Emerging market surprises gain momentum

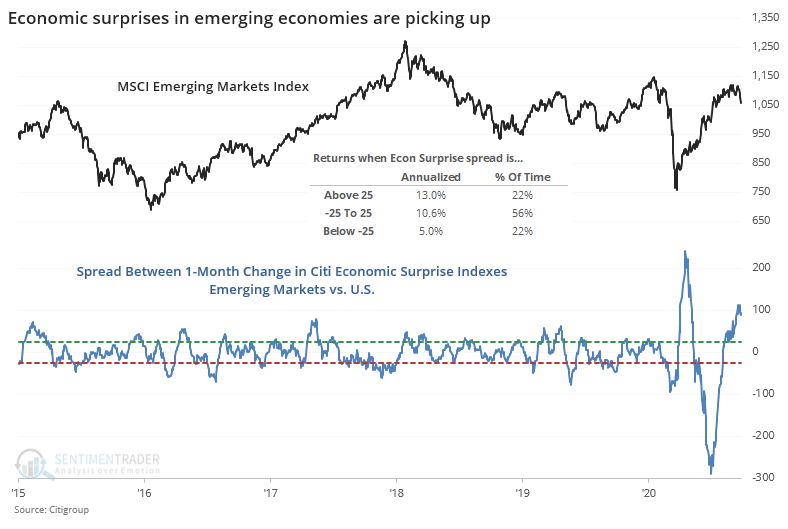

Economic surprises in emerging economies are picking up. Like most everyone else, when times are bad, economists tend to think they're going to get even worse; when times are good, they extrapolate that to mean even better times ahead.

Almost everything related to markets, where humans are involved, cycle from good to less good to bad to less bad, and back again. In emerging markets, economists had predicted horrendous economic numbers, and while they indeed were, they weren't as bad as forecast. That means that economic surprises have been very positive.

They're positive pretty much everywhere else, too. The difference is that surprises in emerging economies continue to get more and more positive, while surprises in places like the U.S. have been easing after a surge earlier in the summer.

Over the past month, surprises in emerging markets have shown much better relative strength versus surprises in the U.S.

This year has seen unprecedented volatility in economic numbers because of uncertainty surrounding the pandemic, so surprises have swung wildly from one extreme to the next. Historically, we can see above that when emerging economy surprises were at least 25 points higher than surprises in the U.S., which happened on about 22% of days since 2003, emerging market indexes did quite well. Almost 3 times better than when surprises were -25.

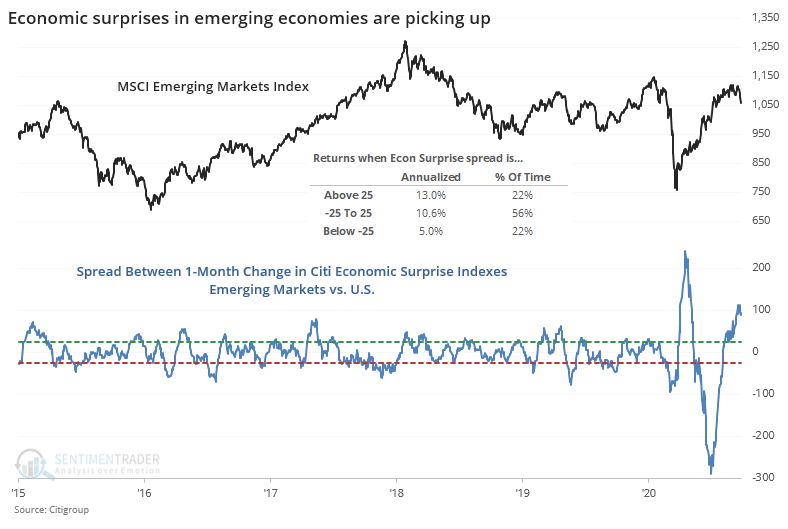

Looking at the markets relative to each other, the same pattern was clear.

Emerging markets have underperformed the U.S. for a decade, but even so, when their surprises were trending well ahead of those in the U.S., the Emerging Markets / S&P 500 ratio tended to do quite well.

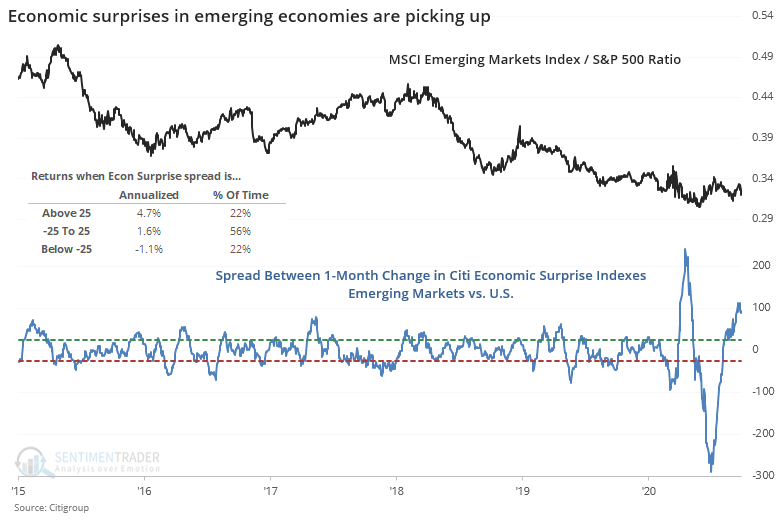

Longer-term internal momentum in these stocks has been horrid. While emerging market indexes haven't fared that badly in recent weeks, the McClellan Summation Index shows heavy internal weakness, falling below zero and declining - not a great combination. But at least it has gone far enough to be considered extremely oversold. The Backtest Engine shows that when it goes this far then starts to reverse, emerging markets mostly saw gains ahead.

The biggest exceptions were in Julys 2008 and 2018. A big warning sign triggered when the Summation Index started to recover from its extreme, yet prices didn't respond well. That's something to watch for here, too.

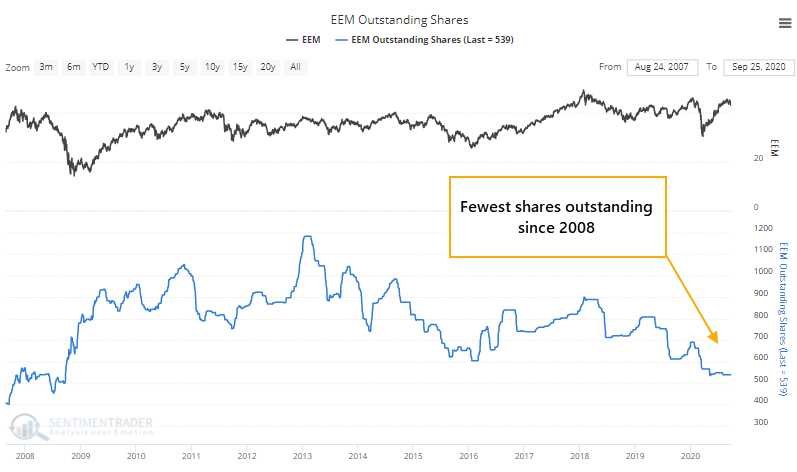

The relatively poor reception to these stocks has caused investors to leave formerly-popular funds like EEM. Shares outstanding there have shrunk to the fewest since 2008.

In some ETFs, watching shares outstanding is misleading because share issuance can either come from buying demand (like we usually see in funds like EEM) or selling demand from short-sellers (like we're probably seeing in XLE right now). When shares outstanding decline in most funds, it's a fairly reliable signal that investor enthusiasm has waned. In EEM, it's been a decent contrary signal, even though some of that demand is likely just leaking to other emerging market ETFs.

There has been more and more interest in non-U.S. markets in recent weeks, as signs of speculative excess, virus issues, and election uncertainty have added to low rates and nosebleed valuations. Those betting on emerging markets to finally assert more of an influence have been wanting for a decade and there is little sign that things are changing yet. The relative momentum in economic surprises is a minor positive, and it would be a better sign if internal momentum finally starts to shift to a more positive stance.