Elevated Volatility As Bond Investors Pay Up

This is an abridged version of our Daily Report.

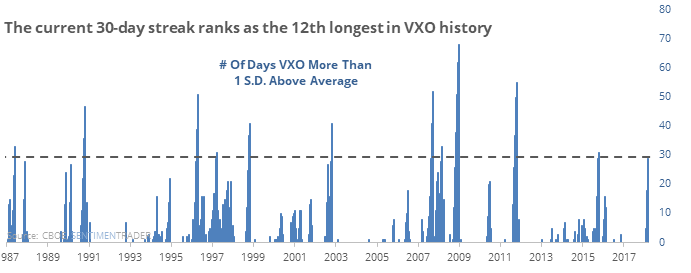

Well above average

Volatility expectations via the VXO (old VIX) have been more than 1 standard deviation above average for 30 straight days.

That ranks as the 12th longest streak in 30 years and 3rd longest since the 2009 bottom. Stocks did well over the next 2-3 months after similar signals, while volatility tended to collapse.

Bond investors aren’t sure

Stocks are struggling to regain a medium-term uptrend, and high-yield bond investors are paying up for insurance. That should be a negative scenario for stocks because bond investors are the “smart money”. It has actually been worse when stocks were rallying strongly as opposed to declining. Part of that is just due to the strong uptrend for most of the past 12 years, however.

Backing off

We’ve now added an Optimism Index (Optix) for the Australian dollar. It is currently neutral but a couple of weeks ago was at a record high. According to the Backtest Engine, any time the Optix was above 60...

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.