Emerging Market's Negative Surprises Even As Nasdaq Hits June High

This is an abridged version of our Daily Report.

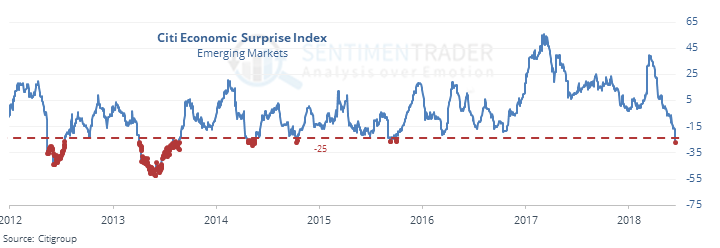

Emerging disappointment

Economic surprises in emerging markets have been consistently, and increasingly, negative.

That has led to mostly poor returns in emerging market stocks and currencies. It has been better for emerging market bonds (in dollars), with positive total returns most times.

Traders are leaving

One positive sign for the stocks is that ETF traders are leaving funds like EEM, which suffered a $750 million exodus on Wednesday alone.

Nasdaq’s June high

The Nasdaq Composite scored another new high as we head into mid-June. Prior highs around this time led to some short-term weakness, primarily into the end of the month. After that, there wasn’t much to chew on for the “worst six months” crowd in tech.

Bond options

While bond funds like TLT pull back, options traders in 10-year Treasury futures have been buying calls to an extreme degree. The 10-day average of the 10-Year Put/Call Ratio is down to one of its lowest levels in years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |