Emerging Markets - A Breakout Accompanied by a Surge in New Highs and Rising LEI's

"When the facts change, I change my mind - what do you do, sir?" - John Maynard Keynes

As measured by the MSCI Index (MXEF), emerging markets recently broke out of a long base formation. I want to highlight two noticeable developments around the breakout that caught my eye in today's note.

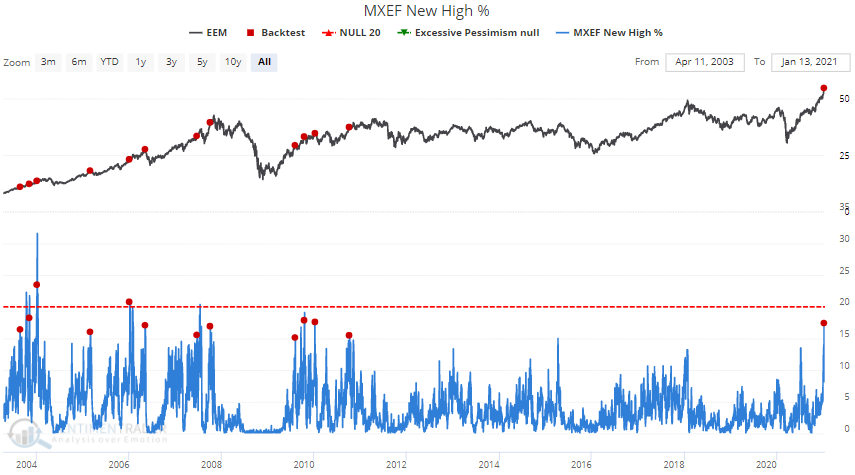

New highs for the MXEF Index recently surged above 15%. As the chart below indicates, this is the highest level since 2010. Breakouts, accompanied by strong internal participation, are a welcome development.

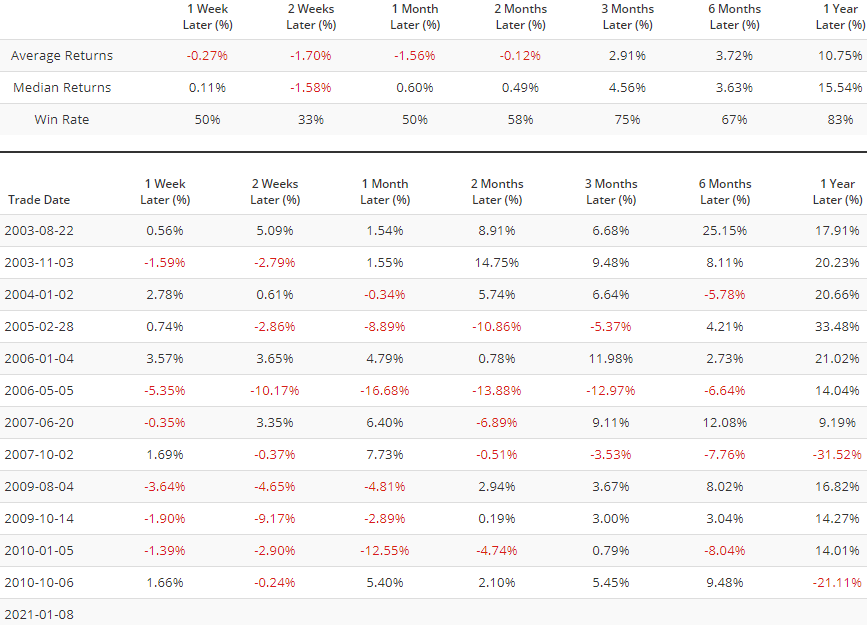

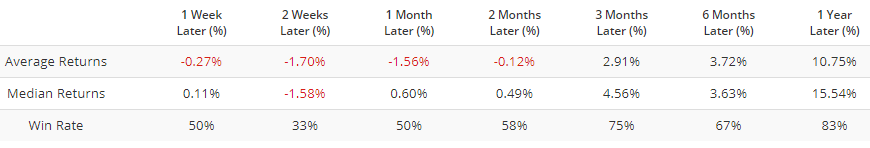

While short-term returns are weak, they get better as we approach the 1-year timeframe.

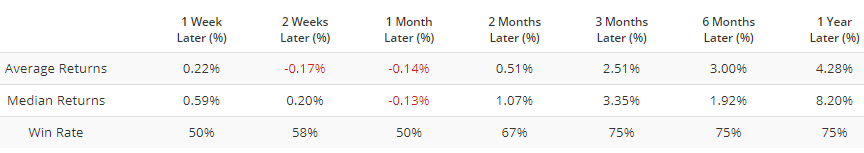

If I compare the average and median returns 1-year later versus the S&P 500, one can see a significantly better relative return profile for EM.

Emerging Markets

S&P 500

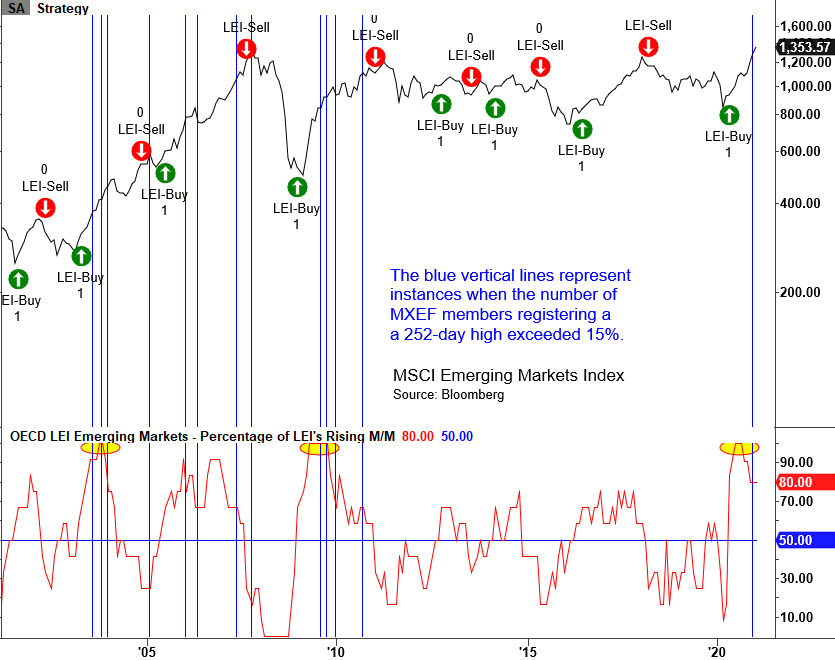

The second noticeable development around emerging markets that caught my eye has to do with Leading Economic Indicators from the OECD. While the signal occurred last year, I thought it was important to highlight it alongside the recent new highs surge. I measure the percentage of LEI's rising on a month over month basis for 13 Countries. As shown in the chart below, the number of Countries with a rising LEI spiked to 100% on the most recent buy signal. 2009 was the last time this measure had a reading of 100%.