Emerging Market Contagion As Hedgers Bet Against Dollar

This is an abridged version of our Daily Report.

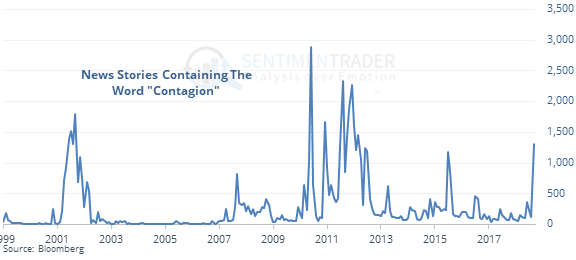

Contagion spreads despite calm crude

Stories with “contagion” worries are spiking to the highest level in 5 years.

The cause, a collapse in emerging markets, is despite a calm market in crude oil, which has usually acted as a balm on those emerging market losses.

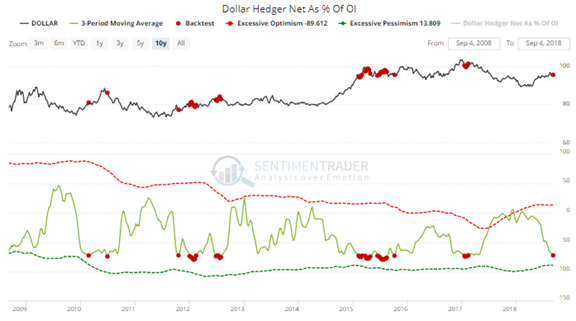

Smart contrarian bets

Smart money hedgers have taken an extreme short position in the dollar, which has preceded weak returns over the next 2-3 months.

At the same time, they’re betting heavily on metals and various ag contracts, with a good record of success.

Six days of blah

The S&P 500 fund, SPY, has suffered six straight days with a lower high and lower low than the prior day. Over its 25-year history, this has happened 12 other times.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers added yet again to already-extreme positions in the metals. According to the Backtest Engine, when hedgers held more than 6% of the open interest in platinum, its two-year return was positive 41 out of 42 weeks.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |