Economic Surprises Turn Negative, So Do Investors And Gold

This is an abridged version of our Daily Report.

A slip in surprises

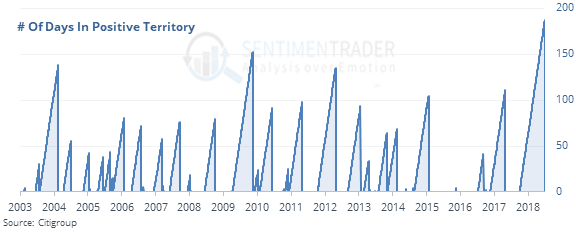

U.S. economic surprises have ended their longest-ever positive streak, after being positive since last September.

The ends of other long positive streaks led to mixed returns in stocks, excellent ones in bonds, and poor in gold.

Mom & pop become discouraged

The AAII survey is nearing the bottom 10% of all readings in 30 years as individuals give up on the idea of a sustained rally. That kind of pessimism has led to some of the best forward returns for the S&P out of all deciles of sentiment in the survey.

Gold’s historic couple of weeks

Gold has had only a single up day in two weeks, a historic level of selling. Similar bad two-week streaks led to short-term rebounds, but medium- to long-term returns were mixed.

Slide in Financials

Among sector ETFs, Financials have had the worst breadth. Heading into Thursday, only 1% of them were above their 10-day averages, and fewer than 10% above their 50-day. According to the Backtest Engine, since 1999, that has led to rebounds over the next weeks about 70% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |