Economic and Consumer Sentiment Composite Buy Signal

Several years ago, I created an economic and consumer sentiment composite to measure survey data changes across a diverse group of categories. The composite contains data from small business owners, housing, manufacturing, services, and consumers. The economic and consumer sentiment composite model for March is now complete, with an update from the NFIB on Tuesday. The new data helped drive the 3-month net change in the composite above a level that generated a new buy signal as of 3/31/21.

Source/Components

1.) NFIB Small Business Optimism

2.) NFIB Small Business Economy to Improve

3.) University of Michigan Consumer Sentiment

4.) Conference Board Consumer Confidence

5.) ISM Manufacturing PMI

6.) National Association of Homebuilders

7.) Philadelphia Fed Business Outlook

8.) ISM Non-Manufacturing NMI

Calculations

1.) % Rank each component versus entire history from highest to lowest and average the group on an equal-weighted basis.

Economic and Consumer Sentiment Composite Buy Signal

The Economic and Consumer Sentiment Composite model seeks to identify instances in history when the 3-month net change in the composite surges above a user-defined threshold when the S&P 500 is in an uptrend. The model will issue an alert based upon the following conditions.

Signal Criteria

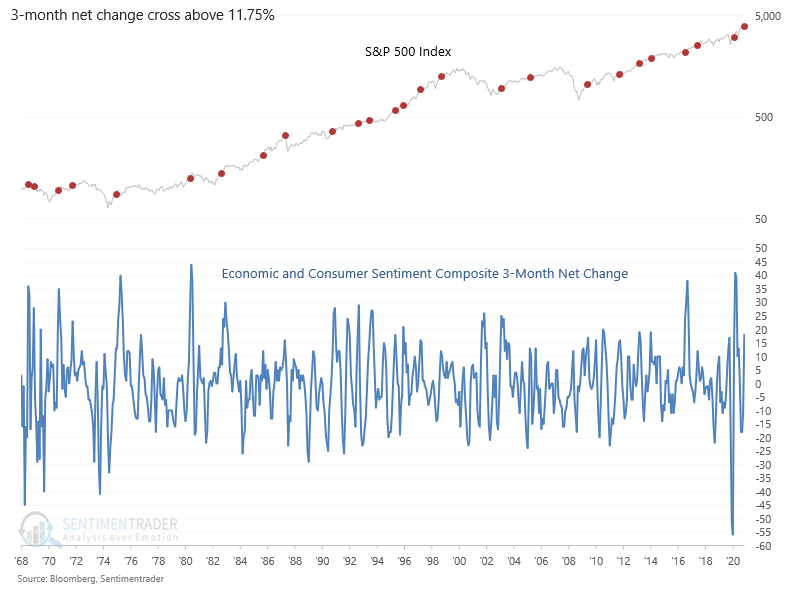

Condition1 = Composite 3-month net change cross above 11.75%.

Condition2 = S&P 500 Index > 12-month moving average.

Condition3 = 3-month net change resets below zero.

Let's take a look at some charts and the historical signal performance.

Current Day Chart

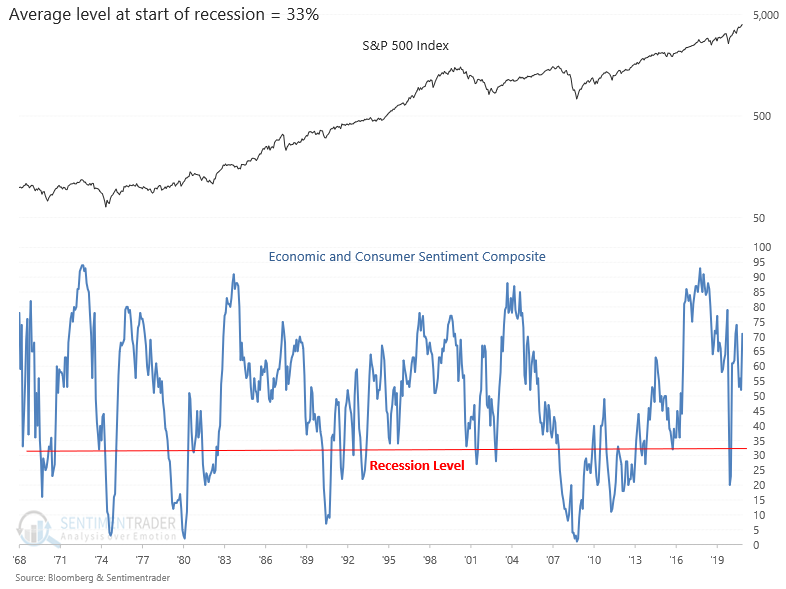

Economic and Consumer Sentiment Composite Chart

Economic Sentiment Composite 3-Month Net Change Chart

Signal Performance

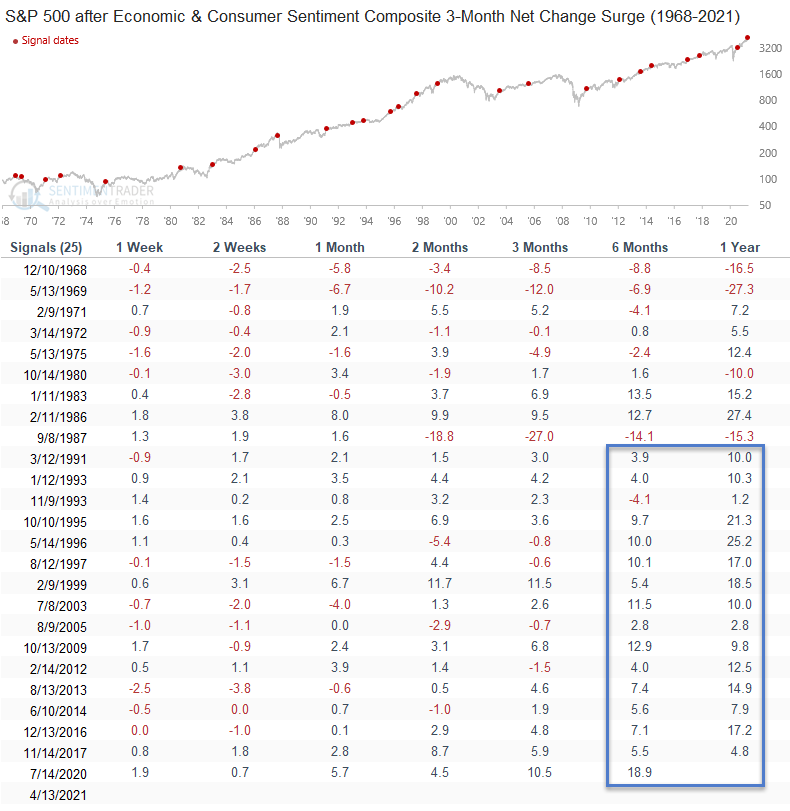

Please note that signal dates have been adjusted forward to the second Tuesday of each new month. That day reflects the report date for the final component update in the model. For example, rather than using a signal date of 3/31/21, the signal date has been adjusted to 4/13/21. I believe this provides a more realistic outlook for assessing forward returns.

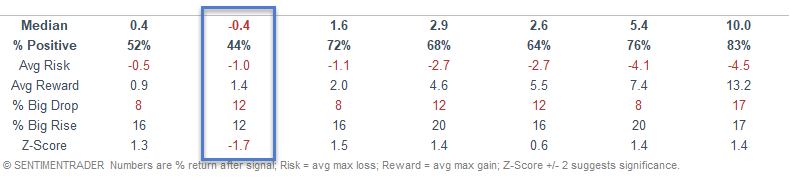

Performance in the six and twelve-month timeframe looks good, especially since 1991. I would note the 2-week timeframe is week.

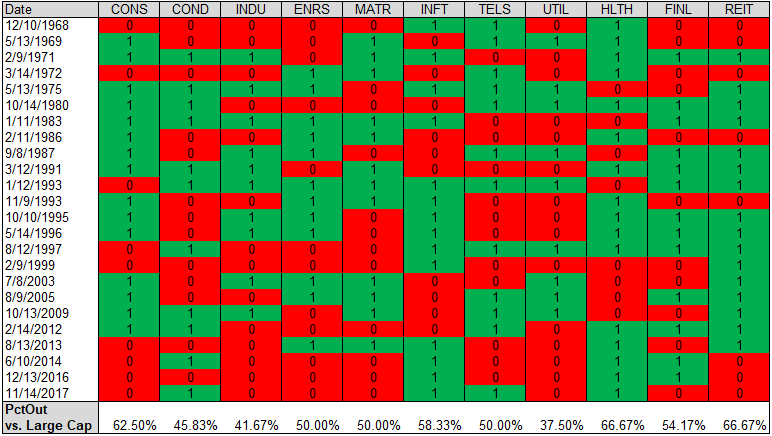

Sector Relative Performance vs. Large-Cap Stocks ( 1 Outperform - 0 Underperform)

Interestingly, the signal tends to favor growth-oriented sectors.