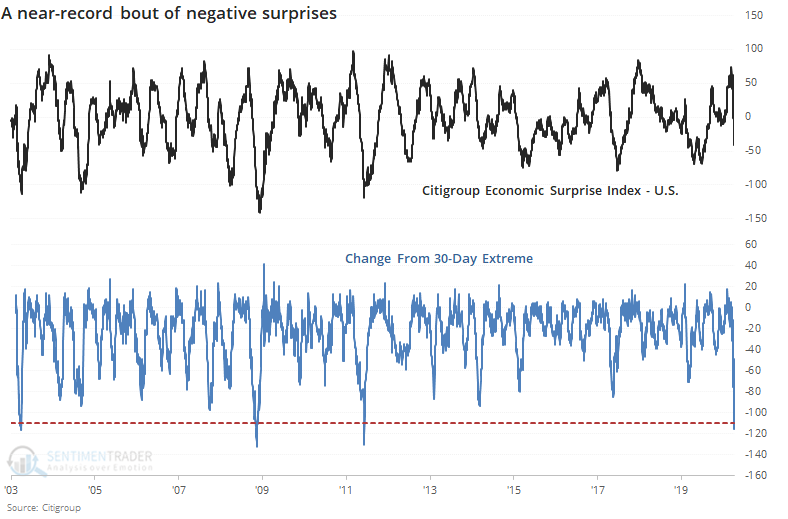

Economic surprises suffer historic plunge

It's been a bad couple of weeks for economic data, and it's going to get worse. It's not a shock that even with lowered expectations, economic data is still surprising economists to the downside.

At some point soon, they will lower their estimates of future economic releases enough that we will start to see surprises on the upside. But with developments still in flux, that hasn't happened yet. Over the past few weeks, there has been a near-record drop in the Citigroup index that tracks U.S. economic surprises.

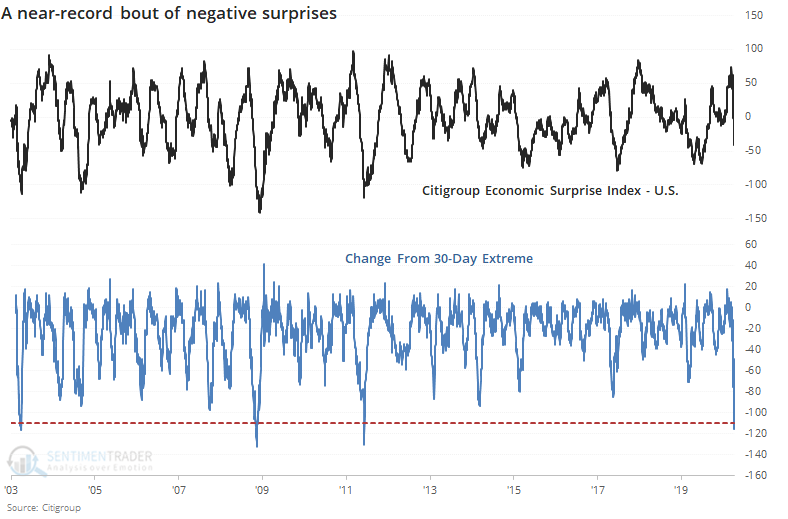

Whether we can read anything into this in terms of what it means for markets going forward is questionable given the unprecedented nature of what we've seen in recent weeks. Most investors have a greater interest in stocks, but we've seen in past years that this data is less consistent for that asset than others.

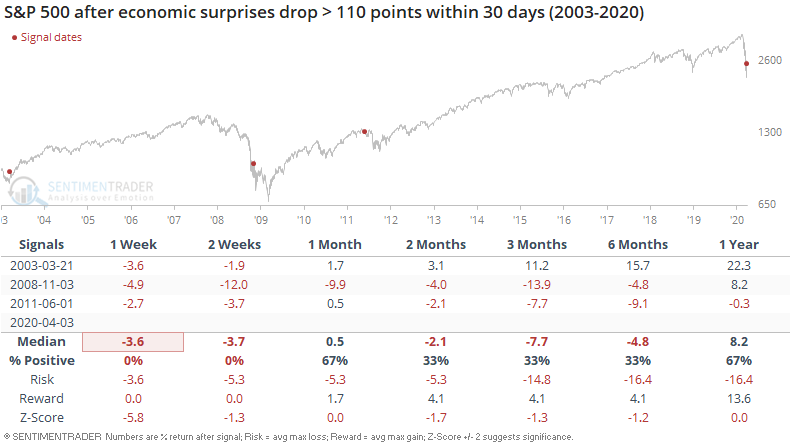

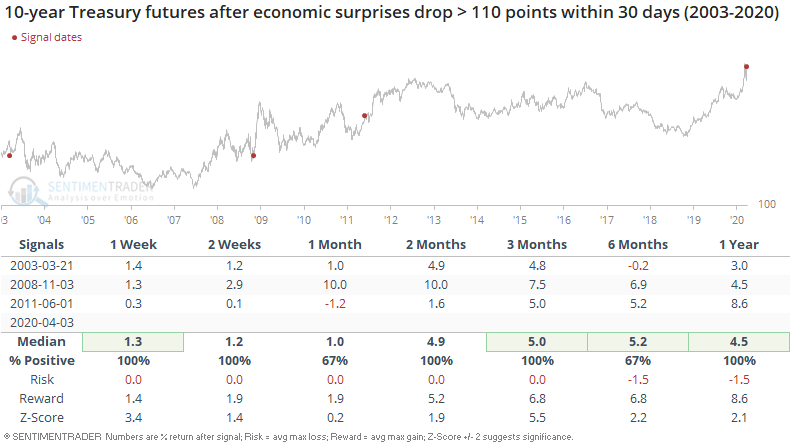

Bonds, on the other hand, had a strong tendency to rally in the months ahead. Well, as much as we can consider a sample size of three as being "strong."

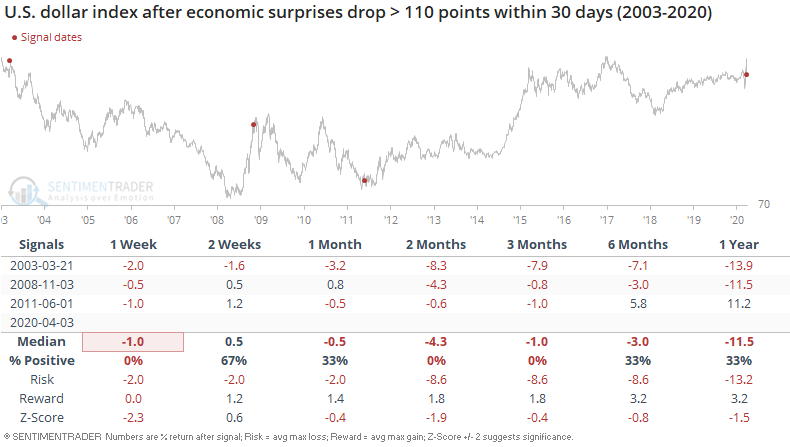

The dollar struggled.

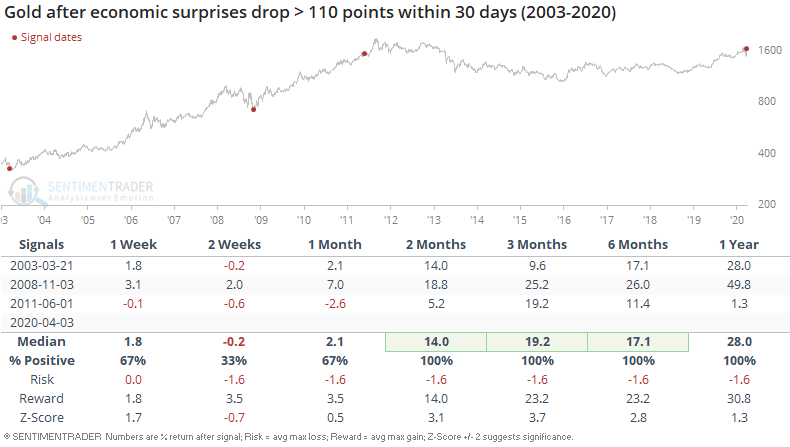

Because of that dollar weakness and persistent 2010s bull market, gold did very well.

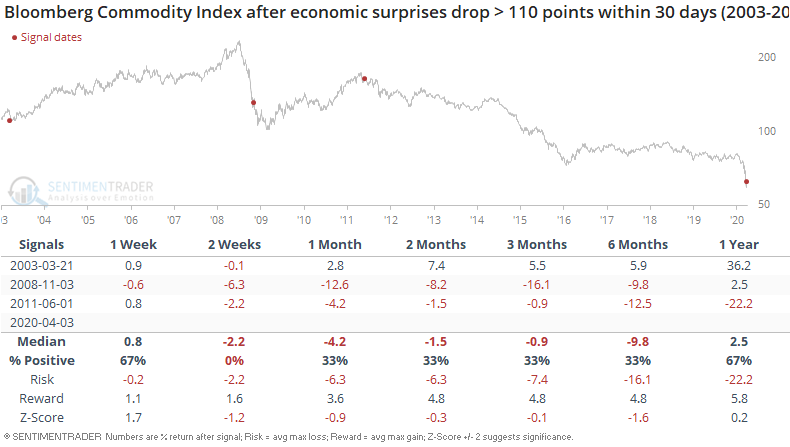

It was less of a boon for commodities in general.

It's hard to read much of anything into the shock of the past month and what it means going forward relative to historical examples. From what we have, though, the past 15 years has seen good returns in bonds and gold after very swift declines in economic reports versus their expected values.