Easy Conditions As Traders Short More VIX

This is an abridged version of our Daily Report.

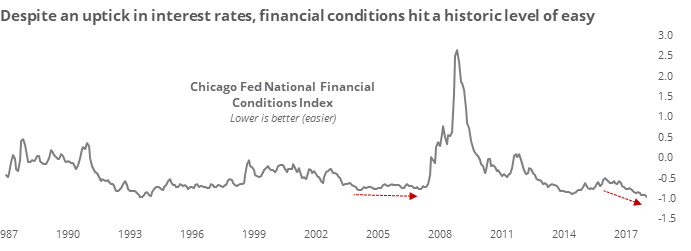

Easy conditions

A major measure of national financial conditions just reached a historic level of easiness because “it’s all good.”

This is despite a sharp jump in interest rates, which is peculiar behavior. That seems like it should be a good sign, but it wasn’t the handful of other times it happened.

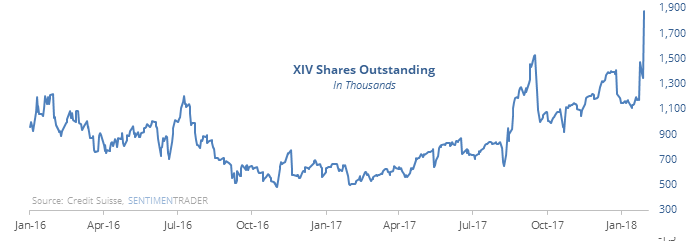

Short VIX traders buy the dip

Traders in the most popular ETF that bets against the VIX “fear gauge” have poured into the fund in recent days.

This buy-the-dip mentality has served them well over the life of the fund, at least over a couple of months. It’s hard to shake an uneasy feeling that this has all become so easy, though.

Googling a bellwether

If prices hold where they are, this would be one of the largest-ever negative overnight reactions to a miss in Alphabet (Google) earnings.

Concern is rising

The 10-day average of the Total Put/Call Ratio is starting to rise from its lowest level in almost three years. Since 2010, the 10-day average has curled up from at least a 1-year low 8 times.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.