Energy sector tries to reclaim its long-term average

During September and October, we looked at several ways in which the energy sector was perhaps the most-hated out of all sectors of all time (here, here, and here).

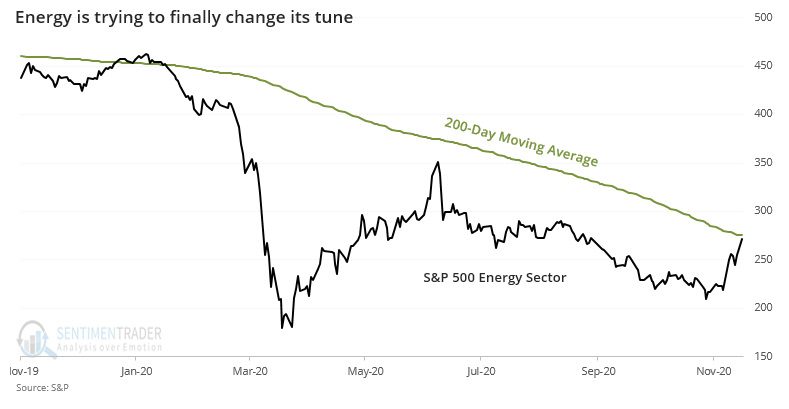

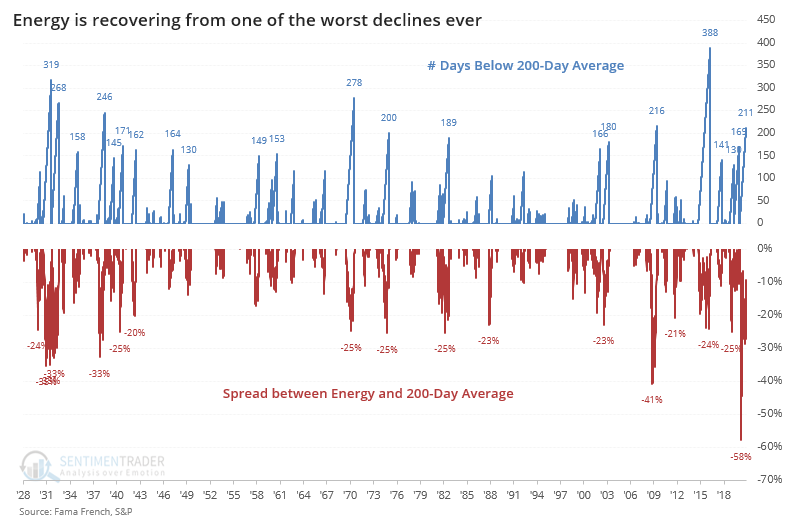

They've benefitted from the relief rally over the past two weeks and the S&P 500 Energy Sector index is even on the cusp of rising above its 200-day average. It's not *quite* there, and the previous attempt in June was handily rejected, but some popular funds like XLE have already moved above their average.

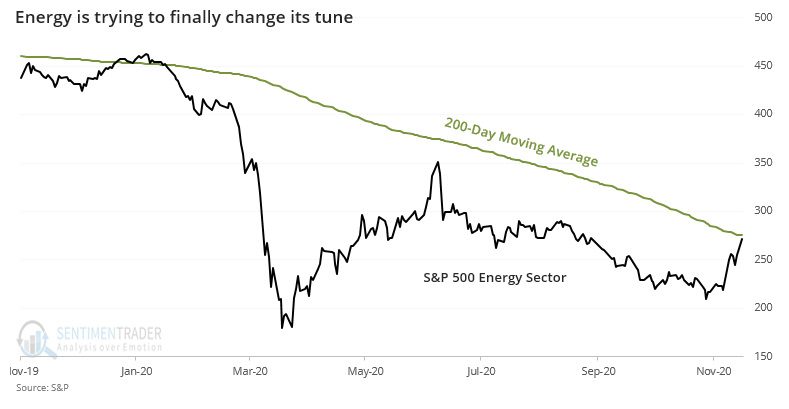

For the S&P 500 Energy Sector index, if it's able to follow through like XLE, then this would end one of the longest periods below its 200-day average in history. And it would completely retrace its worst-ever spread against its average. At its worst point, the sector was nearly 60% below its 200-day average, worse even than the drubbings in the 1930s.

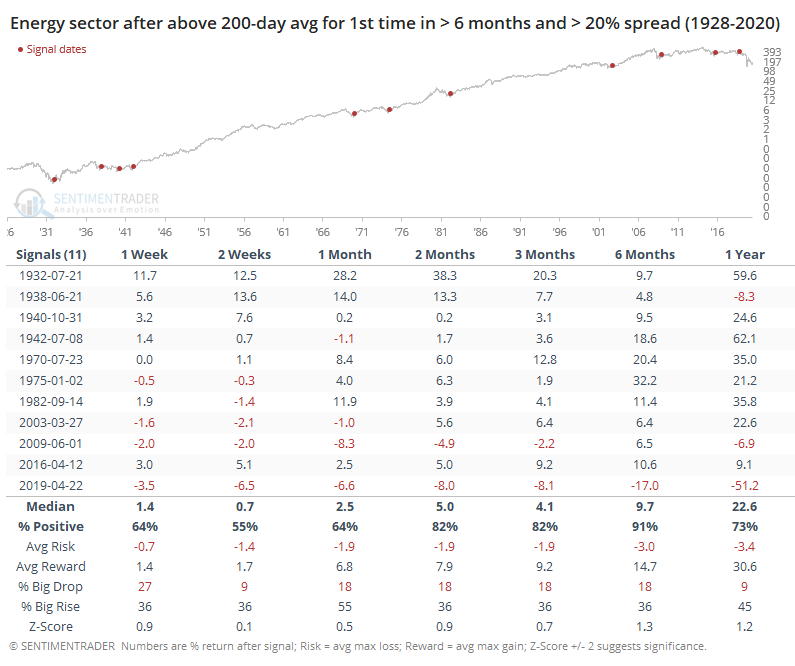

Other times it recovered like this proved to be a good sign going forward. The only real failure was the last signal in April 2019, which was rejected immediately.

Investors have been looking for a long time for signs of capitulation and then recovery in some of these stocks. There is a compelling argument to be made that the former was achieved, and the latter is showing impressive progress. While there have been many fakeouts over the years, the depths of the latest decline and magnitude of the most recent recovery suggest that the probability is higher that this one should stick. If the energy index can reclaim its 200-day average in the coming days, and especially if buyers show enough interest to allow some upside follow-though, it bodes very well for further medium- to long-term gains.