Economic activity hasn't done this since the global financial crisis

Key points:

- The Macro Index Model declined by 27% in the month of May

- After similar contractions, the S&P 500 showed flat to slightly negative returns

- Sector and industry group returns and consistency look more unfavorable

- Commodities look constructive, especially compared to stocks

The Macro Index Model plunged on a month/month basis

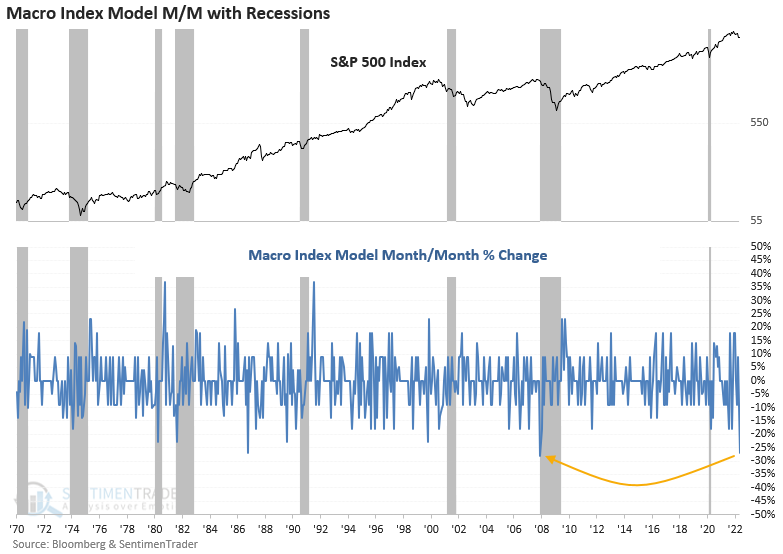

The SentimenTrader Macro Index Model combines 11 diverse economic indicators to determine the state of the U.S. economy right now. The Index plunged by the 2nd most significant amount in history, with data reporting in May. Powerful m/m contractions occurred just before recessions in 1981-82 and 2007-08. In some instances, like in 1990-91 and 2001, the plunge occurred well ahead of an economic downturn. And 1986 is a reminder that not all significant declines are associated with a recession.

Let's conduct a study to assess the outlook for stocks and commodities after the Macro Index Model declines by 20% or more in a single month.

Similar signals preceded flat to slightly negative returns for the S&P 500

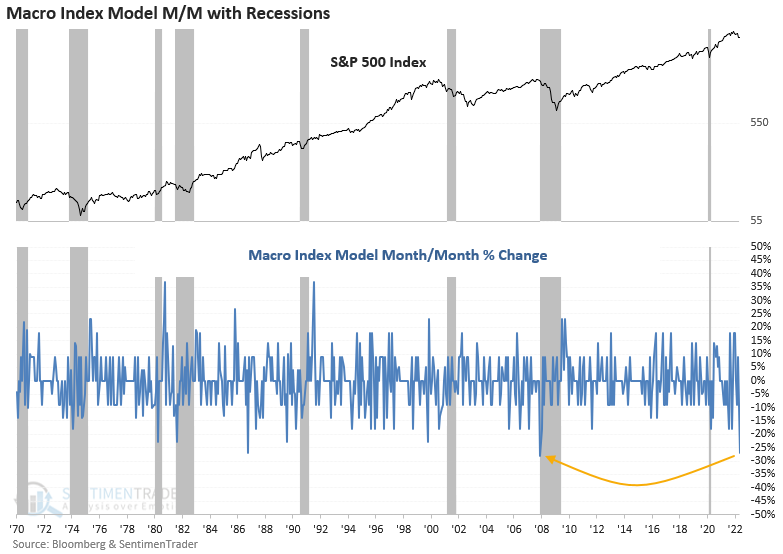

This study generated a signal 6 other times over the past 42 years. After the others, the S&P 500 showed flat to slightly negative returns and a coin toss on the win rate across almost all time frames. While the sample size is small, which is typically the case with economic data, the m/m plunge in the Macro Index Model should act as a friendly reminder that growth decelerations can impact stocks.

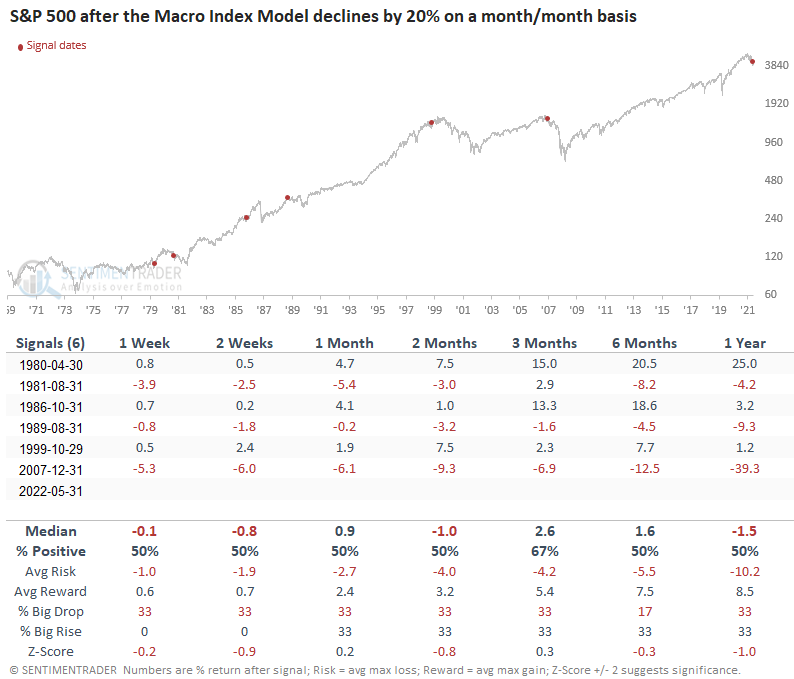

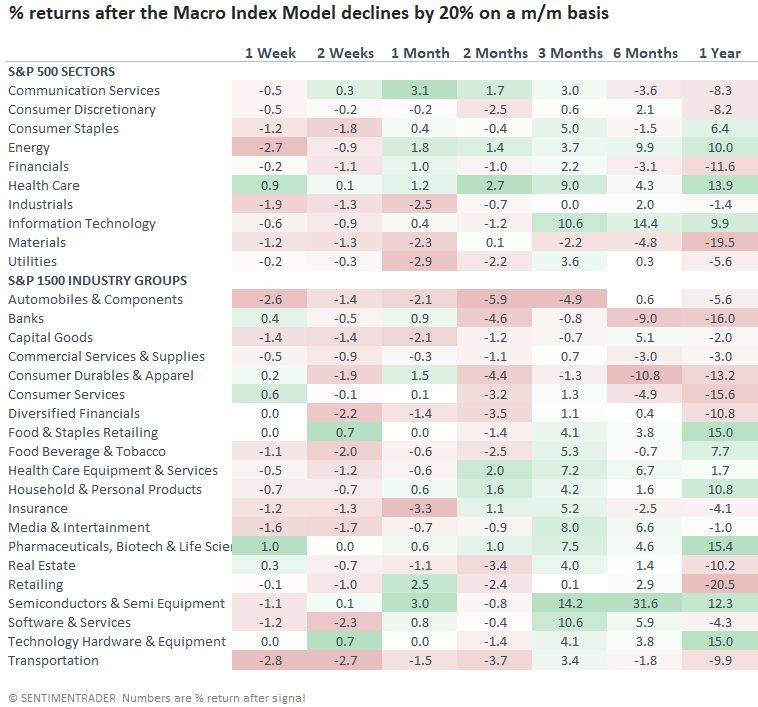

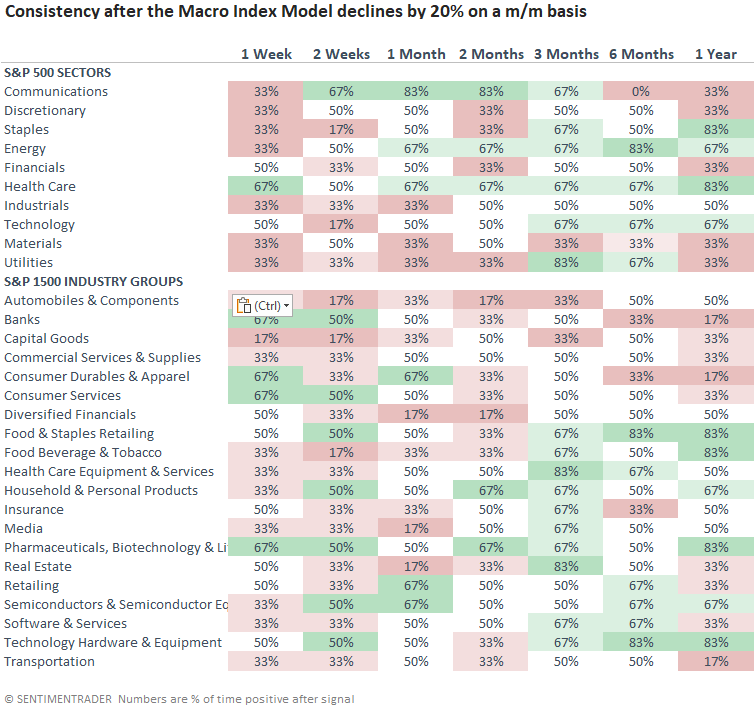

Sector and industry group performance after signals

The sector and industry group table appears more alarming than a broad index like the S&P 500. The slowing economic backdrop looks unfavorable toward most cyclical and value-oriented groups, especially financials/banks. Not surprisingly, defensive-oriented groups perform the best. The historical record for Energy is interesting and supports the case for a continuation of the bullish trend.

Sector and industry group consistency after signals

Energy, health care, and staples show the most consistent trends, especially in the 3 to 12-month time frames.

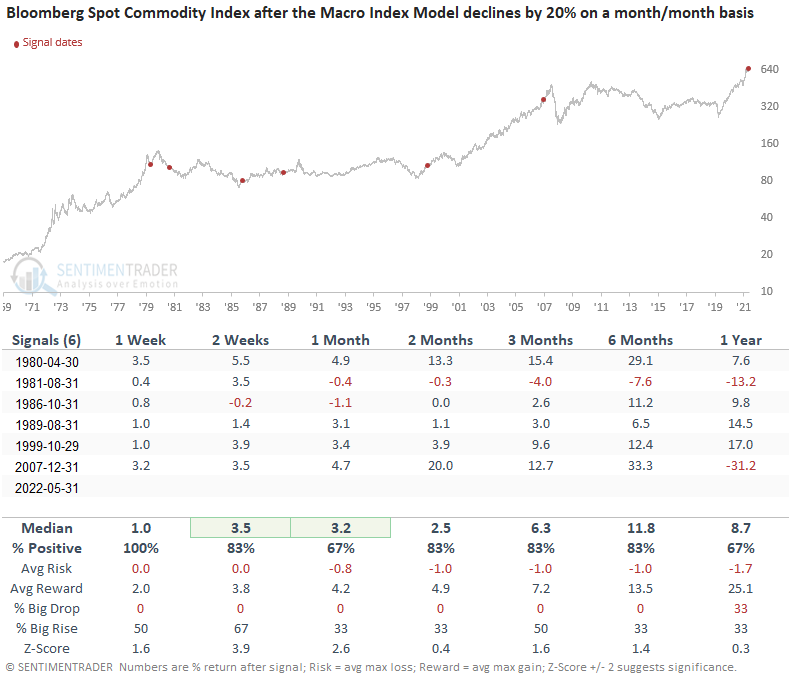

What happens to commodities after signals

The outlook table for commodities suggests the bull market can continue despite the m/m plunge in economic activity. The 33% gain in 6 months after the 2007 signal is a reminder that commodities can disconnect from the economy and stocks in a meaningful way at times.

What the research tells us...

When the Macro Index Model contracts on a month/month basis by 20% or more, we need to be mindful that a deceleration in growth could impact stocks. And the plunge in the Index could also foreshadow a potential recession. Similar setups to what we're seeing now have preceded flat to slightly negative returns for the S&P 500. Applying the signals to sectors and industries suggests one should be tilted toward defensive groups and away from cyclical/value ones. Interestingly, commodities tend to disconnect from stocks and perform well, which is similar to now.