Emerging Market Bond (And Stock) Rout

This is an abridged version of our Daily Report.

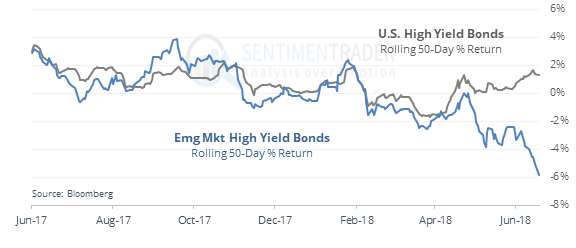

Emerging market bond rout

U.S. high-yield bonds have outperformed emerging market bonds by 7% in 50 days.

Such wide spreads have led to rallies in emerging market bonds more than U.S..

Stock rout, too

Emerging market stocks have lagged U.S. stocks by 8% through mid-year. Other bouts of underperformance led to further losses for emerging market stocks.

Short-term exhaustion

While lagging emerging market stocks tend to continue to lag through year-end, there can be periods where they shine. Price action like Tuesday and a huge outflow from the EEM fund on Monday suggest we may be about to see that.

Bears can’t gain traction

The S&P 500 fund, SPY, has gapped down at the open then closed higher than its open for the past 3 sessions, frustrating bears. It’s rare to see a string of 3 such days in a row, with only 10 signals since the fund’s inception.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |