Earnings surprises trigger quick upgrades

Despite fears and pessimistic projections, corporate earnings are turning out to be okay. Now, companies and Wall Street are both expecting them to get even better.

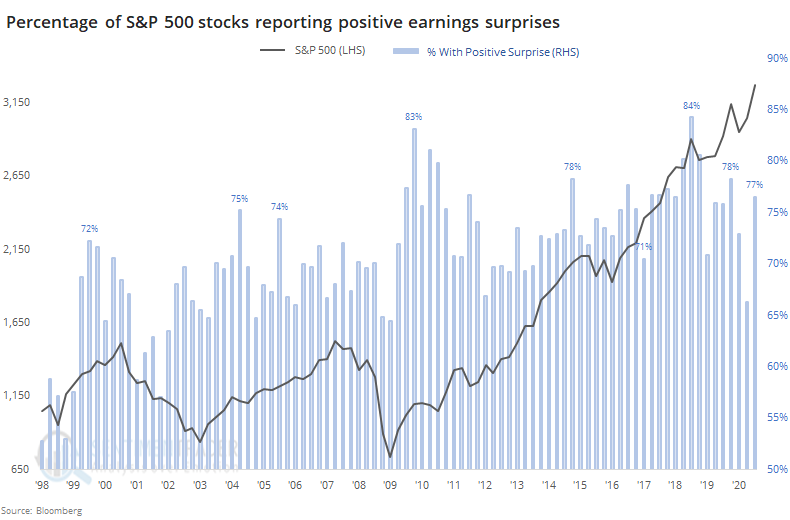

With about 325 companies in the S&P 500 reporting their Q2 earnings, more than three-quarters of them have beat what Wall Street estimated they would earn. This would be one of the better earnings seasons in more than 20 years.

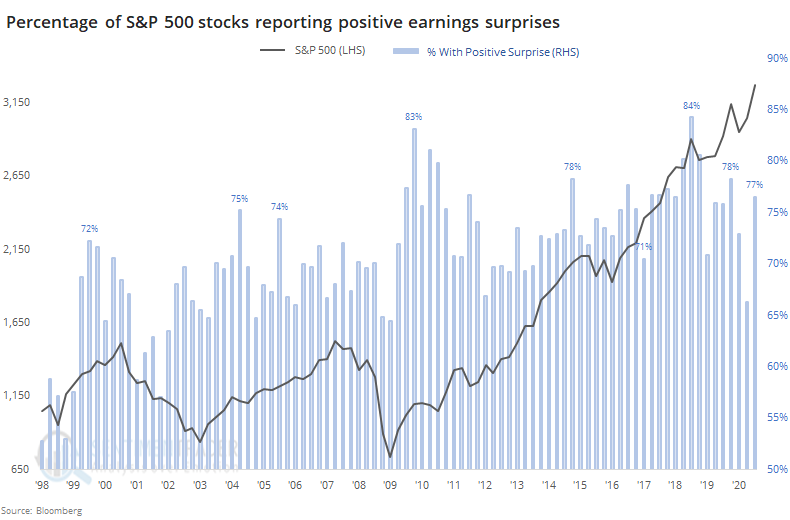

Through approximately this many days in reporting season, this quarter's beat rate ranks 16th out of 91 reporting seasons. After other quarters when reporting was going very well, stocks struggled a bit shorter-term then did very well over the next 6-12 months, thanks to most of them occurring in the past decade.

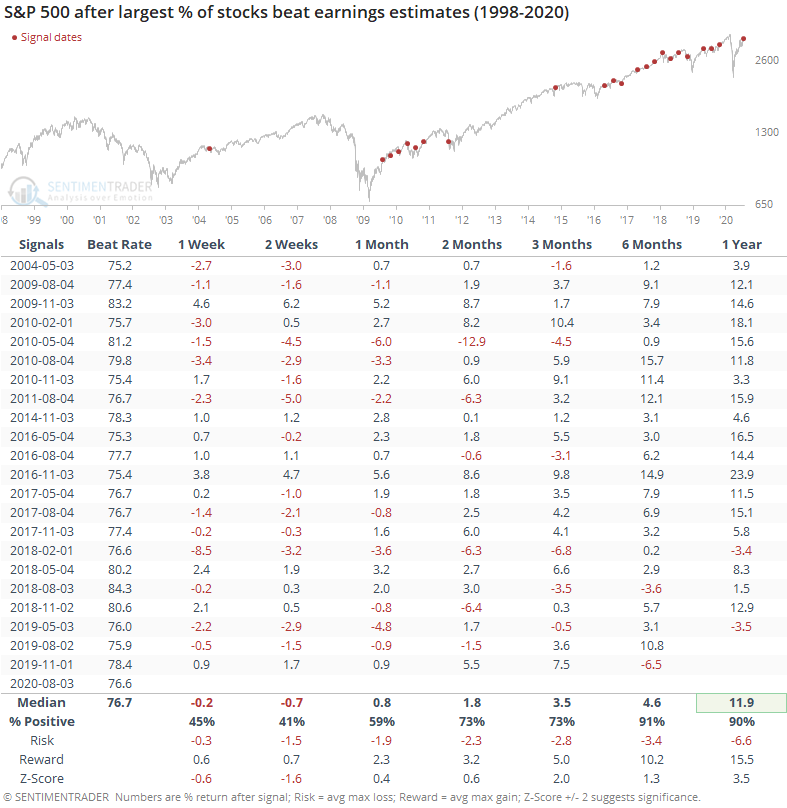

As a result of the positive surprises, companies are upgrading their financial outlooks to the largest degree in at least 20 years.

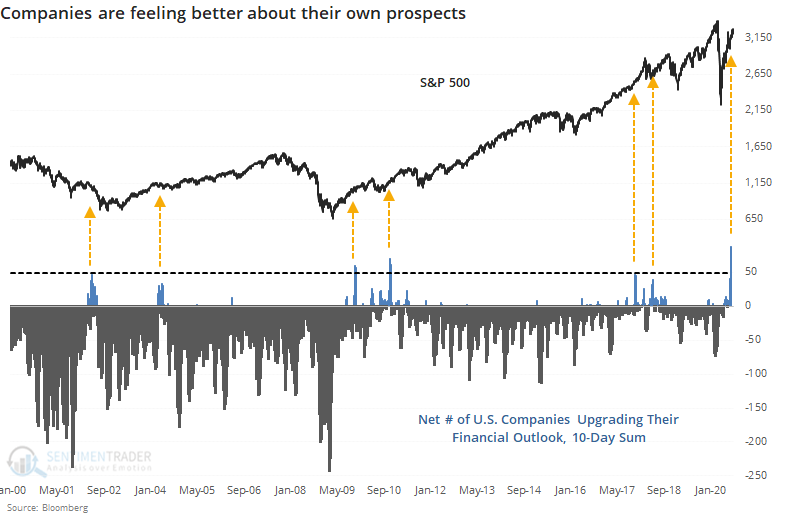

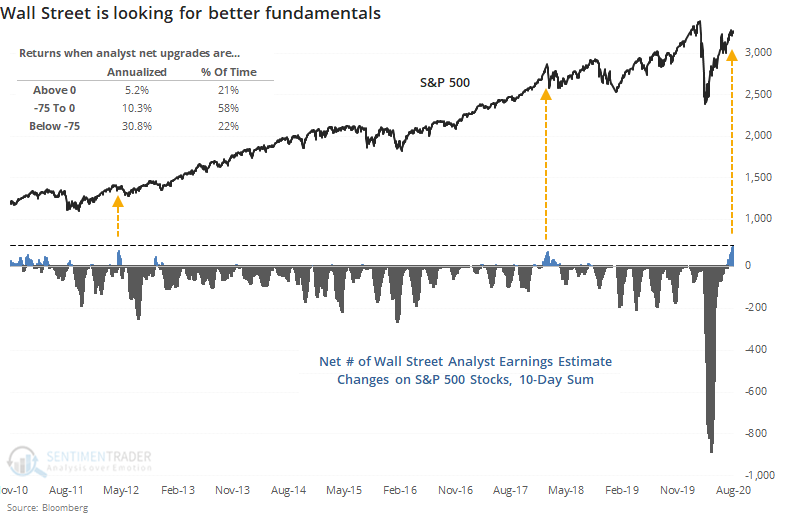

Wall Street is seeing that, and raising. In the past decade, they've never raised the future earnings estimates of companies they cover in the S&P 500 at a faster rate than they're doing now.

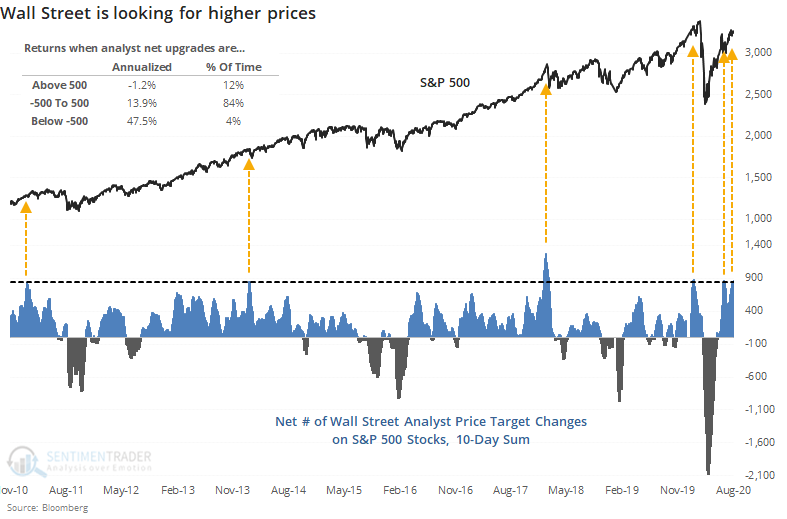

They're also raising price targets.

About the only precedents for what we're seeing now is the jump in upgrades in the spring of 2012 and early 2018. Generally, after extremes in these series, future returns were worse than average. The more optimistic Wall Street got, the lower the future returns in the S&P 500.

It's entirely possible that since we're recovering from one of the biggest hits in generations, we can't rely too much on these technical and fundamental upgrades as much as we could in the recent past. As much as we can, though, it's a minor warning that sentiment on the Street has rapidly changed from deep pessimism, and it has been a pretty good contrary indicator.