Energy ETF Traders Rush In As Animal Spirit Indicator Hits A High

This is an abridged version of our Daily Report.

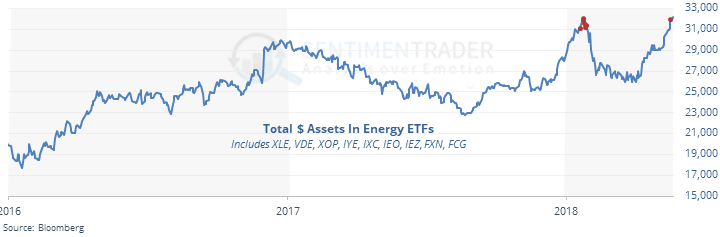

ETF traders rush into Energy

Assets in the primary ETFs focused on the Energy sector have reached $32 billion, a new all-time high. That’s up 20% in just 30 days, among the most rapid increases since at least 2010.

Similar surges led to declines for the sector, though in two cases it took months.

Animal spirit indicator hits a new high

The ratio of High Beta to Low Volatility stocks is often used to show investors’ animal spirit, the acceptance of risk. That ratio just moved to its highest level since 2014, and first new high in months. Other new highs most led to good returns, but longer-term, especially for Tech, but seasonality is an issue.

Russell reversal

The small-cap Russell 2000 ETF (IWM) closed at a 52-week high on Monday, then gapped up above its high on Tuesday, before reversing to close below Monday’s low. Technically, that’s a major reversal day, but one-day patterns are unreliable.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |