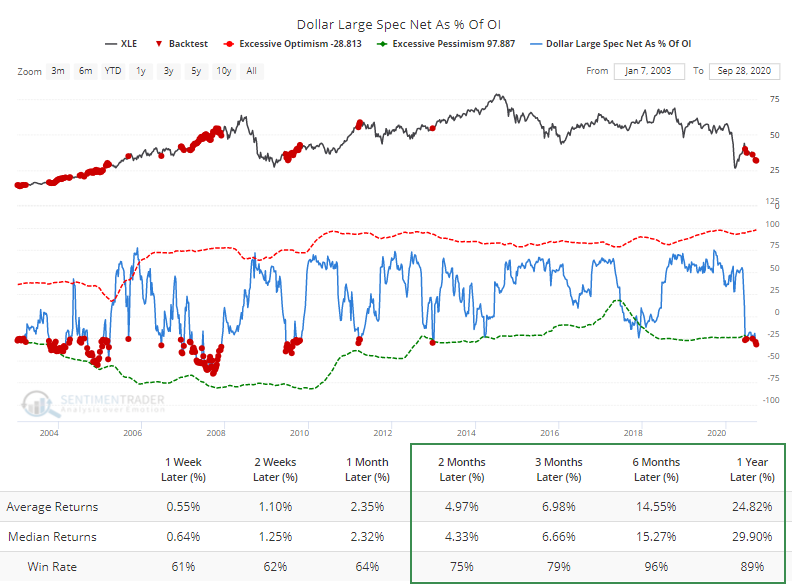

One concern is that speculators are heavily short the U.S. dollar, often a contrary indicator. Since the primary contracts in many commodities are priced in dollars, there is the worry that a rising dollar would have a negative impact on oil and therefore energy stocks. The issue with this argument is that heavy speculative shorts in the dollar doesn't work very well as a contrary indicator, and it didn't matter anyway.

The Backtest Engine shows that XLE performed just fine after speculators were short more than 25% of the open interest in the dollar.

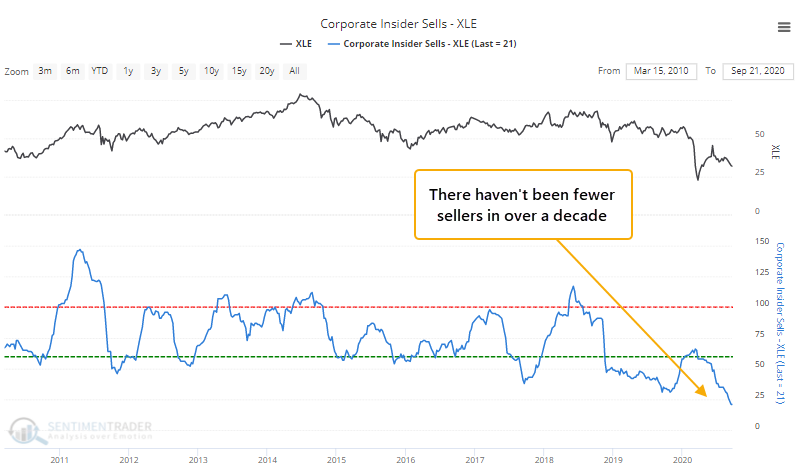

Corporate insiders in energy companies have stepped back from selling shares on the open market. There have never been fewer sellers over the past decade.

Insider buying has also dropped off but from an extremely high level. So the Velocity of the Buy/Sell Ratio is deeply negative, but that hasn't been as reliable as a sell signal as it has for the broader stock market.

From a very long-term point of view, it seems as though investors have given up on energy stocks to a degree rarely seen. Media is filled with the concept that because of the green revolution and a shift in cultural winds, these stocks should be left for dead. And they pretty much have been already. Bankruptcies are rising, and dividends are being threatened. This is the kind of thing we saw among mining stocks in 2015.

This is a risky setup, and there are no guarantees, which became evident enough in February. When we see setups like this, a sector is typically in the death throes of a medium- to long-term decline.