Economists keep underestimating the U.S.

Economic data is exceeding economists' ability to keep up.

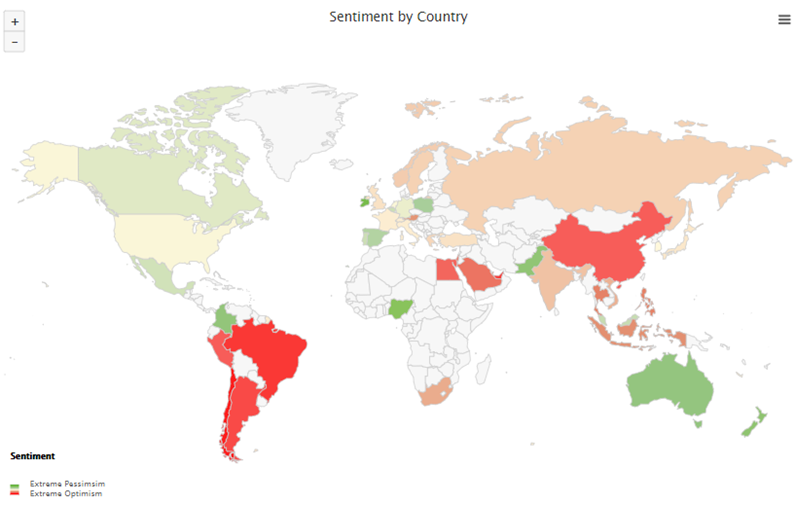

According to Bloomberg, the Citigroup economic surprise index measures data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected and a negative reading means that data releases have been worse than expected.

After a surge in positive economic reports a year ago, economists adjusted their expectations and subsequent reports failed to meet those higher standards. Dean noted that now that conditions are (somewhat) normalizing, reports are once again beating expectations.

In recent days, the Citigroup economic surprise index crossed above zero. This move into positive territory ended a streak of more than 70 days below zero.

This signal has triggered 11 other times over the past 18 years. After the others, stocks tended to do well over longer time frames, while a popular bond ETF showed more of a struggle.

What else we're looking at

- Returns in stocks and bonds after a recovery in economic surprises

- What a breadth recovery in the high-yield bond market means for stocks and bonds

- A look at seasonality and sentiment in major energy contracts

| Stat box Wednesday's trading activity marked only the 40th time since 1975 that both the U.S. dollar and gold rose by more than 0.9% on the same day. |

Etcetera

Bonds bomb. Thanks to an inflation scare, investors are avoiding bonds. The Optimism Index for Treasury notes and bonds has plunged to the lowest level in 3 years.

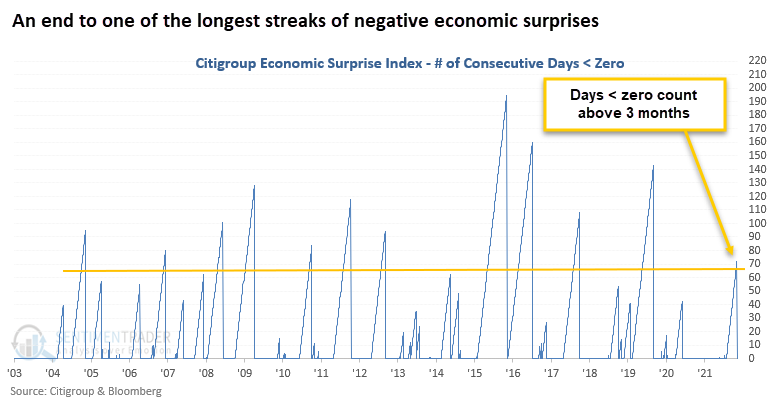

Big tech rebound. After resetting at zero, the McClellan Summation Index for the Nasdaq 100 index has soared again, showing strong underlying momentum in tech shares. The Summation Index is once again above +1,000 and challening the highest level in a year.

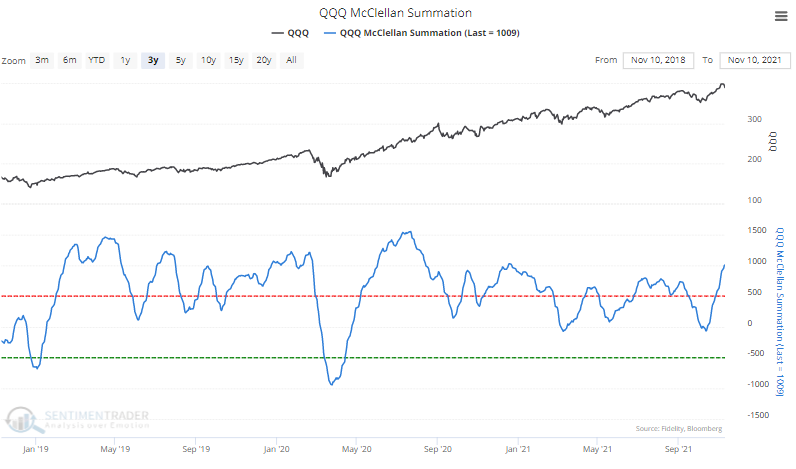

A quick about-face. Our Optimism Index Geo-Map shows that for the first time in a while, investors are suddenly the most optimistic (red color) in South American countries like Brazil, as well as China.