Emerging Stocks' Uptrend Ends As S&P Suffers 4th-Longest Pullback

This is an abridged version of our Daily Report.

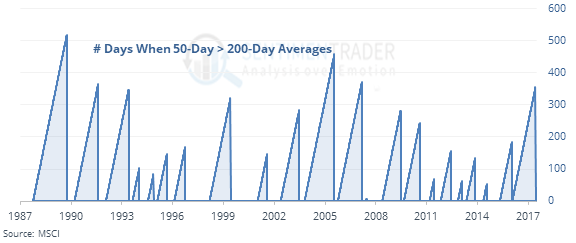

Emerging stocks’ long-term uptrend is gone

Emerging markets have ended one of their longest-ever long-term uptrends.

Risk was high after the others ended, especially over the next two months. They’ve already seen an 8% drop since the trended ended, which served to alleviate most of the risk during the next few months.

Fourth-longest pullback

The S&P just moved into its 4th-longest pullback since the bottom in 2009. The most similar pullbacks since 1929 that lasted this long without a new high led to good returns, especially since 1970

China is the most hated country

The 10-day Optimism Index for the main China fund, FXI, is back below 20. In the fund’s history, it has dropped this low only a handful of time. According to the Backtest Engine, the only losses over the medium-to long-term occurred due to signals in late 2007 though the fall of 2008.

Nobody likes coffee, either

Coffee’s Optimism Index dropped to 17. Over the past five years, that has led to rebounds over the next month 81% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |