Energy bosses are cutting dividends, and workers

Earlier this week, we looked at how poorly energy stocks have performed and how depressed investors in the sector have become as a result.

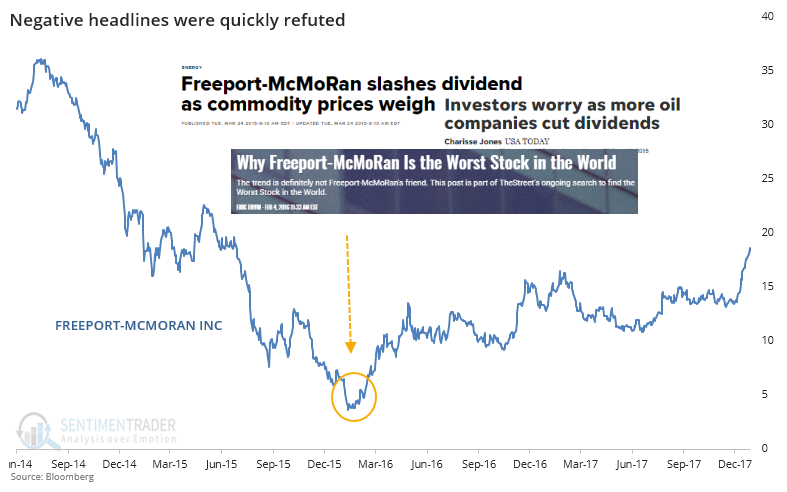

We got some questions about dividend cuts, referencing mining and resource companies back in 2015 because headlines surrounding the sectors are similar. In December 2015, we saw that when it gets so bad that the companies decide to cut their dividends, much of the negativity had already been priced in.

Consider the headlines around when Freeport-McMoRan (FCX) suspended its dividend near the end of 2015.

When you see headlines like "worst company in the world" and "worst sector of the year", you know that a lot of news has already been announced, considered, and acted upon. After those headlines hit, FCX promptly enjoyed a two-year, 430% face-ripper of a rally.

Due to circumstances both within and outside of their control, energy companies have taken the drastic step of reducing or suspending dividends, much like resource companies 5 years ago. Dividends are a point of pride for many of these firms, and they take their dependability seriously. Reducing the payout is a last-ditch measure that signals things are really, really bad and management is taking it very, very seriously.

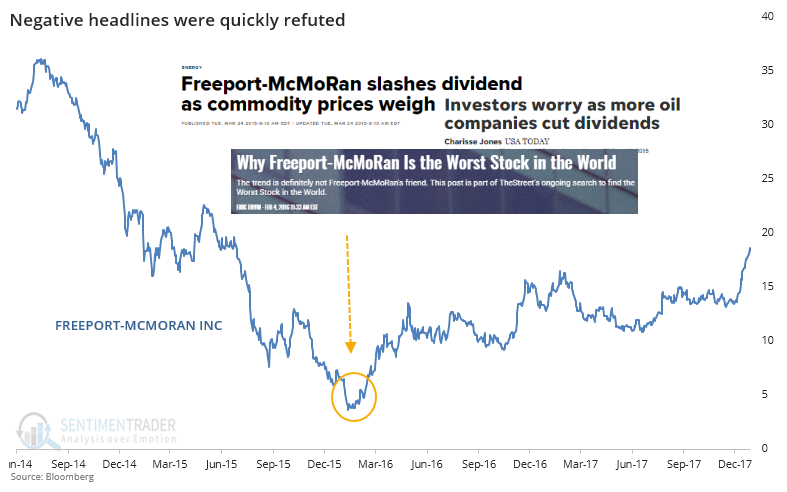

The chart below shows a rolling sum of companies currently in the XLE fund that are showing a reduced dividend payout.

These firms started cutting dividends in earnest in late 2015 and the first couple of months of 2016. Even though the sector bottomed then, reduced payouts continued into the late fall of that year. From early 2016 to the peak over the next 3 years, XLE gained more than 60% and XOP more than 90%.

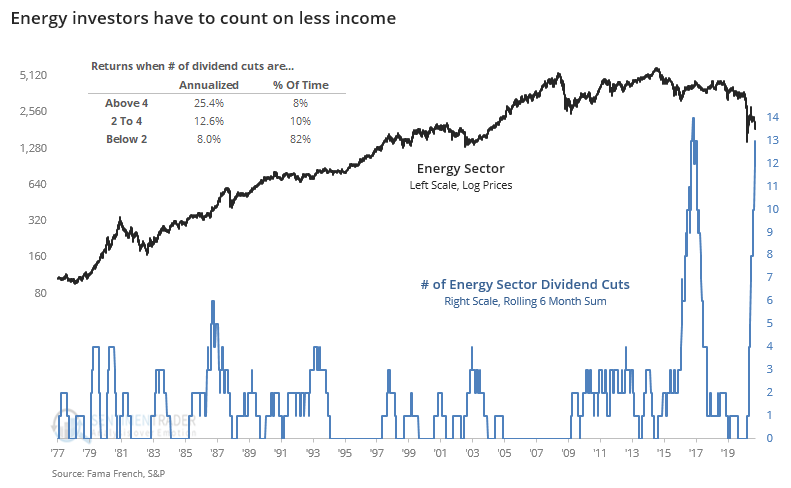

If we look at returns once at least 4 of these firms cut their dividends within the past 6 months, future long-term returns were excellent.

Despite their reputation as being greedy corporate overlords concerned only with profits, management teams at these firms are still human. They feel a responsibility not only toward investors but (hopefully) even more toward employees. They do not take layoff announcements lightly.

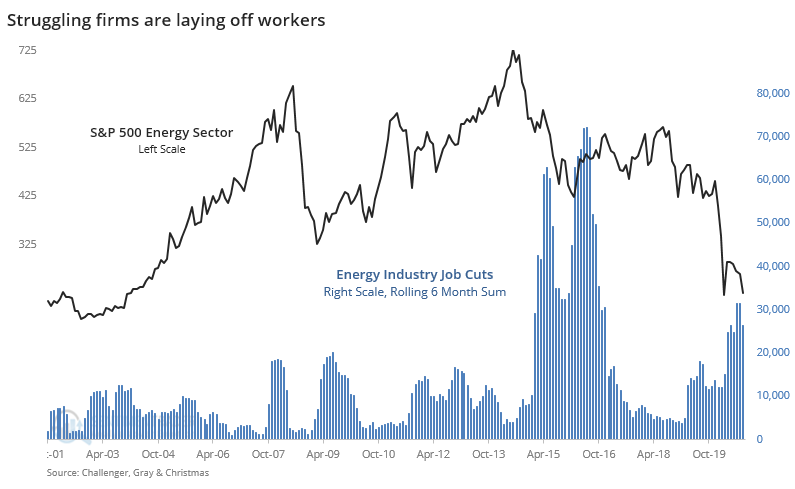

According to Challenger, Gray & Christmas, the pace of job cuts in the energy sector tailed off in September but the 6-month sum is the highest in 20 years outside of the 2015-16 period.

There is no question that the sector acts horribly, both on an absolute and relative basis. About the only question left is whether the bad news is bad enough, and sentiment poor enough, that buyers are about to step in on "less bad" news. There is no sign of that yet, but we'll be watching some of the signs noted earlier to see if it changes.